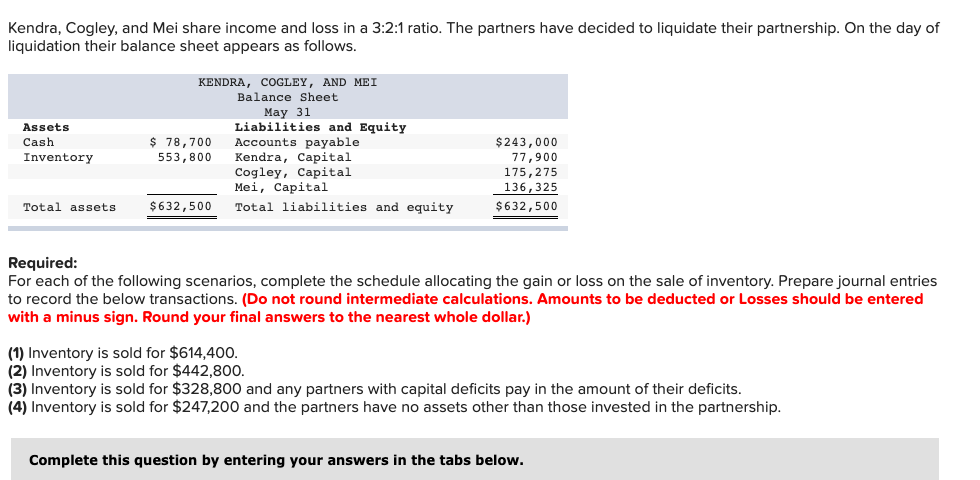

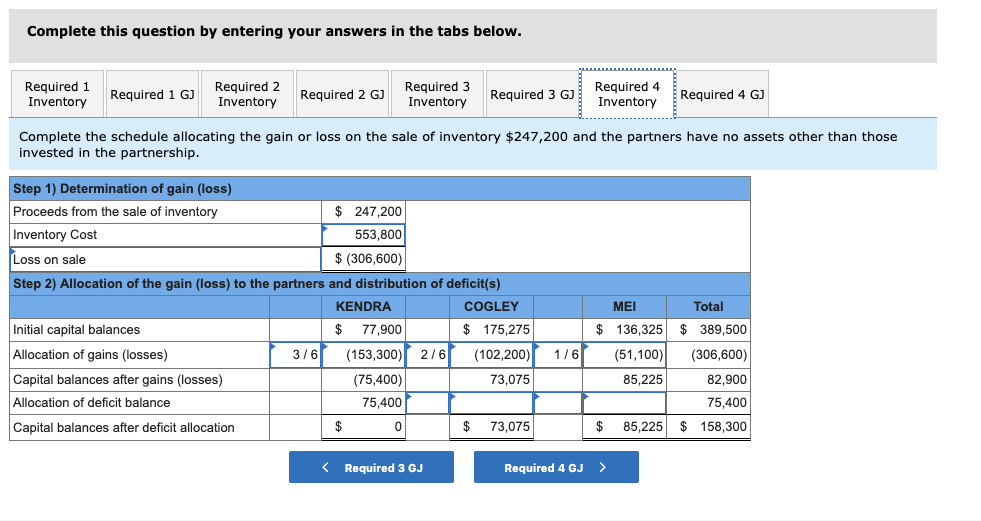

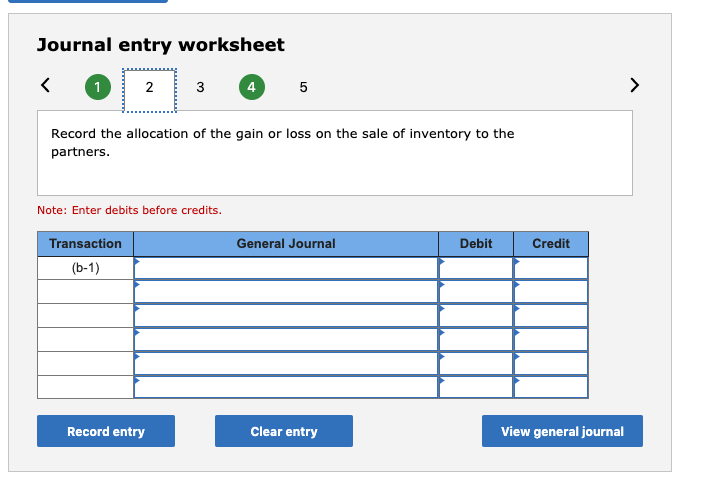

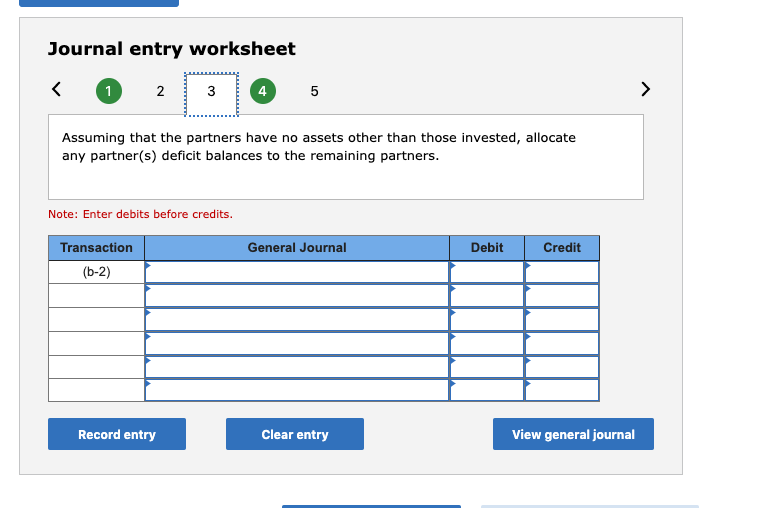

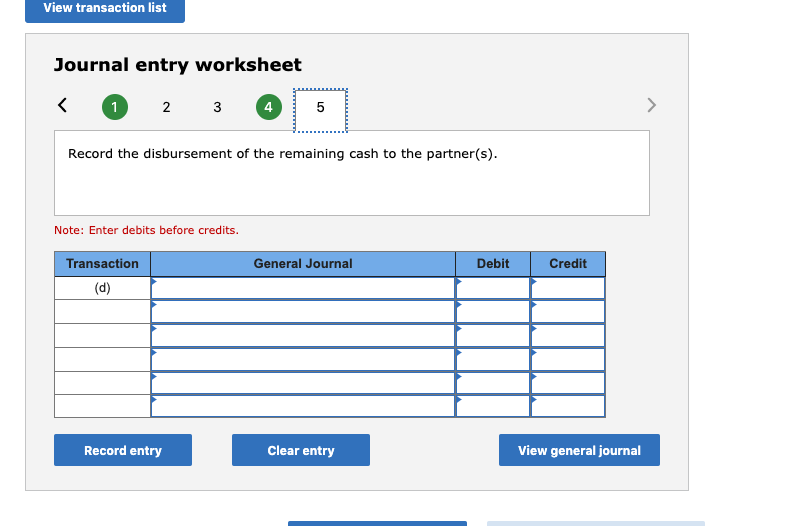

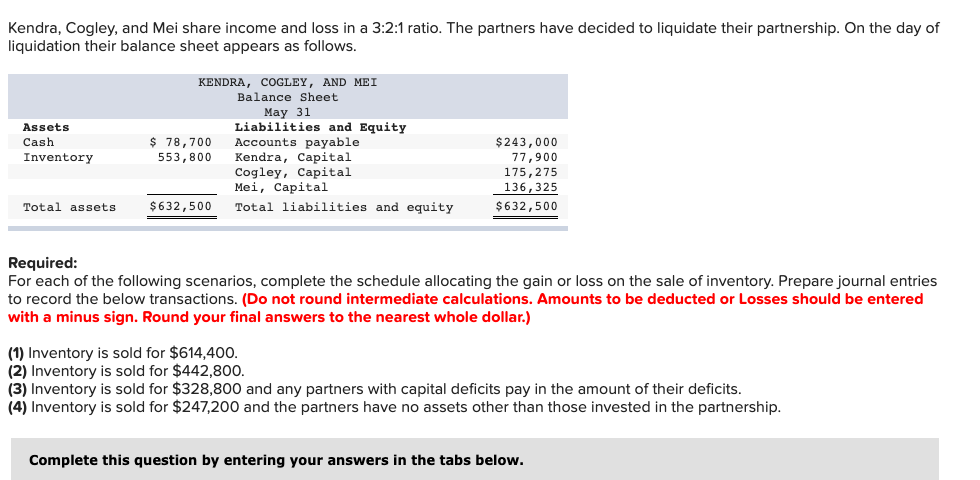

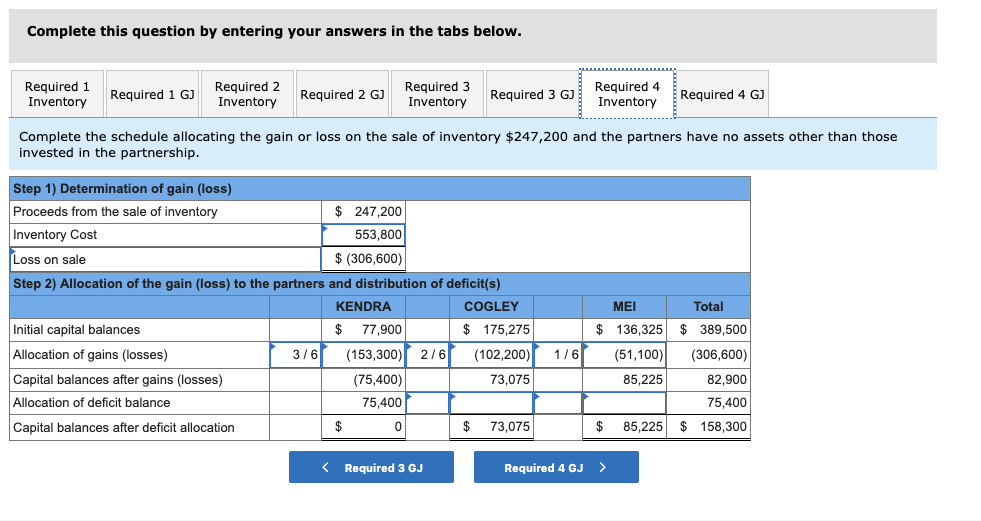

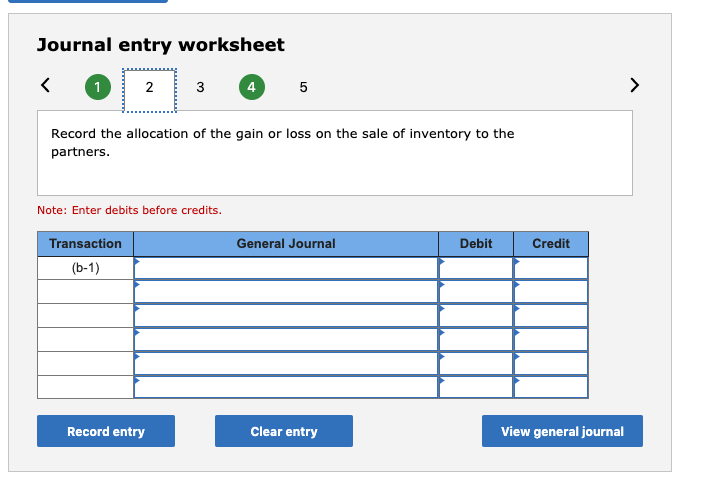

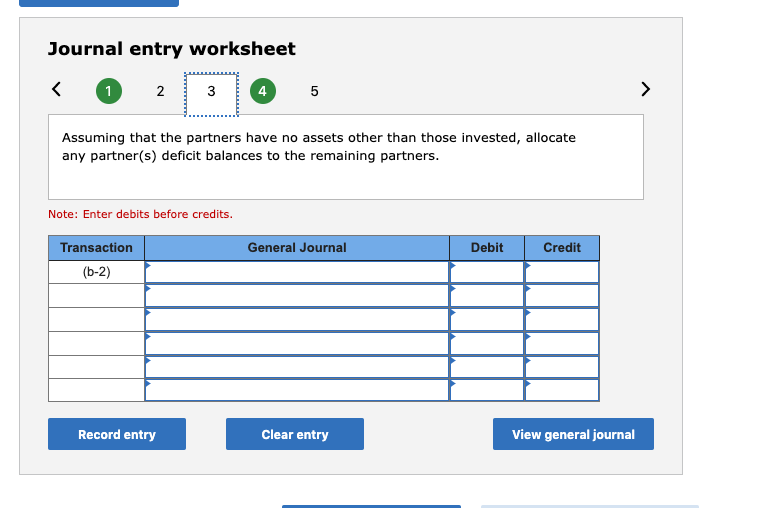

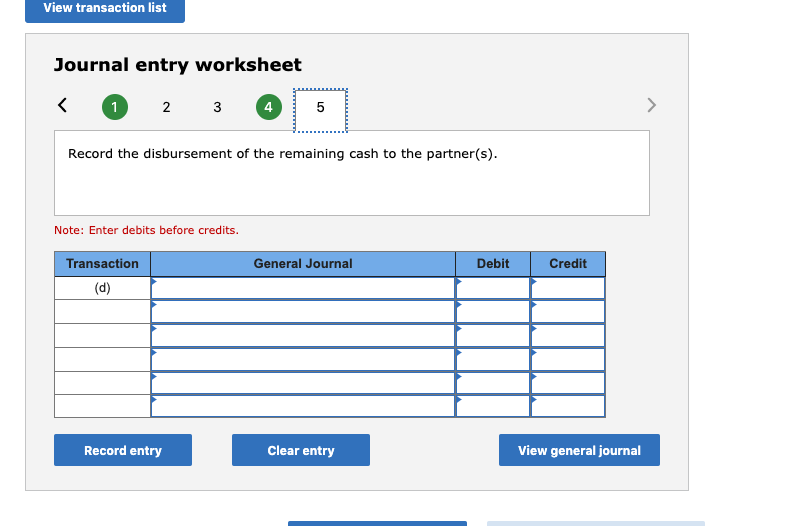

Kendra, Cogley, and Mei share income and loss in a 3:2:1 ratio. The partners have decided to liquidate their partnership. On the day of liquidation their balance sheet appears as follows. KENDRA, COGLEY, AND MEI BaianeeSheet Liabilities and Equity Assets $ 78,700 553,800 Cash Accounts payable Kendra, Capital Cogley, Capital Mei, Capital $243,000 Inventory 77,900 175,275 136,325 $632,500 Total liabilities and equity Total assets $632,500 Required: For each of the following scenarios, complete the schedule allocating the gain or loss on the sale of inventory. Prepare journal entries to record the below transactions. (Do not round intermediate calculations. Amounts to be deducted or Losses should be entered with a minus sign. Round your final answers to the nearest whole dollar.) (1) Inventory is sold for $614,400. (2) Inventory is sold for $442,800. (3) Inventory is sold for $328,800 and any partners with capital deficits pay in the amount of their deficits (4) Inventory is sold for $247,200 and the partners have no assets other than those invested in the partnership. Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Required 2 Inventory Required 1 Inventory Required 3 Inventory Required 4 Inventory Required 3 GJ Required 4 GJ Required 1 GJ Required 2 GJ Complete the schedule allocating the gain or loss on the sale of inventory $247,200 and the partners have no assets other than those invested in the partnership. Step 1) Determination of gain (loss) Proceeds from the sale of inventory 247,200 Inventory Cost 553,800 Loss on sale (306,600) Step 2) Allocation of the gain (loss) to the partners and distribution of deficit(s) KENDRA COGLEY MEI Total Initial capital balances $ 77,900 175,275 136,325 389,500 Allocation of gains (losses) 3/6 (102,200) (306,600) (153,300) 2/6 1/6 (51,100) Capital balances after gains (losses) (75,400) 73,075 85,225 82,900 Allocation of deficit balance 75,400 75,400 85,225 158,300 $ 0 $ 73,075 Capital balances after deficit allocation Required 3 GJ Required 4 GJ Journal entry worksheet 1 2 3 4 Record the allocation of the gain or loss on the sale of inventory to the partners Note: Enter debits before credits Transaction General Journal Debit Credit (b-1) Record entry Clear entry View general journal Journal entry worksheet 1 2 3 4 5 Assuming that the partners have no assets other than those invested, allocate any partner(s) deficit balances to the remaining partners. Note: Enter debits before credits. Transaction General Journal Debit Credit (b-2) Record entry View general journal Clear entry View transaction list Journal entry worksheet 4 5 1 2 3 Record the disbursement of the remaining cash to the partner(s) Note: Enter debits before credits. Transaction General Journal Debit Credit (d) Record entry Clear entry View general journal