Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kenisha and Shawna form the equal KS LLC, with a cash contribution of $926,000 from Kenisha and a property contribution (adjusted basis of $972,300, fair

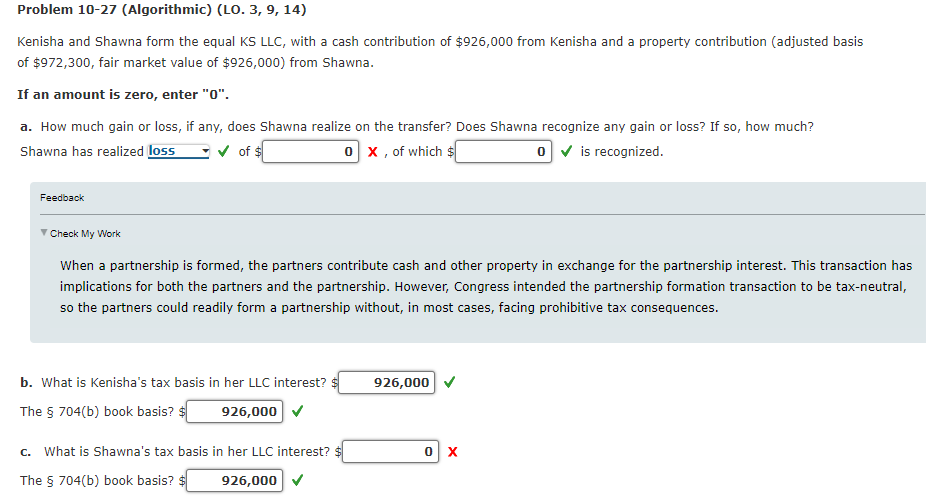

Kenisha and Shawna form the equal KS LLC, with a cash contribution of $926,000 from Kenisha and a property contribution (adjusted basis of $972,300, fair market value of $926,000 ) from Shawna. If an amount is zero, enter "0". a. How much gain or loss, if any, does Shawna realize on the transfer? Does Shawna recognize any gain or loss? If so, how much? Feedback Check My Work When a partnership is formed, the partners contribute cash and other property in exchange for the partnership interest. This transaction has implications for both the partners and the partnership. However, Congress intended the partnership formation transaction to be tax-neutral, so the partners could readily form a partnership without, in most cases, facing prohibitive tax consequences. b. What is Kenisha's tax basis in her LLC interest? $ The 704(b) book basis? $ C. What is Shawna's tax basis in her LLC interest? $X The 704 (b) book basis? $

Kenisha and Shawna form the equal KS LLC, with a cash contribution of $926,000 from Kenisha and a property contribution (adjusted basis of $972,300, fair market value of $926,000 ) from Shawna. If an amount is zero, enter "0". a. How much gain or loss, if any, does Shawna realize on the transfer? Does Shawna recognize any gain or loss? If so, how much? Feedback Check My Work When a partnership is formed, the partners contribute cash and other property in exchange for the partnership interest. This transaction has implications for both the partners and the partnership. However, Congress intended the partnership formation transaction to be tax-neutral, so the partners could readily form a partnership without, in most cases, facing prohibitive tax consequences. b. What is Kenisha's tax basis in her LLC interest? $ The 704(b) book basis? $ C. What is Shawna's tax basis in her LLC interest? $X The 704 (b) book basis? $ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started