Answered step by step

Verified Expert Solution

Question

1 Approved Answer

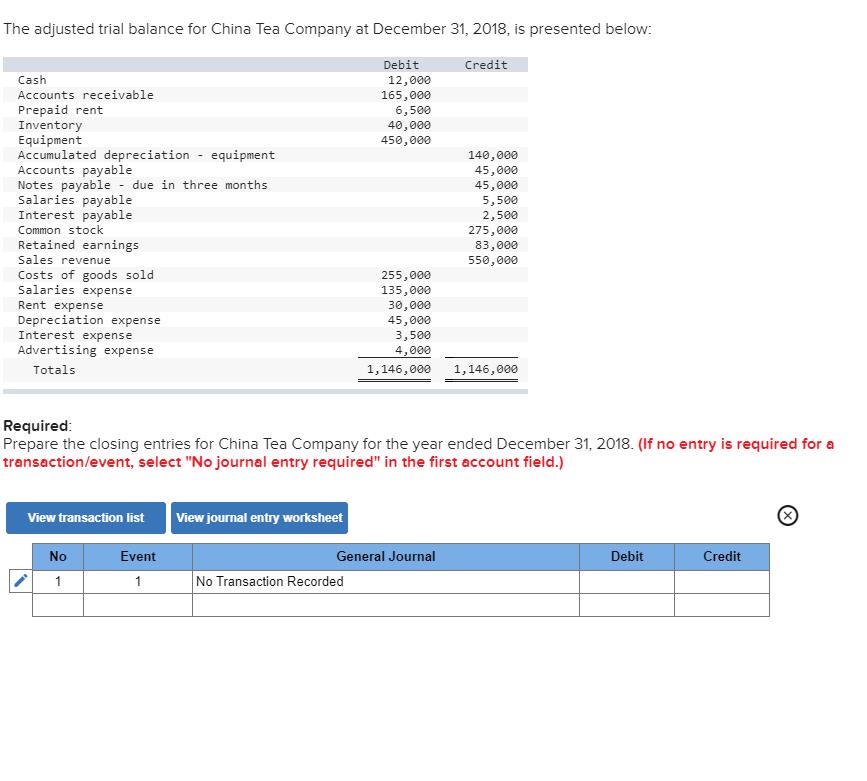

The adjusted trial balance for China Tea Company at December 31, 2018, is presented below: Debit Credit Cash 12,000 Accounts receivable 165,000 Prepaid rent

The adjusted trial balance for China Tea Company at December 31, 2018, is presented below: Debit Credit Cash 12,000 Accounts receivable 165,000 Prepaid rent 6,500 Inventory 40,000 Equipment 450,000 Accumulated depreciation equipment Accounts payable 140,000 45,000 Notes payable due in three months 45,000 Salaries payable 5,500 Interest payable 2,500 275,000 Common stock Retained earnings Sales revenue Costs of goods sold Salaries expense Rent expense Depreciation expense Interest expense Advertising expense Totals Required: 83,000 550,000 255,000 135,000 30,000 45,000 3,500 4,000 1,146,000 1,146,000 Prepare the closing entries for China Tea Company for the year ended December 31, 2018. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list View journal entry worksheet No Event General Journal 1 1 No Transaction Recorded Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The initial answer provided pertains to a makeorbuy decision involving Kennedy Company which is unre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started