Question

Kenneth Washburn, head of the Sporting Goods Division of Reliable Products, has just completed a miserable nine months. If it could have gone wrong, it

Kenneth Washburn, head of the Sporting Goods Division of Reliable Products, has just completed a miserable nine months. If it could have gone wrong, it did. Sales are down, income is down, inventories are bloated, and quite frankly, Im beginning to worry about my job, he moaned. Washburn is evaluated on the basis of ROI. Selected figures for the past nine months follow.

|

| |||

| Sales | $ | 7,200,000 |

|

| Operating income |

| 576,000 |

|

| Invested capital |

| 8,000,000 |

|

In an effort to make something out of nothing and to salvage the current years performance, Washburn was contemplating implementation of some or all of the following four strategies:

- Write off and discard $91,000 of obsolete inventory. The company will take a loss on the disposal.

- Accelerate the collection of $121,000 of overdue customer accounts receivable.

- Stop advertising through year-end and drastically reduce outlays for repairs and maintenance. These actions are expected to save the division $226,000 of expenses and will conserve cash resources.

- Acquire two competitors that are expected to have the following financial characteristics:

|

| Projected Sales | Projected Operating Expenses | Projected Invested Capital | ||||||||||||

| Anderson Manufacturing |

| $ | 4,520,000 |

|

|

| $ | 3,650,000 |

|

|

| $ | 7,250,000 |

|

|

| Palm Beach Enterprises |

|

| 6,770,000 |

|

|

|

| 6,190,000 |

|

|

|

| 7,250,000 |

|

|

Problem 13-43 Part 4

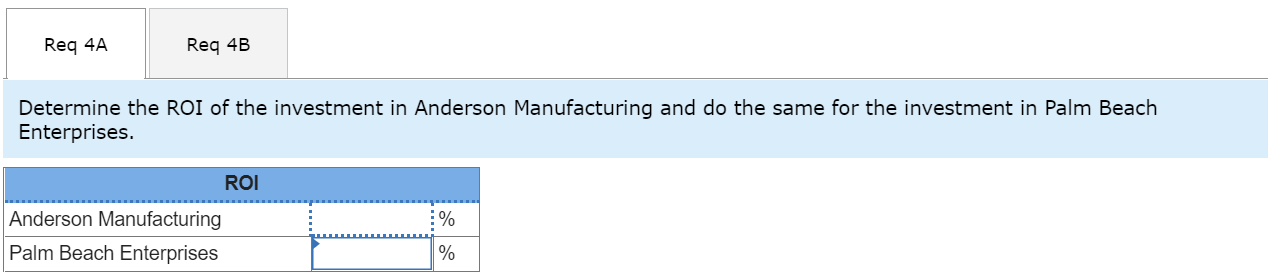

4-a. Determine the ROI of the investment in Anderson Manufacturing and do the same for the investment in Palm Beach Enterprises.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started