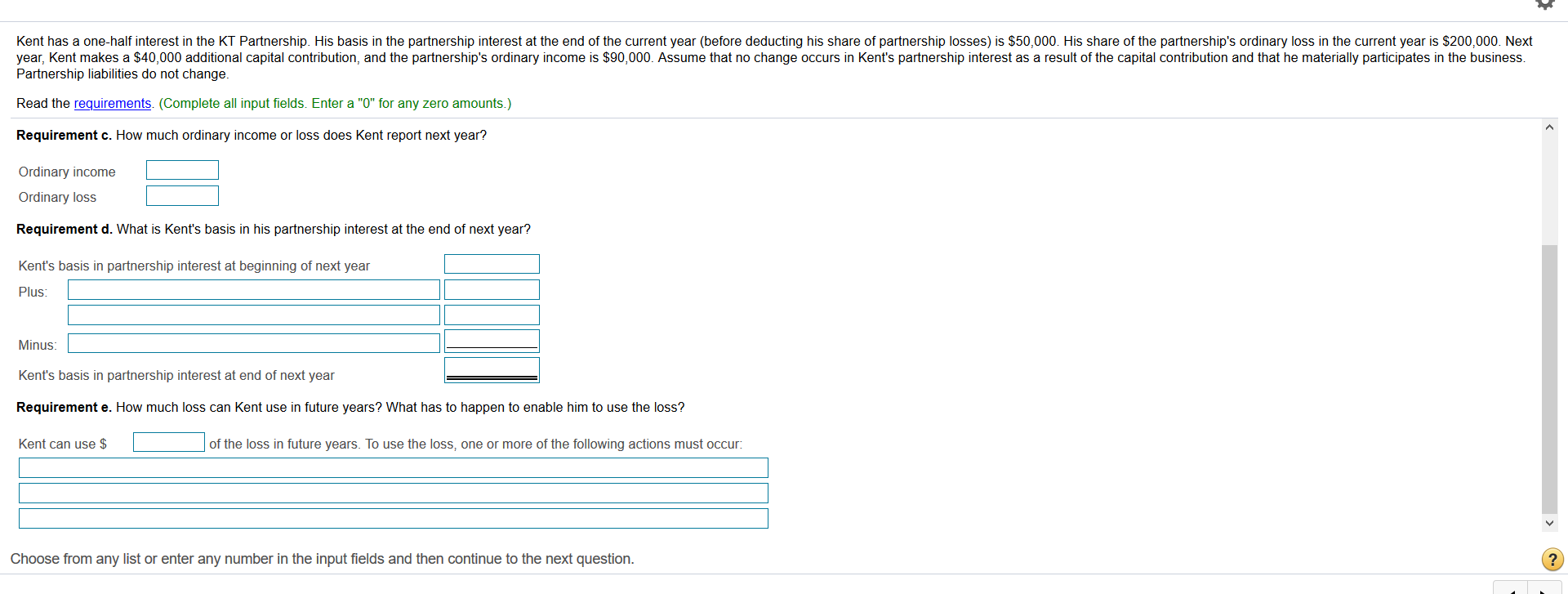

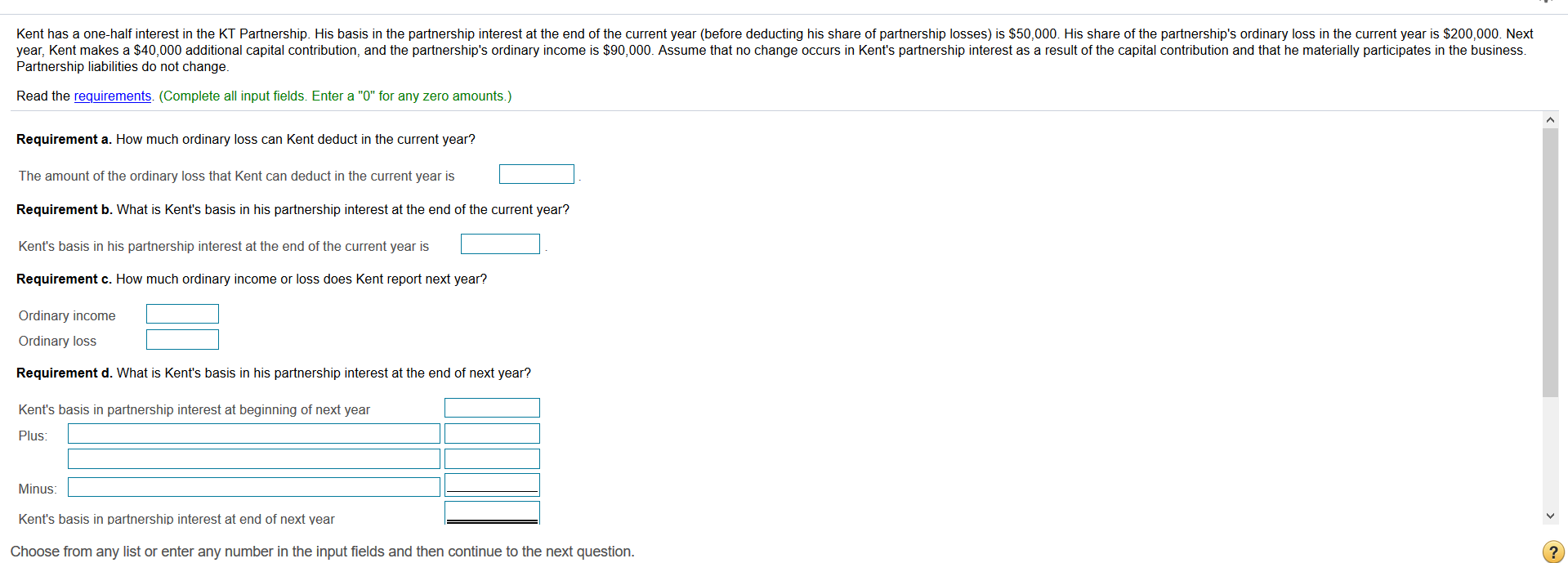

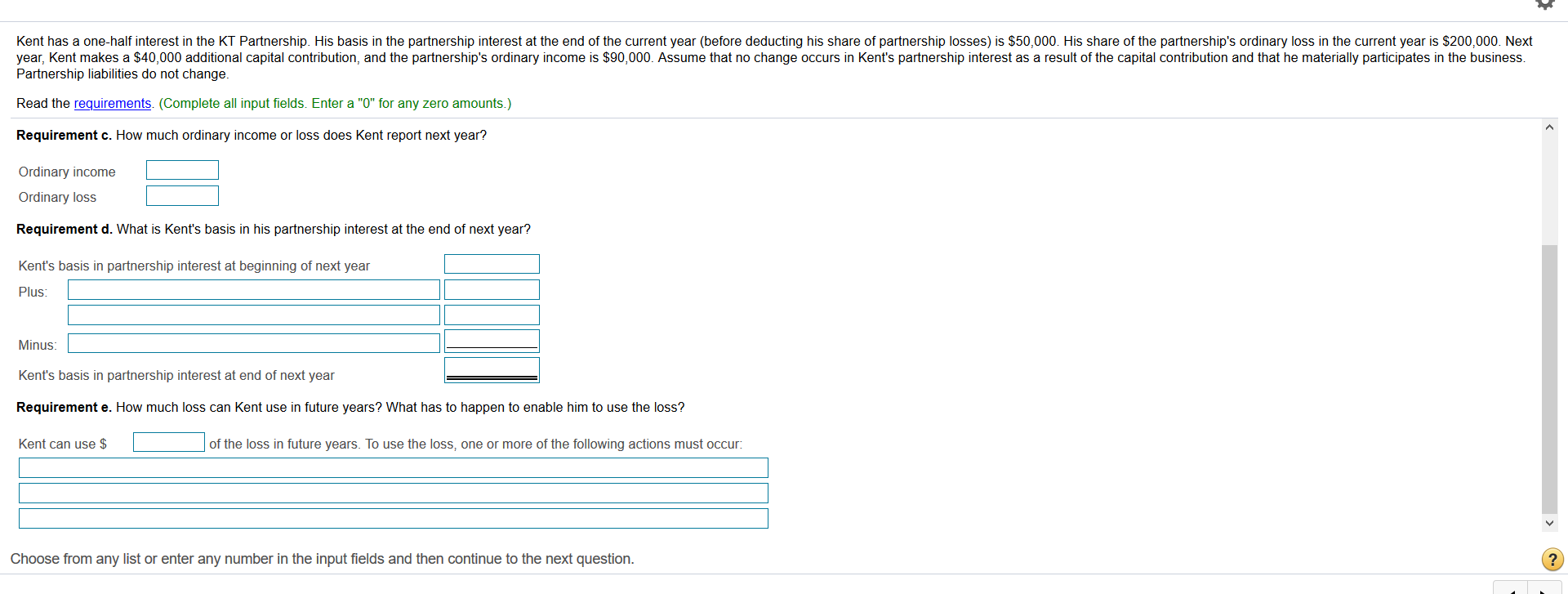

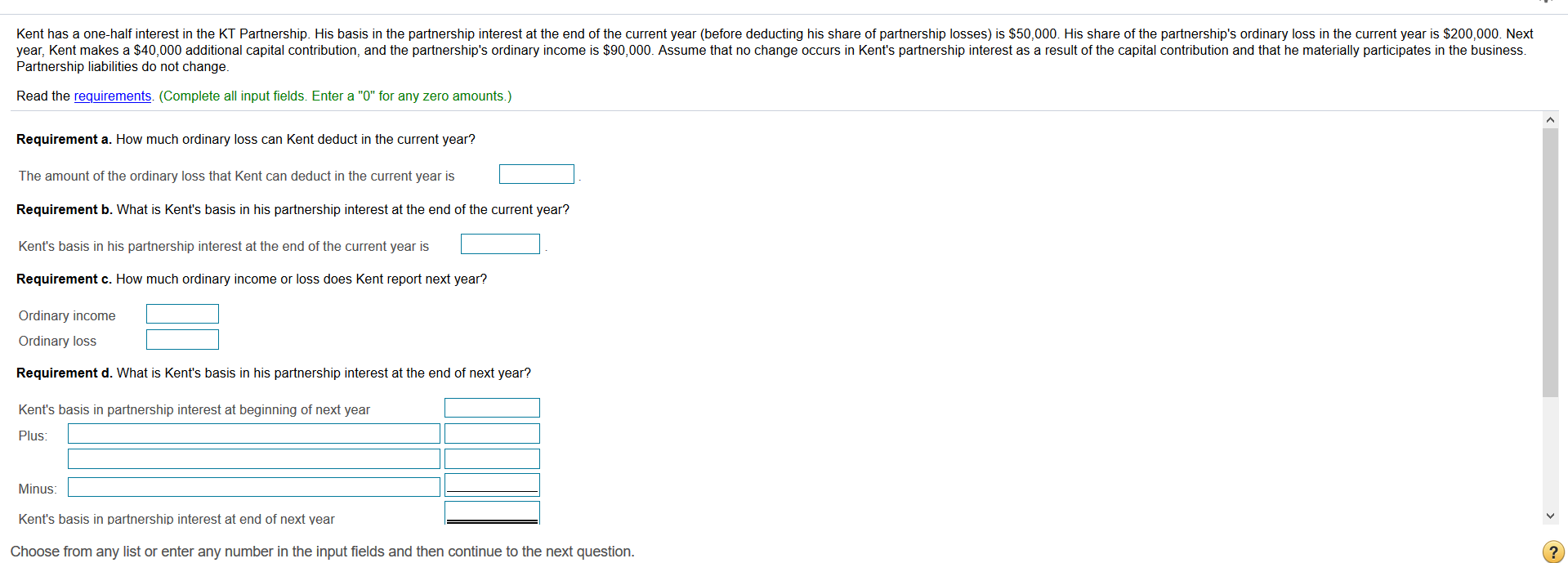

Kent has a one-half interest in the KT Partnership. His basis in the partnership interest at the end of the current year before deducting his share of partnership losses) is $50,000. His share of the partnership's ordinary loss in the current year is $200,000. Next year, Kent makes a $40,000 additional capital contribution, and the partnership's ordinary income is $90,000. Assume that no change occurs in Kent's partnership interest as a result of the capital contribution and that he materially participates in the business. Partnership liabilities do not change. Read the requirements. (Complete all input fields. Enter a "0" for any zero amounts.) Requirement c. How much ordinary income or loss does Kent report next year? Ordinary income Ordinary loss Requirement d. What is Kent's basis in his partnership interest at the end of next year? Kent's basis in partnership interest at beginning of next year Plus: Minus: Kent's basis in partnership interest at end of next year Requirement e. How much loss can Kent use in future years? What has to happen to enable him to use the loss? Kent can use $ of the loss in future years. To use the loss, one or more of the following actions must occur: Choose from any list or enter any number in the input fields and then continue to the next question. Kent has a one-half interest in the KT Partnership. His basis in the partnership interest at the end of the current year (before deducting his share of partnership losses) is $50,000. His share of the partnership's ordinary loss in the current year is $200,000. Next year, Kent makes a $40,000 additional capital contribution, and the partnership's ordinary income is $90,000. Assume that no change occurs in Kent's partnership interest as a result of the capital contribution and that he materially participates in the business. Partnership liabilities do not change. Read the requirements. (Complete all input fields. Enter a "0" for any zero amounts.) Requirement a. How much ordinary loss can kent deduct in the current year? The amount of the ordinary loss that Kent can deduct in the current year is Requirement b. What is Kent's basis in his partnership interest at the end of the current year? Kent's basis in his partnership interest at the end of the current year is Requirement c. How much ordinary income or loss does Kent report next year? Ordinary income Ordinary loss Requirement d. What is Kent's basis in his partnership interest at the end of next year? Kent's basis in partnership interest at beginning of next year Plus: Minus: Kent's basis in partnership interest at end of next year Choose from any list or enter any number in the input fields and then continue to the next question. Kent has a one-half interest in the KT Partnership. His basis in the partnership interest at the end of the current year before deducting his share of partnership losses) is $50,000. His share of the partnership's ordinary loss in the current year is $200,000. Next year, Kent makes a $40,000 additional capital contribution, and the partnership's ordinary income is $90,000. Assume that no change occurs in Kent's partnership interest as a result of the capital contribution and that he materially participates in the business. Partnership liabilities do not change. Read the requirements. (Complete all input fields. Enter a "0" for any zero amounts.) Requirement c. How much ordinary income or loss does Kent report next year? Ordinary income Ordinary loss Requirement d. What is Kent's basis in his partnership interest at the end of next year? Kent's basis in partnership interest at beginning of next year Plus: Minus: Kent's basis in partnership interest at end of next year Requirement e. How much loss can Kent use in future years? What has to happen to enable him to use the loss? Kent can use $ of the loss in future years. To use the loss, one or more of the following actions must occur: Choose from any list or enter any number in the input fields and then continue to the next question. Kent has a one-half interest in the KT Partnership. His basis in the partnership interest at the end of the current year (before deducting his share of partnership losses) is $50,000. His share of the partnership's ordinary loss in the current year is $200,000. Next year, Kent makes a $40,000 additional capital contribution, and the partnership's ordinary income is $90,000. Assume that no change occurs in Kent's partnership interest as a result of the capital contribution and that he materially participates in the business. Partnership liabilities do not change. Read the requirements. (Complete all input fields. Enter a "0" for any zero amounts.) Requirement a. How much ordinary loss can kent deduct in the current year? The amount of the ordinary loss that Kent can deduct in the current year is Requirement b. What is Kent's basis in his partnership interest at the end of the current year? Kent's basis in his partnership interest at the end of the current year is Requirement c. How much ordinary income or loss does Kent report next year? Ordinary income Ordinary loss Requirement d. What is Kent's basis in his partnership interest at the end of next year? Kent's basis in partnership interest at beginning of next year Plus: Minus: Kent's basis in partnership interest at end of next year Choose from any list or enter any number in the input fields and then continue to the next