Question

Kenton Shoes Ltd is a small company that sells a range of Casual and Work shoes through the internet. The accountant has asked you to

Kenton Shoes Ltd is a small company that sells a range of Casual and Work shoes through the internet. The accountant has asked you to calculate the value of the company’s closing inventory on 31 December 20X1 for inclusion in the financial statements. The following additional information is available:

1. Pairs of shoes counted in the warehouse at the year-end stocktake were as follows:- Casual Shoes 10,000, Work Shoes 5,000 pairs

2. 2,000 pairs of Casual Shoes were received into stores on 3 January 20X2. The goods were ordered on 23 December 20X1 and invoiced on 24 December but were still in transit from the US supplier when the inventory count was being performed. The invoice for these goods is included in the purchase ledger and the trade payable has been recognized on 31 December 20X1.

3. Due to an increase in the price of toughened leather, the supplier of Work Shoes increases the cost of each pair from 1 November 20X1. Since this date, Kenton Shoes has received 3,000 pairs in its stores.

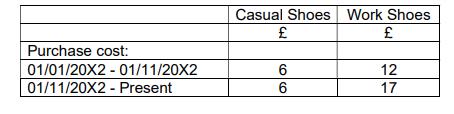

4. Selling price and cost per pair of shoes in 20X2.

5. It is company policy to use the FIFO method of recording the flow of inventory costs.

Required:-

a) Prepare a calculation of the value of inventories to be included in the year-end (31 December 20X1) financial statements, following IAS 2 – Inventories.

b) Write a report to the chief accountant explaining the reasons (under IAS 2) for valuing the inventories on the bases you applied in (a).

Purchase cost: 01/01/20X2 01/11/20X2 - 01/11/20X2 - Present Casual Shoes Work Shoes 12 17 4 6 6

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

ANSWERS a The value of inventories to be included in the yearend 31 December 20X1 financial statemen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started