Answered step by step

Verified Expert Solution

Question

1 Approved Answer

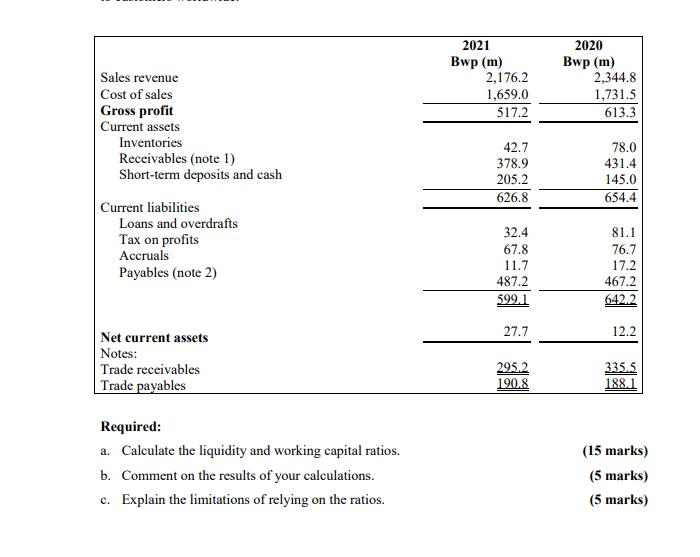

Sales revenue Cost of sales Gross profit Current assets Inventories Receivables (note 1) Short-term deposits and cash Current liabilities Loans and overdrafts Tax on

Sales revenue Cost of sales Gross profit Current assets Inventories Receivables (note 1) Short-term deposits and cash Current liabilities Loans and overdrafts Tax on profits Accruals Payables (note 2) Net current assets Notes: Trade receivables Trade payables Required: a. Calculate the liquidity and working capital ratios. b. Comment on the results of your calculations. c. Explain the limitations of relying on the ratios. 2021 Bwp (m) 2,176.2 1,659.0 517.2 42.7 378.9 205.2 626.8 32.4 67.8 11.7 487.2 599.1 27.7 295.2 190.8 2020 Bwp (m) 2,344.8 1,731.5 613.3 78.0 431.4 145.0 654.4 81.1 76.7 17.2 467.2 642.2 12.2 335.5 188.1 (15 marks) (5 marks) (5 marks)

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

aLiquidity ratio Current ratio 2021 CR CACL 54313027 179 CA inventories ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d8bedcb85a_176624.pdf

180 KBs PDF File

635d8bedcb85a_176624.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started