Answered step by step

Verified Expert Solution

Question

1 Approved Answer

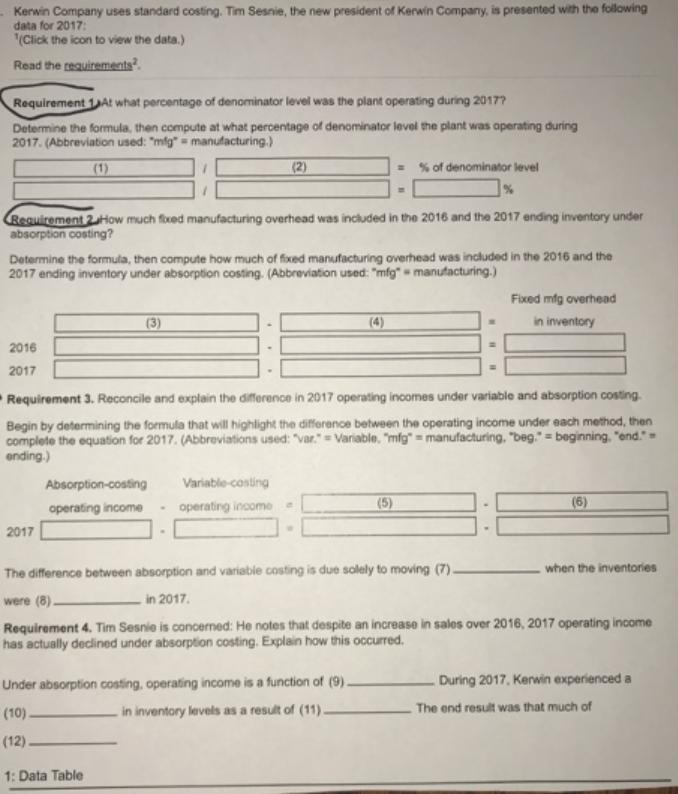

Kerwin Company uses standard costing. Tim Sesnie, the new president of Kerwin Company, is presented with the following data for 2017: (Click the icon

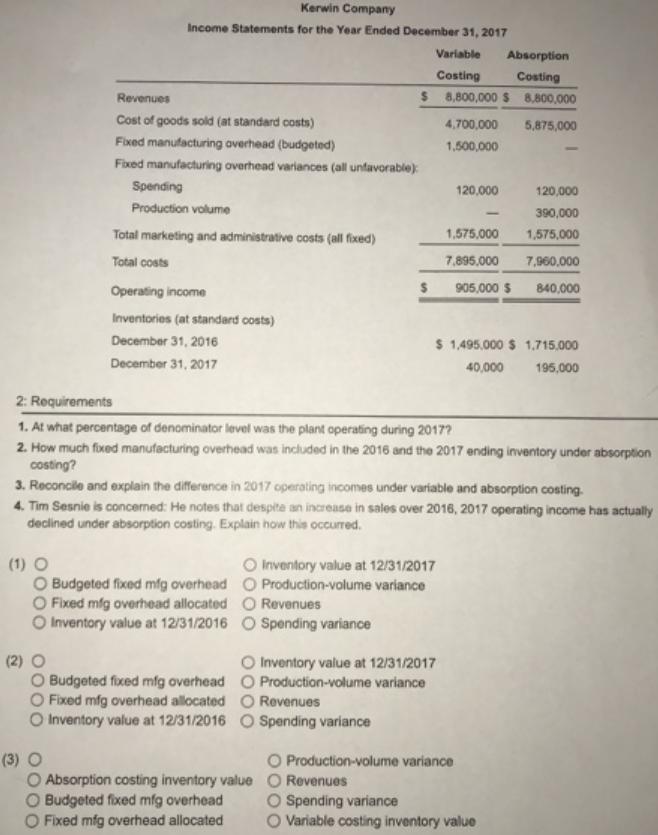

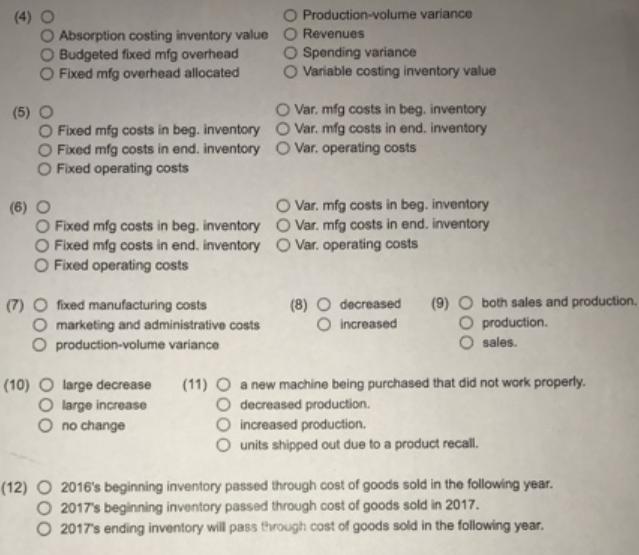

Kerwin Company uses standard costing. Tim Sesnie, the new president of Kerwin Company, is presented with the following data for 2017: (Click the icon to view the data.) Read the requirements. Requirement 1At what percentage of denominator level was the plant operating during 2017? Determine the formula, then compute at what percentage of denominator level the plant was operating during 2017. (Abbreviation used: "mfg" manufacturing.) Requirement 2 How much fixed manufacturing overhead was included in the 2016 and the 2017 ending inventory under absorption costing? 2016 2017 Determine the formula, then compute how much of fixed manufacturing overhead was included in the 2016 and the 2017 ending inventory under absorption costing. (Abbreviation used: "mfg" manufacturing.) (3) 2017 (2) Absorption-costing operating income Requirement 3. Reconcile and explain the difference in 2017 operating incomes under variable and absorption costing. Begin by determining the formula that will highlight the difference between the operating income under each method, then complete the equation for 2017. (Abbreviations used: "var." Variable. "mfg" = manufacturing, "beg. = beginning, "end." => ending.) . Variable-costing =% of denominator level operating income a (5) Under absorption costing, operating income is a function of (9). (10). in inventory levels as a result of (11). (12). 1: Data Table Fixed mig overhead in inventory (6) when the inventories The difference between absorption and variable costing is due solely to moving (7). were (8). in 2017. Requirement 4. Tim Sesnie is concerned: He notes that despite an increase in sales over 2016, 2017 operating income has actually declined under absorption costing. Explain how this occurred. During 2017, Kerwin experienced a The end result was that much of (1) O Kerwin Company Income Statements for the Year Ended December 31, 2017 (2) O Revenues Cost of goods sold (at standard costs) Fixed manufacturing overhead (budgeted) Fixed manufacturing overhead variances (all unfavorable): Spending Production volume (3) O Total marketing and administrative costs (all fixed) Total costs Operating income Inventories (at standard costs) December 31, 2016 December 31, 2017 O Budgeted fixed mig overhead O Fixed mig overhead allocated O Inventory value at 12/31/2016 Variable Absorption Costing Costing $ 8,800,000 $ 8,800,000 2: Requirements 1. At what percentage of denominator level was the plant operating during 2017? 2. How much fixed manufacturing overhead was included in the 2016 and the 2017 ending inventory under absorption costing? 3. Reconcile and explain the difference in 2017 operating incomes under variable and absorption costing. 4. Tim Sesnie is concerned: He notes that despite an increase in sales over 2016, 2017 operating income has actually declined under absorption costing. Explain how this occurred. O Budgeted fixed mig overhead O Fixed mfg overhead allocated O Inventory value at 12/31/2016 O Spending variance $ Inventory value at 12/31/2017 O Production-volume variance O Revenues Spending variance O Absorption costing inventory value Budgeted fixed mfg overhead O Fixed mig overhead allocated Inventory value at 12/31/2017 O Production-volume variance O Revenues 4,700,000 5,875,000 1,500,000 120,000 390,000 1,575,000 1,575,000 7,895,000 7,960,000 905,000 $ 840,000 $ 1,495,000 $1,715,000 40,000 195,000 120,000 O Production-volume variance O Revenues O Spending variance O Variable costing inventory value (5) O Absorption costing inventory value O Budgeted fixed mfg overhead O Fixed mfg overhead allocated O Fixed mfg costs in beg. inventory O Fixed mfg costs in end. inventory O Fixed operating costs (6) O O Fixed mfg costs in beg. inventory O Fixed mfg costs in end. inventory O Fixed operating costs fixed manufacturing costs O marketing and administrative costs O production-volume variance (10) O large decrease (11) O large increase O no change Production-volume variance O Revenues O Spending variance O Variable costing inventory value O Var. mfg costs in beg. inventory O Var. mfg costs in end. inventory O Var. operating costs O Var. mfg costs in beg. inventory O Var. mfg costs in end. inventory O Var. operating costs (8) O decreased (9) O both sales and production. O increased production. sales. a new machine being purchased that did not work properly. decreased production. increased production. units shipped out due to a product recall. (12) 2016's beginning inventory passed through cost of goods sold in the following year. O 2017's beginning inventory passed through cost of goods sold in 2017. 2017's ending inventory will pass through cost of goods sold in the following year.

Step by Step Solution

★★★★★

3.41 Rating (179 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started