Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kevin borrowed a 25-year mortgage loan of $8,000,000 from Hang Seng Bank (HSB) to purchase a flat in North Point 6 years ago. The

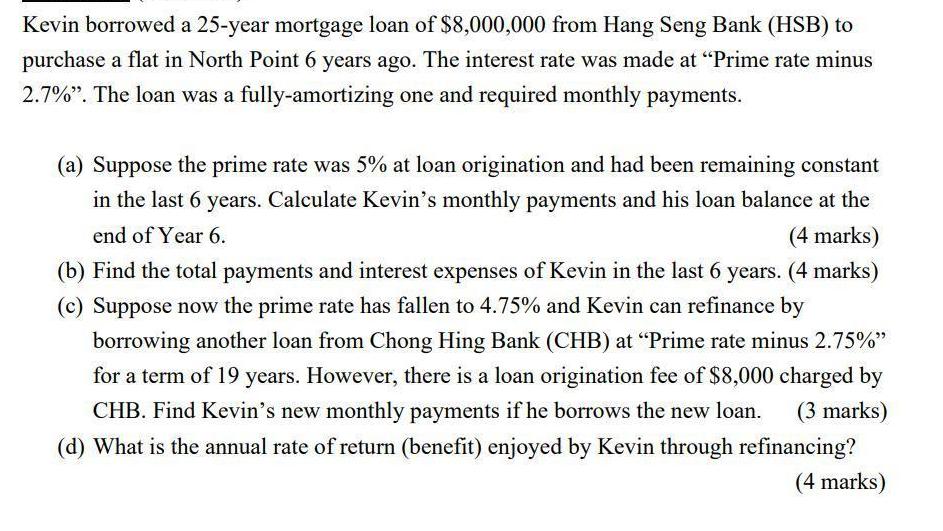

Kevin borrowed a 25-year mortgage loan of $8,000,000 from Hang Seng Bank (HSB) to purchase a flat in North Point 6 years ago. The interest rate was made at "Prime rate minus 2.7%". The loan was a fully-amortizing one and required monthly payments. (a) Suppose the prime rate was 5% at loan origination and had been remaining constant in the last 6 years. Calculate Kevin's monthly payments and his loan balance at the end of Year 6. (4 marks) (b) Find the total payments and interest expenses of Kevin in the last 6 years. (4 marks) (c) Suppose now the prime rate has fallen to 4.75% and Kevin can refinance by borrowing another loan from Chong Hing Bank (CHB) at "Prime rate minus 2.75%" for a term of 19 years. However, there is a loan origination fee of $8,000 charged by CHB. Find Kevin's new monthly payments if he borrows the new loan. (3 marks) (d) What is the annual rate of return (benefit) enjoyed by Kevin through refinancing? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Prime rate at loan origination 5 Interest rate for Kevins loan 5 27 23 Number of payments for a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started