Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kevin incorporates his sole proprietorship as Great Corporation and transfers its assets to Great in exchange for all 100 shares of Great stock and

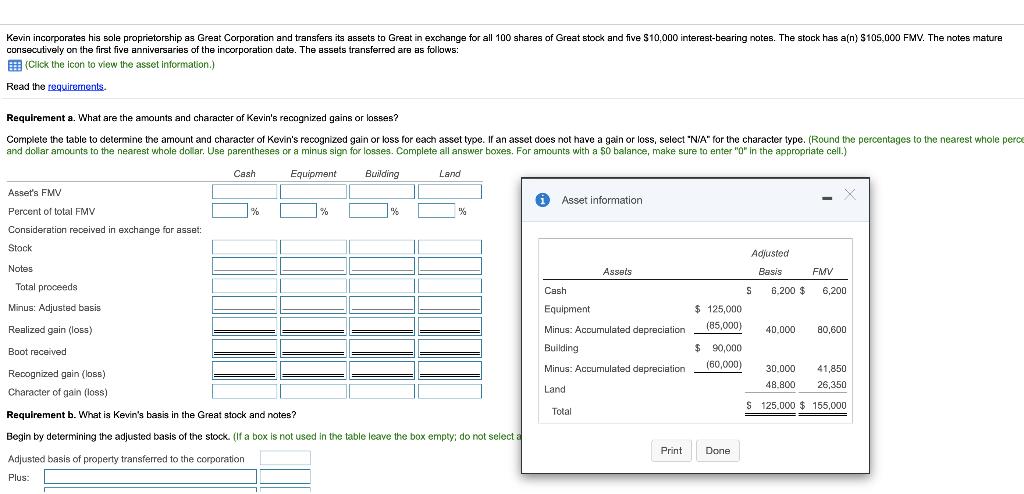

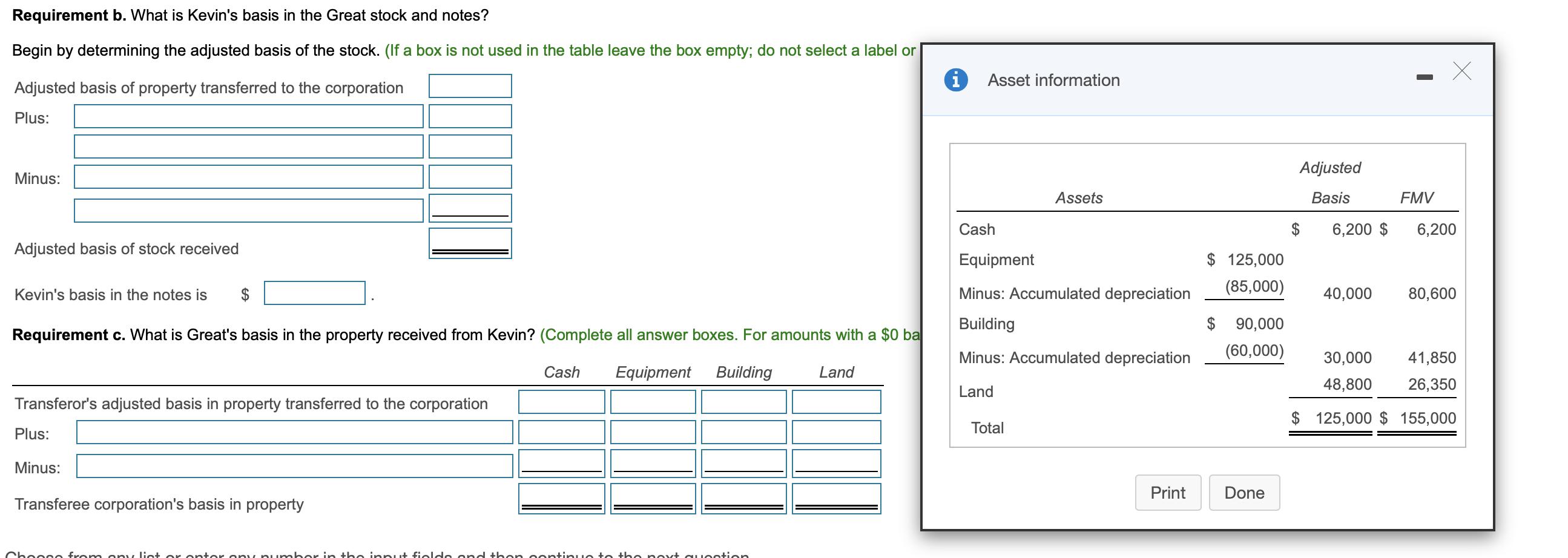

Kevin incorporates his sole proprietorship as Great Corporation and transfers its assets to Great in exchange for all 100 shares of Great stock and five $10,000 interest-bearing notes. The stock has a(n) S105,000 FMV. The notes mature consecutively cn the first five anniversaries of the incorporation date. The assets transferred are as follows: E (Click the icon to view the asset information.) Read the reguirements. Requirement a. What are the amounts and character of Kevin's recognized gains or losses? Complete the table to determine the amount and character of Kevin's recognized gain or loss for cach asset type. If an asset does not have a gain or loss, select "N/A" for the character type. (Round the percentages to the nearest whole perce and dollar amounts to the nearest whole dollar. Use parentheses or a minus sign for losses. Complete all answer boxes. For amounts with a $0 balance, make sure to enter "0" in the appropriate cell.) Cash Equipment Building Land Asset's FMV O Asset information % % 7% Percent of total FMV Consideration received in exchange for asset: Stock Adjusted Notes Assets Basis FMV Total proceeds Cash 6,200 $ 6,200 Minus: Adjusted basis Equipment $ 125,000 Realized gain (loss) Minus: Accumulated depreciation (85,000) 40,000 80,600 Boot received Building $ 90,000 Minus: Accumulated depreciation (60,000) 30.000 41,850 Recognized gain (loss) 48.800 26,350 Land Character of gain (loss) $ 125.000 $ 155,000 Total Requirement b. What is Kevin's basis in the Great stock and notes? Begin by determining the adjusted basis of the stock. (If a box is not used in the table leave the box empty; do not select a Print Done Adjusted basis of property transferred to the corporation Plus: Requirement b. What is Kevin's basis in the Great stock and notes? Begin by determining the adjusted basis of the stock. (If a box is not used in the table leave the box empty; do not select a label or Asset information Adjusted basis of property transferred to the corporation Plus: Adjusted Minus: Assets Basis FMV Cash $ 6,200 $ 6,200 Adjusted basis of stock received Equipment $ 125,000 Kevin's basis in the notes is $ Minus: Accumulated depreciation (85,000) 40,000 80,600 Building $ 90,000 Requirement c. What is Great's basis in the property received from Kevin? (Complete all answer boxes. For amounts with a $0 ba Minus: Accumulated depreciation (60,000) 30,000 41,850 Cash Equipment Building Land 48,800 26,350 Land Transferor's adjusted basis in property transferred to the corporation $ 125,000 $ 155,000 Total Plus: Minus: Print Done Transferee corporation's basis in property

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Deler mine lte amoua audchayacter for kevina vecognized gaiulkoos Tolal Icash 6200 80600H13...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started