Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kevin is 45 years old, divorced, and has two children, ages 16 and 18, from his previous marriage. He earns $160,000 a year as

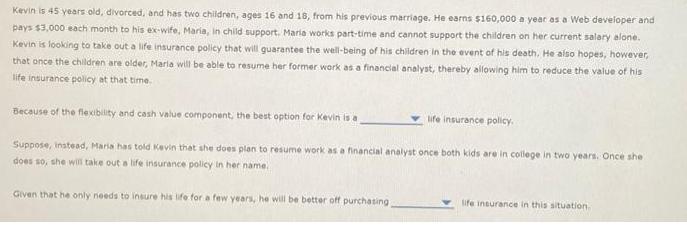

Kevin is 45 years old, divorced, and has two children, ages 16 and 18, from his previous marriage. He earns $160,000 a year as a Web developer and pays $3,000 each month to his ex-wife, Maria, in child support. Maria works part-time and cannot support the children on her current salary alone. Kevin is looking to take out a life insurance policy that will guarantee the well-being of his children in the event of his death. He also hopes, however, that once the children are older, Maria will be able to resume her former work as a financial analyst, thereby allowing him to reduce the value of his life insurance policy at that time. Because of the flexibility and cash value component, the best option for Kevin is a Suppose, instead, Maria has told Kevin that she does plan to resume work as a financial analyst once both kids are in college in two years. Once she does so, she will take out a life insurance policy in her name. Given that he only needs to insure his life for a few years, he will be better off purchasing, life insurance policy. life insurance in this situation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1adjustable life insurance policy EXPLANATION Adjustable insurance may be a hybrid of term lif...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started