Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kevin owns a retail store, and during the current year he purchased $671,200 worth of inventory. Kevin's beginning inventory was $67,120, and his ending inventory

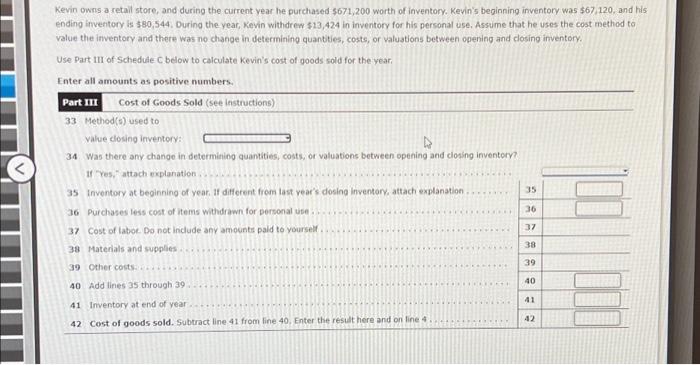

Kevin owns a retail store, and during the current year he purchased $671,200 worth of inventory. Kevin's beginning inventory was $67,120, and his ending inventory is $80,544. During the year, Kevin withdrew $13,424 in inventory for his personal use. Assume that he uses the cost method to value the inventory and there was no change in determining quantities, costs, or valuations between opening and closing inventory. Use Part III of Schedule C below to calculate Kevin's cost of goods sold for the year. Enter all amounts as positive numbers. Part III Cost of Goods Sold (see instructions) 33 Method(s) used to value closing inventory: k 34 Was there any change in determining quantities, costs, or valuations between opening and closing inventory? If "Yes," att explanation 35 Inventory at beginning of year. If different from last year's closing inventory, attach explanation 36 Purchases less cost of items withdrawn for personal use 37 Cost of labor. Do not include any amounts paid to yourself 38 Materials and supplies. 39 Other costs.. 40 Add lines 35 through 39 41 Inventory at end of year ..... 42 Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4 35 36 37 38 39 40 41 42

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started