Answered step by step

Verified Expert Solution

Question

1 Approved Answer

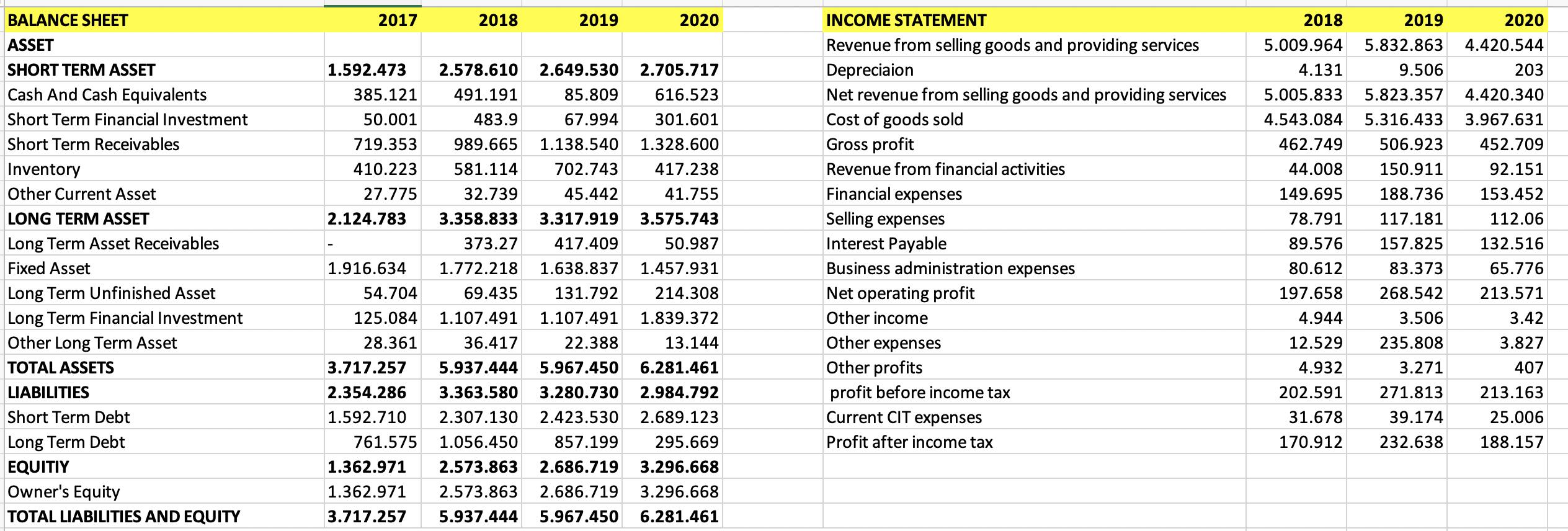

Calculate Cash flow to the creditor, Cashflow to the stock holder, Cash flow from the assets for the company in the last three years (2018-2020)

Calculate Cash flow to the creditor, Cashflow to the stock holder, Cash flow from the assets for the company in the last three years (2018-2020) based on the company financial statement published on its website? Comments about the results

Calculate Cash flow to the creditor, Cashflow to the stock holder, Cash flow from the assets for the company in the last three years (2018-2020) based on the company financial statement published on its website? Comments about the results

BALANCE SHEET ASSET SHORT TERM ASSET Cash And Cash Equivalents Short Term Financial Investment Short Term Receivables Inventory Other Current Asset LONG TERM ASSET Long Term Asset Receivables Fixed Asset Long Term Unfinished Asset Long Term Financial Investment Other Long Term Asset TOTAL ASSETS LIABILITIES Short Term Debt Long Term Debt EQUITIY Owner's Equity TOTAL LIABILITIES AND EQUITY 2017 2018 2.124.783 2019 2020 27.775 1.592.473 2.578.610 2.649.530 2.705.717 385.121 491.191 85.809 616.523 50.001 483.9 67.994 301.601 719.353 989.665 1.138.540 1.328.600 410.223 581.114 702.743 417.238 32.739 45.442 41.755 3.358.833 3.317.919 3.575.743 373.27 417.409 50.987 1.916.634 1.772.218 1.638.837 1.457.931 54.704 69.435 131.792 214.308 125.084 1.107.491 1.107.491 1.839.372 28.361 36.417 22.388 13.144 3.717.257 5.937.444 5.967.450 6.281.461 2.354.286 3.363.580 3.280.730 2.984.792 1.592.710 2.307.130 2.423.530 2.689.123 857.199 295.669 1.362.971 2.573.863 2.686.719 3.296.668 1.362.971 2.573.863 2.686.719 3.296.668 3.717.257 5.937.444 5.967.450 6.281.461 761.575 1.056.450 INCOME STATEMENT Revenue from selling goods and providing services Depreciaion Net revenue from selling goods and providing services Cost of goods sold Gross profit Revenue from financial activities Financial expenses Selling expenses Interest Payable Business administration expenses Net operating profit Other income Other expenses Other profits profit before income tax Current CIT expenses Profit after income tax 92.151 2018 2019 2020 5.009.964 5.832.863 4.420.544 4.131 9.506 203 5.005.833 5.823.357 4.420.340 4.543.084 5.316.433 3.967.631 462.749 506.923 452.709 44.008 150.911 149.695 188.736 153.452 78.791 117.181 112.06 89.576 157.825 132.516 83.373 65.776 268.542 213.571 3.506 235.808 3.271 271.813 39.174 80.612 197.658 4.944 12.529 4.932 202.591 31.678 3.42 3.827 407 213.163 25.006 170.912 232.638 188.157

Step by Step Solution

★★★★★

3.59 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Assumptions 1 There are no details given for the year 2017 I am assuming that the long term liabilit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started