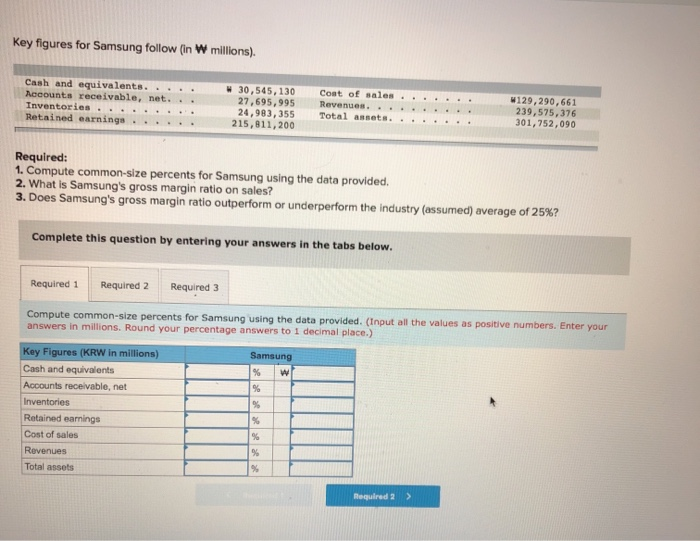

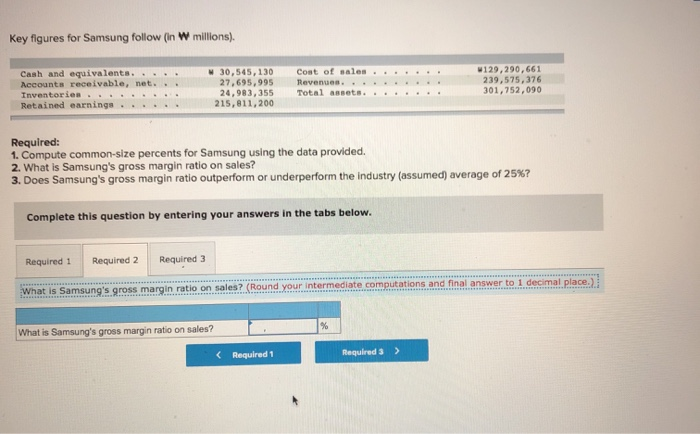

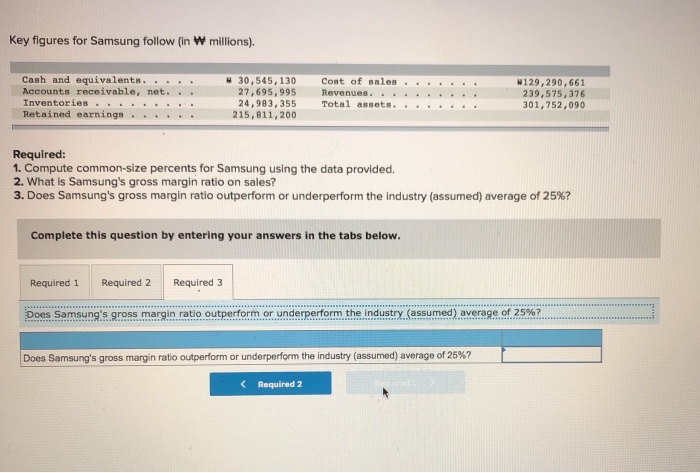

Key figures for Samsung follow (in W millions). Cash and equivalents... Accounts receivable, net... Inventories . . . . . . . . . Retained earnings . . . . . . W 30,545, 130 27,695,995 24,983,355 215,811,200 Coat of sales .... Revenues. . . . . . . . . . Total assets...... W129, 290,661 239,575,376 301,752,090 Required: 1. Compute common-size percents for Samsung using the data provided. 2. What Is Samsung's gross margin ratio on sales? 3. Does Samsung's gross margin ratio outperform or underperform the industry (assumed) average of 25%? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute common-size percents for Samsung using the data provided. (Input all the values as positive numbers. Enter your answers in millions. Round your percentage answers to 1 decimal place.) Samsung Key Figures (KRW in millions) Cash and equivalents Accounts receivable, net Inventories Retained earnings Cost of sales Revenues Total assets Required 2 > Key figures for Samsung follow (in W millions). Cash and equivalents... Accounts receivable, net... Inventorien . . . . . . . . Retained earnings .. . , W 30,545, 130 27,695,995 24,983,355 215,811,200 Coat of sales .. Revenues. .... Total assets... w129,290,661 239,575,376 301,752,090 Required: 1. Compute common-size percents for Samsung using the data provided. 2. What is Samsung's gross margin ratio on sales? 3. Does Samsung's gross margin ratio outperform or underperform the industry (assumed) average of 25%? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 answer to 1 decimal place.) What is Samsung's gross margin ratio on sales? (Round your intermediate comput What is Samsung's gross margin ratio on sales? Key figures for Samsung follow (In W millions). Cash and equivalents... Accounts receivable, net... Inventories ...... Retained earnings ... W 30,545,130 27,695,995 24,983,355 215,811,200 Cost of sales . . . . . . . Revenues. . . . . . . . . Total assets. . . . . . . . w129, 290,661 239,575,376 301,752,090 Required: 1. Compute common-size percents for Samsung using the data provided. 2. What is Samsung's gross margin ratio on sales? 3. Does Samsung's gross margin ratio outperform or underperform the industry (assumed) average of 25%? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Does Samsung's gross margin ratio outperform or underperform the industry (assumed) average of 25%? Does Samsung's gross margin ratio outperform or underperform the industry (assumed) average of 25%? ( Required 2