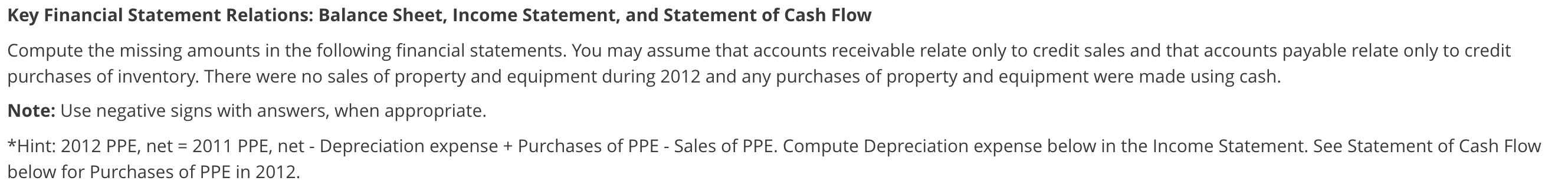

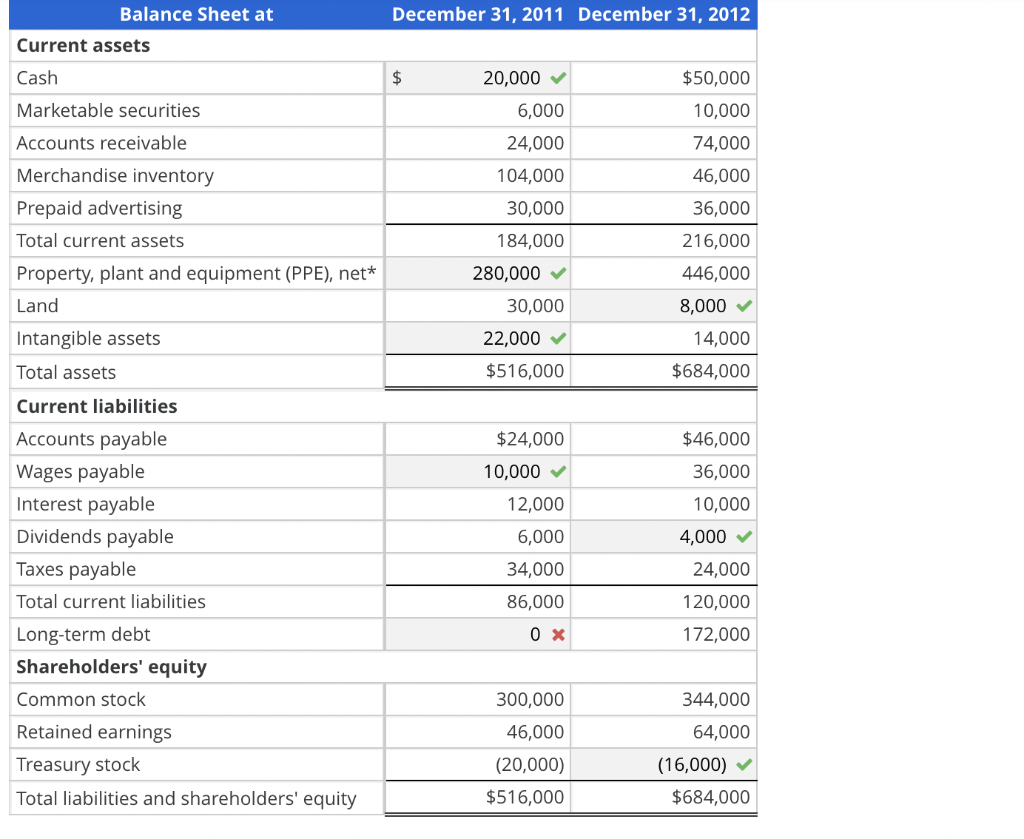

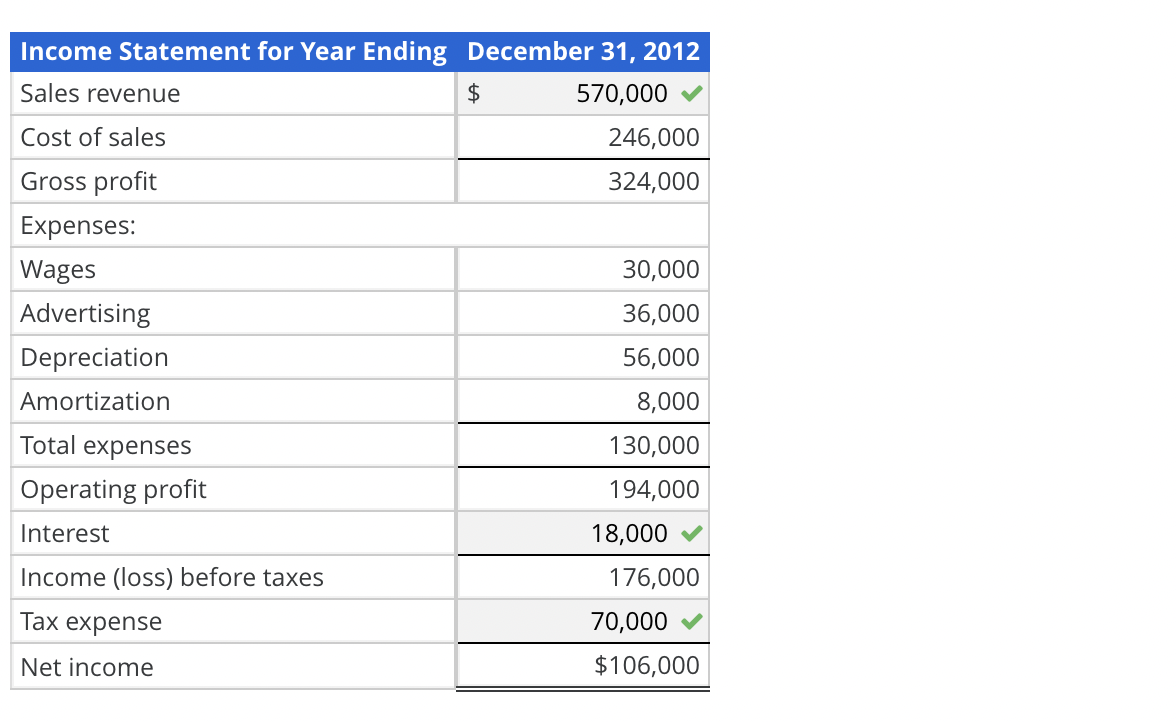

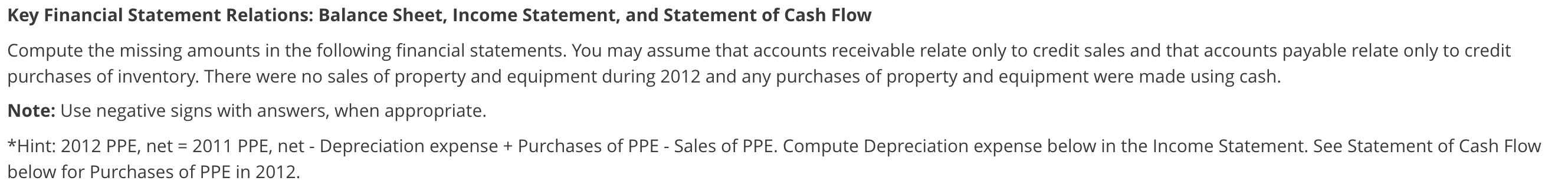

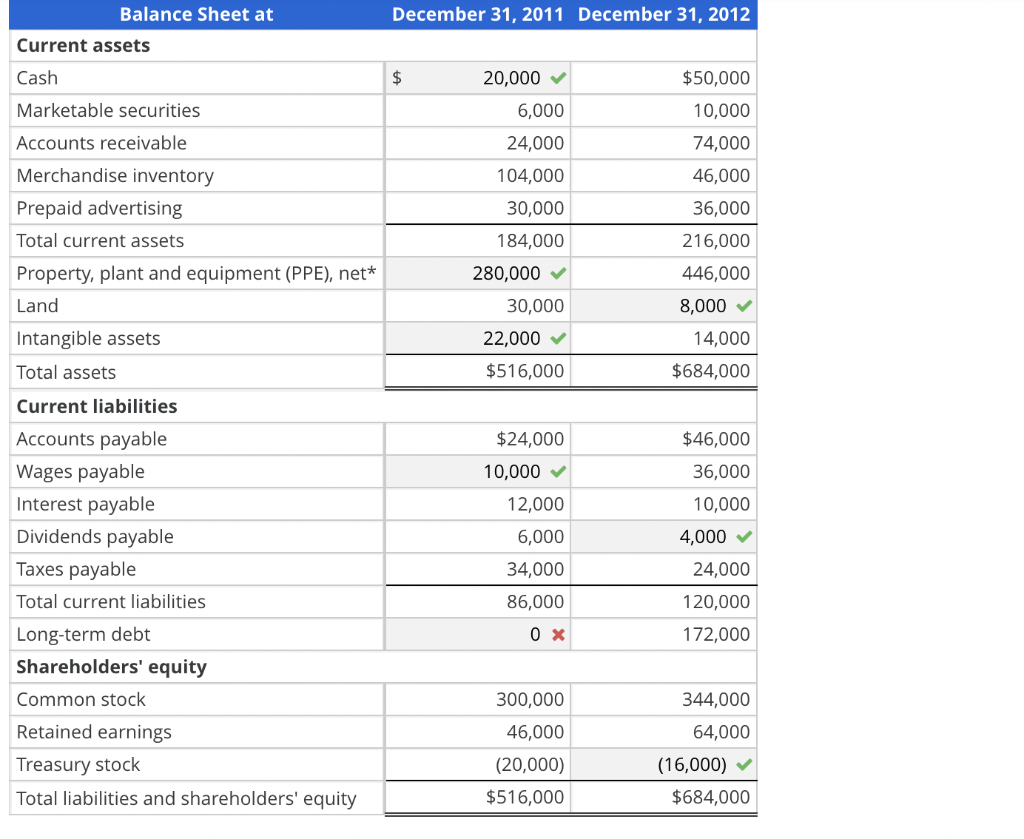

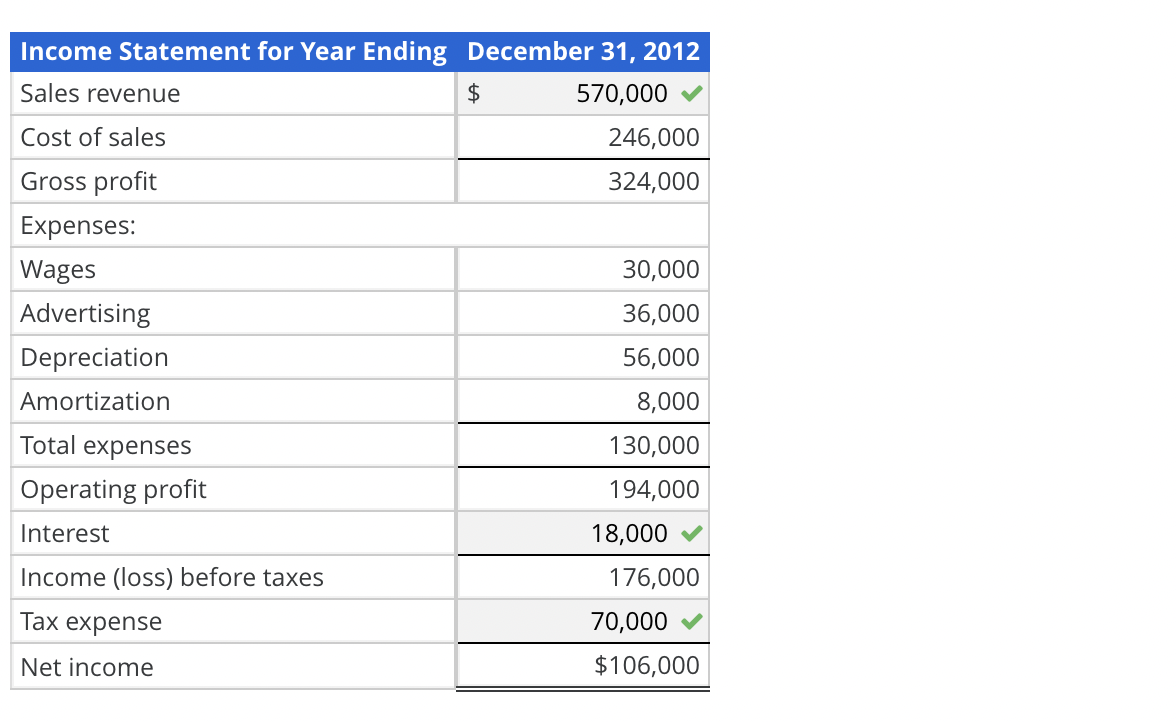

Key Financial Statement Relations: Balance Sheet, Income Statement, and Statement of Cash Flow Compute the missing amounts in the following financial statements. You may assume that accounts receivable relate only to credit sales and that accounts payable relate only to credit purchases of inventory. There were no sales of property and equipment during 2012 and any purchases of property and equipment were made using cash. Note: Use negative signs with answers, when appropriate. *Hint: 2012 PPE, net = 2011 PPE, net - Depreciation expense + Purchases of PPE - Sales of PPE. Compute Depreciation expense below in the Income Statement. See Statement of Cash Flow below for Purchases of PPE in 2012. Balance Sheet at December 31, 2011 December 31, 2012 Current assets Cash $ 20,000 $50,000 6,000 24,000 104,000 30,000 184,000 280,000 30,000 22,000 $516,000 10,000 74,000 46,000 36,000 216,000 446,000 8,000 14,000 $684,000 Marketable securities Accounts receivable Merchandise inventory Prepaid advertising Total current assets Property, plant and equipment (PPE), net* Land Intangible assets Total assets Current liabilities Accounts payable Wages payable Interest payable Dividends payable Taxes payable Total current liabilities Long-term debt Shareholders' equity Common stock Retained earnings Treasury stock Total liabilities and shareholders' equity $24,000 10,000 12,000 6,000 34,000 86,000 $46,000 36,000 10,000 4,000 24,000 120,000 OX 172,000 344,000 300,000 46,000 (20,000) $516,000 64,000 (16,000) $684,000 Income Statement for Year Ending December 31, 2012 Sales revenue $ 570,000 Cost of sales 246,000 Gross profit 324,000 Expenses: Wages 30,000 Advertising 36,000 Depreciation 56,000 Amortization 8,000 Total expenses 130,000 Operating profit 194,000 Interest 18,000 Income (loss) before taxes 176,000 70,000 Net income $106,000 Tax expense December 31, 2012 $520,000 (166,000) (4,000) (80,000) (20,000) 0 x 208,000 Statement of Cash Flow for Year Ended Cash flow from operating activities Cash collections from customers Cash payments for: Inventory Wages Taxes Interest Advertising Net cash provided by operations Cash flow from investing activities (Purchases) sale of property, plant and equipment (Purchase) sale of marketable securities (Purchase) sale of land Net cash provided by investing activities Cash flow from financing activities Issuance (repayment) of long-term debt Payment of dividend Issuance (repurchase) of common stock (Purchase) sale of treasury stock Net cash provided by financing activities Change in cash (222,000) 0 x 22,000 (204,000) 68,000 (90,000) 44,000 4,000 26,000 $ 0 x