Question

Define each of the following terms: a. Working capital; net working capital; net operating working capital b. Relaxed investment policy; restricted investment policy; moderate investment

Define each of the following terms:

a. Working capital; net working capital; net operating working capital

b. Relaxed investment policy; restricted investment policy; moderate investment policy

c. Permanent current assets; temporary current assets

d. Current assets financing policy; maturity matching (self-liquidating) approach

e. Cash conversion cycle (CCC); inventory conversion period; average collection period; payables deferral period

f. Cash budget; target cash balance

g. Lockbox; account receivable

h. Credit policy; credit period; discounts; credit standards; collection policy; credit terms; credit score

i. Trade credit; free trade credit; costly trade credit

j. Promissory note; line of credit; revolving credit agreement

k. Prime rate; regular, or simple interest; add-on interest

l. Commercial paper; accruals; spontaneous funds

CURRENT ASSETS INVESTMENT POLICY Calgary Company is thinking of modifying its current assets investment policy. Fixed assets are $600,000, sales are projected at $3 million, the EBIT/Sales ratio is projected at 15%, the interest rate is 10% on all debt, the federal-plus-state tax rate is 40%, and Calgary plans to maintain a 50% debt-to-assets ratio. Three alternative current assets investment policies are under consideration: 40%, 50%, and 60% of projected sales. What is the expected return on equity under each alternative?

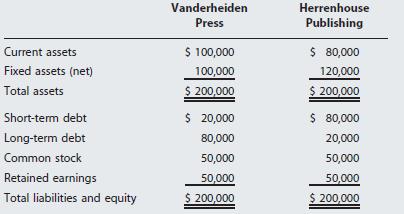

CURRENT ASSETS FINANCING Vanderheiden Press Inc. and Herrenhouse Publishing Company had the following balance sheets as of December 31, 2015 (thousands of dollars):

Earnings before interest and taxes for both firms are $30 million, and the effective federal-plus-state tax rate is 40%.

a. What is the return on equity for each firm if the interest rate on short-term debt is 10% and the rate on long-term debt is 13%?

b. Assume that the short-term rate rises to 20%. Although the rate on new long-term debt rises to 16%, the rate on existing long-term debt remains unchanged. What would be the returns on equity for Vanderheiden Press and Herrenhouse Publishing under these conditions?

c. Which company is in a riskier position? Why?

Vanderheiden Herrenhouse Press Publishing $ 100,000 $ 80,000 Current assets Fixed assets (net) 100,000 $ 200,000 120,000 $ 200,000 Total assets $ 20,000 $ 80,000 Short-term debt Long-term debt 80,000 20,000 Common stock 50,000 50,000 Retained earnings 50,000 50,000 Total liabilities and equity $ 200,000 $ 200,000

Step by Step Solution

3.57 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Working capital is the difference between current assets and current liabilities Net working capital is the difference between a company s total current assets and total current liabilities Net oper...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started