Question

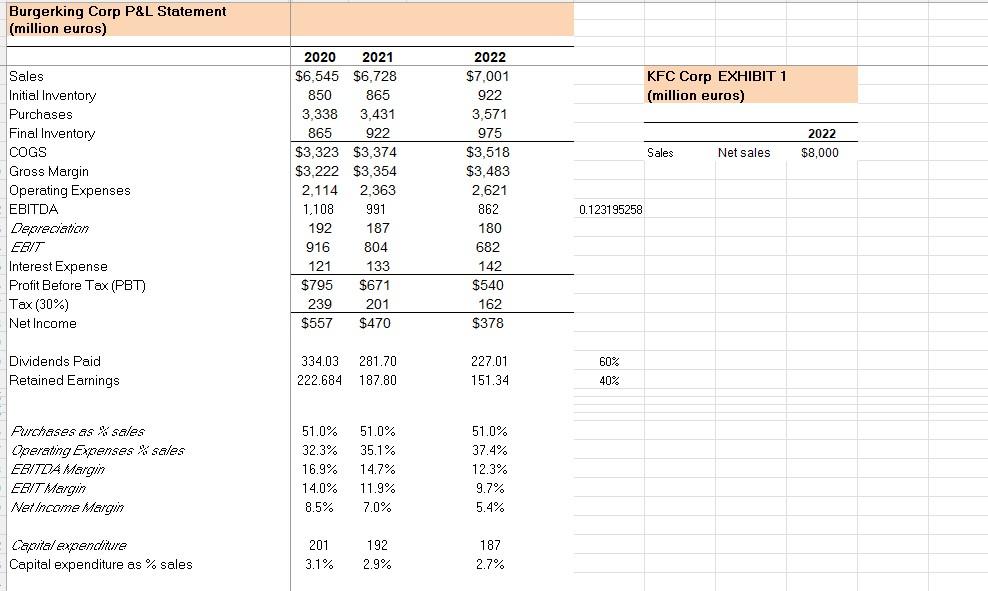

KFC Corporation is analyzing the possibility to acquire Burgerking Corp. Burgerking earnings have been under pressure in recent years, due to the change in consumer

KFC Corporation is analyzing the possibility to acquire Burgerking Corp.

Burgerking earnings have been under pressure in recent years, due to the change in consumer preferences. Consumers are now more willing to pay an extra price for healthier food, and are reducing the consumption of fast food.

KFC Corp is exposed to the growing segment of the food industry, while Burgerking is focused on un-healthy food. KFC expects to improve Burgerking distribution channel, using its existing distribution network, restructuring production facilities from un-healthy food to healthy food and to reduce operating costs in the process. KFC will give Burgerking some machinery that is not in used, but is on sale for 1m eur, which is its fair market price. It will be fully depreciated during the following 4 years (2023-2026) and then sold its salvage value of 100,000.

There is enough room to grow the acquired company (Burgerkings) sales by 11% per year during the next 5 years, and then reduce the growth rate to 5.5% per year until year 10. Growth at perpetuity is estimated to be 5%. However, the acquisition will place several outlets for both brands that are close by in intense competition (derived from Burgerking better competitive capabilities after the acquisition), and KFC sales will be reduced by 1% from its actual level (2022) in years 2023, 2024 and 2025. The impact is null from that date onwards.

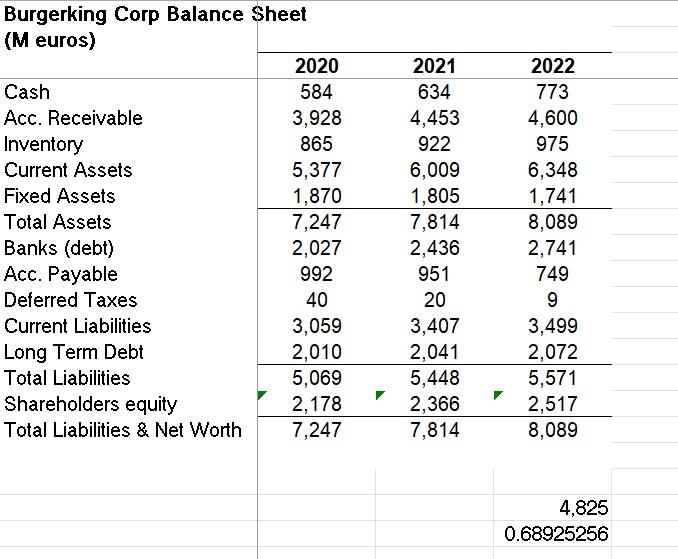

Managers at KFC forecast that the EBITDA Margin will also improve by 2.75% of sales from the level today (12.31%) thanks to the synergies in the distribution channel and the manufacturing operating efficiencies. The acquirer expects Burgerkings NWK to be reduced by 0.25% of sales (per year) from 2022 level in years 2023 to 2024 and then to grow at 0.05% (per year) as percentage of sales from 2025 onwards (2025 included).

The depreciation expense will be stable as percentage of sales during the forecast period, at a ratio similar to 2022.Capital Expenditure will increase by 0.35% per year as a percentage of sales during the first three years (2023 to 2026), but will come back to the 2021 level as a percentage of sales from 2027 onwards.The tax rate is expected to be 21%

Please find the P&L and Balance Sheet of Burgerkings Corp in the Excel attached, save time and use that information for your calculations.

KFCs Corp will change the leverage of the acquired company.

The new capital structure will be 40% debt to total debt plus equity (D/V)

Please find the relevant information to calculate the discount rate (WACC):

Burgerkings Corp is placing a bond today in the market at a price of 100.15, and a coupon of 5.46% annual, maturity ten years (end 2032). Assume that the YTM of its debt in the 40% D/V ratio is going to be the same than that of this bond. The risk free rate (German Govt 10 years) yield to maturity is 1,78%.

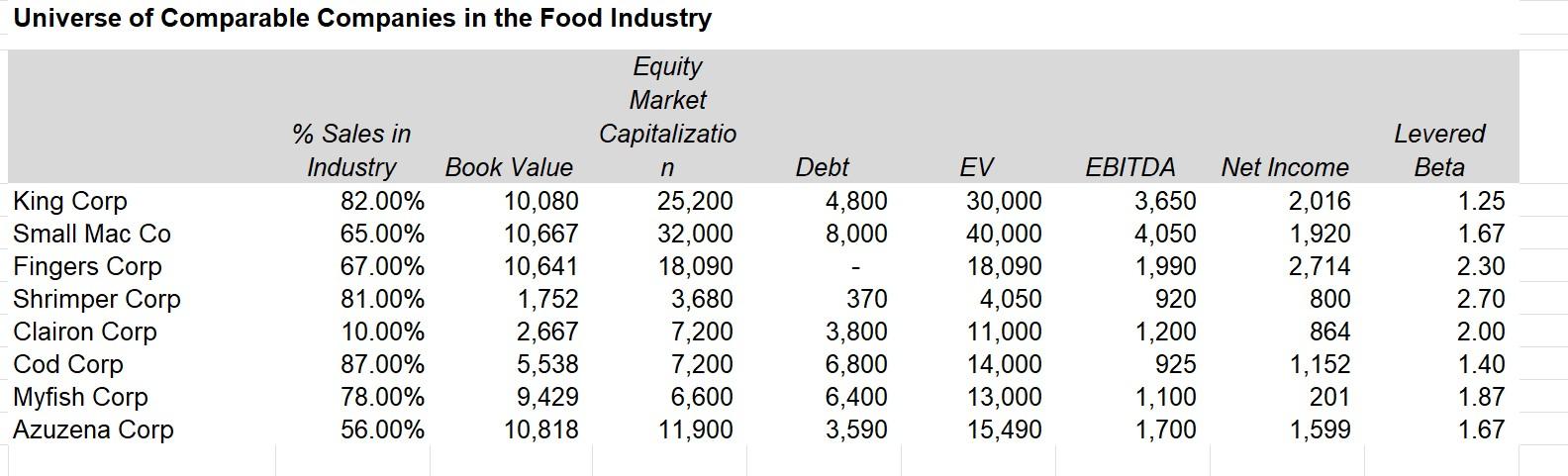

The levered beta of Burgerkings Corp is not known but we have data from a universe of comparable companies shown in the Excel.

The Equity Risk Premium is 4.29%

KFCs Dividend Payout ratio is 45%. Management expects to increase the payout ratio to 55% after the acquisition. KFCs Inc business size (sales) are similar to Burgerkings Corp, but more profitable. It has grown in the past through debt issuance and retained earnings. KFCs Balance Sheet leverage is in line with the target D/V that it is proposing Burgerkings Corp BS.

Nicefoods management owns 20% of the company, and has an incentive program linked to economic value creation during long term periods (6 years). The stock options, if granted, would increase their stake to 25% of the company in 5 years.

Using the information given above please:

Calculate the projected FCF . Please explain why you include or not the use of excess capacity, cannibalization expenses. If included please show the impact at a different line .

Value Burgerkings Corp using a DCF analysis (WACC). What is its EV? What is the Value of its Equity?

Please also value Burgerkings Corp using for the terminal value a Market Multiple EV/EBIT 17.5x. (use the Ebit in the TV year to derive the EV)

Explain why the valuation using DFC (WACC) and DCF (WACC) & EV/EBIT is different. When would you use the valuation using the exit multiple EV/EBIT? When would you use the WACC for the derivation of the TV?

Please describe the impact of the change in the dividend policy from the point of view of signaling and agency problem. Make any assumptions you need to make to support your comment. Would you recommend then a different dividend policy? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started