Answered step by step

Verified Expert Solution

Question

1 Approved Answer

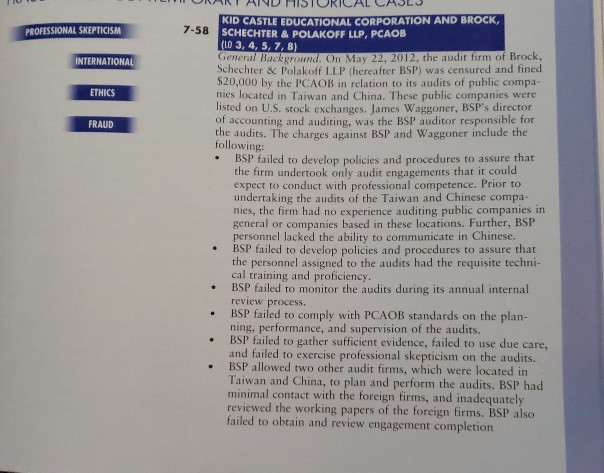

KID CASTLE EDUCATIONAL CORPORATION AND BROCK, SCHECHTER & POLAKOFF LLP, PCAOB 10 3, 4, 5, 7, 8) PROFESSIONAL SKEPTICISM 7-58 General Background. On May 22,

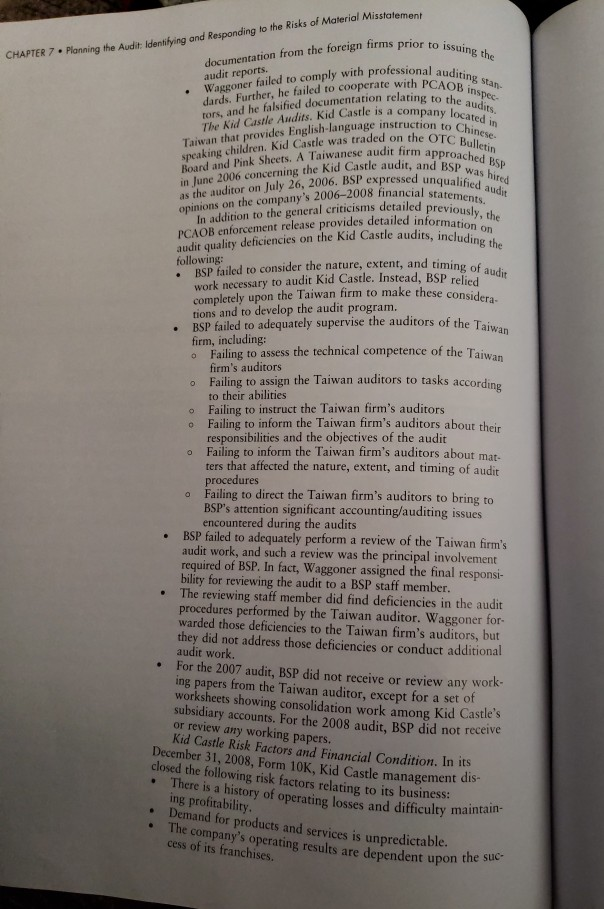

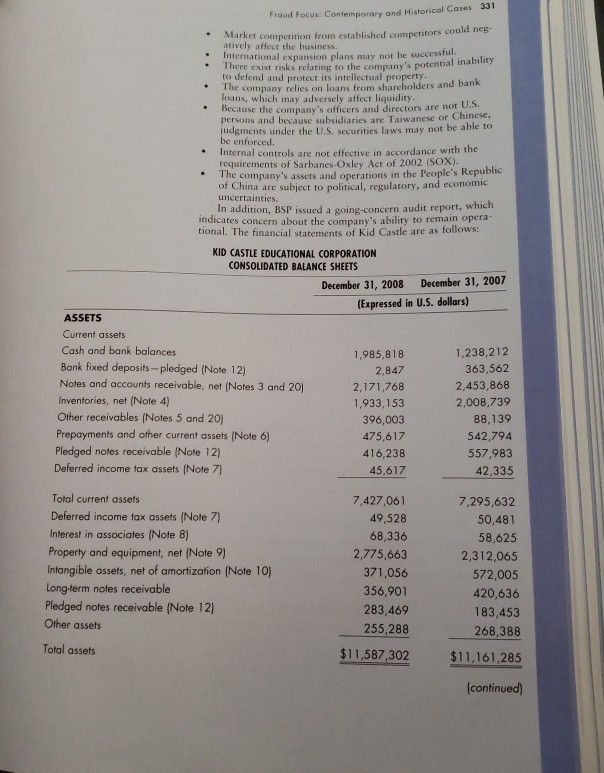

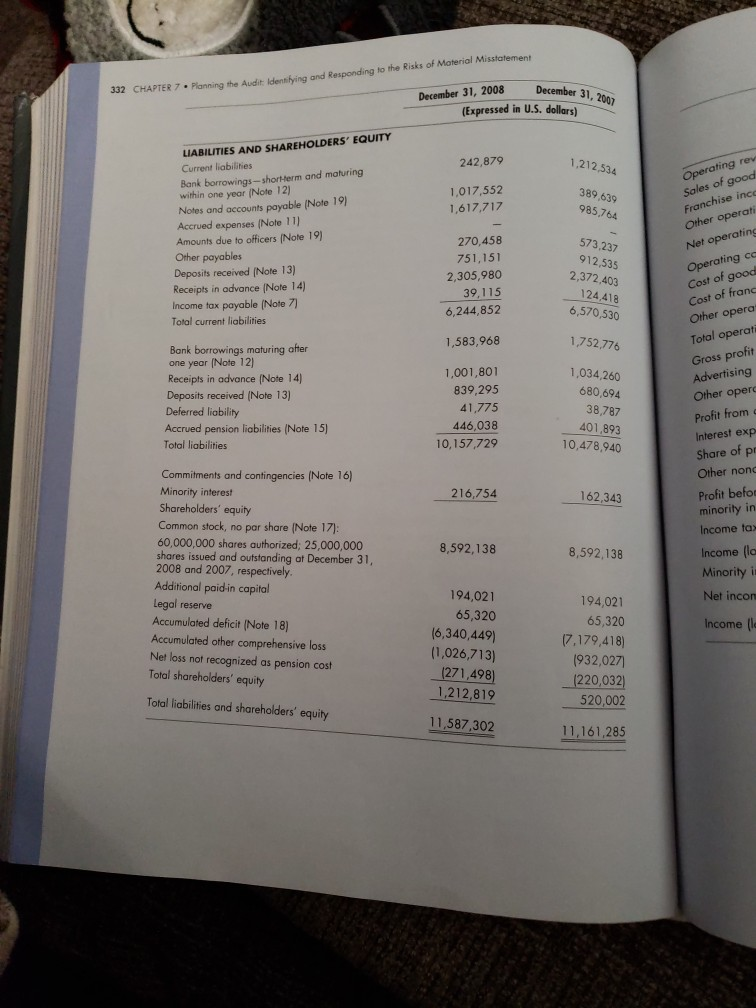

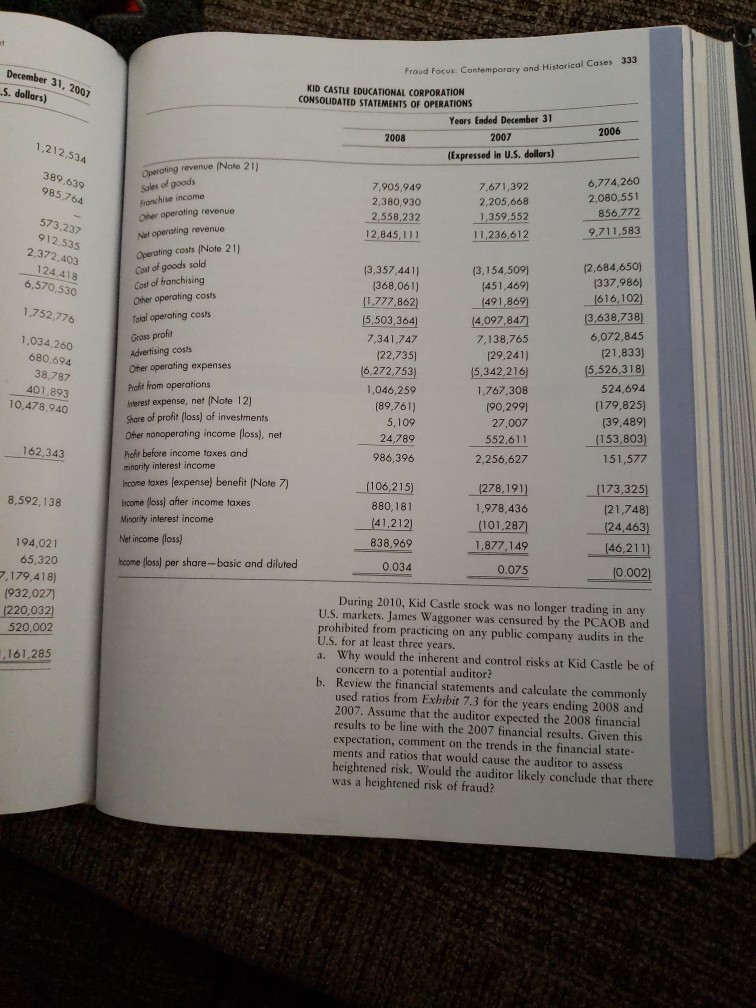

KID CASTLE EDUCATIONAL CORPORATION AND BROCK, SCHECHTER & POLAKOFF LLP, PCAOB 10 3, 4, 5, 7, 8) PROFESSIONAL SKEPTICISM 7-58 General Background. On May 22, 2012, the audit firm of Brock Schechter & Polakoff LLP (hereafter BSP) was censured and fined 820,000 by the PCAOB in relation to its audits of public compa nies located in Taiwan and China. These public companies were listed on U.S. stock exchanges. James Waggoner, BSP's director of accounting and auditing, was the BSP auditor responsible for the audits. The charges against BSP and Waggoner include the INTERNATIONAL ETHICS FRAUD BSP failed to develop policies and procedures to assure that the firm undertook only audit engagements that it could expect to conduct with professional competence. Prior to undertaking the audits of the Taiwan and Chinese compa- nies, the firm had no experience auditing public companies in general or companies based in these locations. Further, BSP personnel lacked the ability to communicate in Chinese . BSP failed to develop policies and procedures to assure that the personnel assigned to the audits had the requisite techni- cal training and proficiency. BSP failed to monitor the audits during its annual internal review process BSP failed to comply with PCAOB standards on the plan ning, performance, and supervision of the audits . . BSP failed to gather sufficient evidence, failed to use due care BSP allowed two other audit firms, which were located in and failed to exercise professional skepticism on the audits Taiwan and China, to plan and perform the audits. BSP had minimal contact with the foreign firms, and inadequately reviewed the working papers of the foreign firms. BSP also failed to obtain and review engagement completion to issuing the CHAPTER 7 Plonning the Audi: Identfying and Responding to the Risks of documentation from the foreign firms prior to audit reports. . Waggoner failed to comply with professional a auditing stan- inspe dards. Further, he failed to cooperate withPCAing The Kid Castle Audits. Kid Castle is a company Taiwan that provides English-language instructio ocated speaking children. Kid Castle was traded on the O hi Board and Pink Sheets. A Taiwanese audit firm a in June 2006 concerning the Kid Castle audit, and Pced as the auditor on July 26, 2006. BSP expressed u opinions on the company's 2006-2008 fislif tors, and he falsified documentation relating to t letin audit ts. In addition to the general criticisms detailed PCAOB enforcement release provides detailed information, the audit quality deficiencies on the Kid Castle audits, includ previou win timing of audit BSP failed to consider the nature, extent, and ti work necessary to audit Kid Castle. Instead, BSP relied it completely upon the Taiwan firm to make these considera tions and to develop the audit program. BSP failed to adequately supervise the auditors of the Taiwan firm, including Failing to assess the technical competence of the Taiwan o firm's auditors Failing to assign the Taiwan auditors to tasks accordin o to their abilities Failing to instruct the Taiwan firm's auditors o Failing to inform the Taiwan firm's auditors about their o responsibilities and the objectives of the audit Failing to inform the Taiwan firm's auditors about mat o ters that affected the nature, extent, and timing of audit procedures Failing to direct the Taiwan firm's auditors to bring to o BSP's attention significant accounting/auditing issues encountered during the audits BSP failed to adequately perform a review of the Taiwan firm's audit work, and such a review was the principal involvement required of BSP. In fact, Waggoner assigned the final responsi- bility for reviewing the audit to a BSP staff member. The reviewing staff member did find deficiencies in the audit procedures performed by the Taiwan auditor. Waggoner for warded those deficiencies to the Taiwan firm's auditors, but they did not address those deficiencies or conduct additional audit work. For the 2007 audit, BSP did not receive or review any work- ing papers from the Taiwan auditor, except for a set of worksheets showing consolidation work among Kid Castle's subsidiary accounts. For the 2008 audit, BSP did not receive or review any working papers. Kid Castle Risk Factors and Financial Condition. In its December 31, 2008, Form 10K, Kid Castle management dis- closed the following risk factors relating to its business * There is a history of operating losses and difficulty maintain- ing profitability Demand for products and services is unpredictable. The e company's operating results are dependent upon the su cess of its franchises. 331 Fraud focus: Contemporary and Historical Cases : Marker competition from established competitors cou atively affect the business. International expansion plans may not he successful. to defend and proteet its intellectual property loans, which may adversely affect liquidity persons and because subsidiaries are Taiwanese or Chinese, udgments under the U.S. securities laws may not be able to ability * There exist risks relating to the company's potential company relies on loans from shareholders and bank *Because the company's officers and directors are not .Internal controls are not effective in accordance with the requirements of Sarbanes Oxley Act of 2002 (SOX). c company's assets and operations in the People's Republic of China are subject to political, regulatory, and economic In addition, BSP issued a going-concern audit report, whic indicates concern about the company's ability to remain opera tional. The financial statements of Kid Castle are as follows: KID CASTLE EDUCATIONAL CORPORATION CONSOLIDATED BALANCE SHEETS December 31, 2008 December 31, 2007 (Expressed in U.S. dollars) Current assets Cash and bank balances Bank fixed deposits-pledged (Note 12) Notes and accounts receivable, net (Notes 3 and 20) Inventories, net (Note 4) Other receivables (Notes 5 and 20) Prepayments and other current assets (Note 6) Pledged notes receivable (Note 12) Deferred income tax assets (Note 7) 2,8471,238,212 2,453,868 2,008,739 88,139 542,794 557,983 1,985,818 363,562 1,933,153 396,003 475,617 416,238 45.6142,335 Total current assets Deferred income tax assets (Note 7) Interest in associates (Note 8) 7,295,632 50,481 58,625 2,312,065 7,427,061 49,528 68,336 2,775,663 371,056 356,901 283,469 255,288 Property and equipment, net (Note 9) Intangible assets, net of amortization (Note 10) 420,636 183,453 268,388 $11,161,285 Pledged notes receivable (Note 12) 11587 202 1,161,285 Total assets continued) CHAPTER 7 Planning the Audit: Idenslying and Responding to the Risks of Moterial Misstatement December 31, 2008 Decenb 332 (Expressed in U.S. dollars) LIABILITIES AND SHAREHOLDERS' EQUITY 242,879 1,212 534 Current liabilities Operating rev Bank borrowings-shortterm and maturing 1,017,552 1,617,717 389,639 985,764 Franchise ince Other operati Net within one year (Note 12) Notes and accounts payable (Note 19) Accrued expenses (Note 11) Amounts due to officers (Note 19) Other payables Deposits received (Note 13) ting 270,458 751,151 2,305,980 39,115 6,244,852 573,237 912,535 2,372,403 24,418 6,570,530 Receipts in advance (Note 14) Income tax payable (Note 7) Total current liabilities Cost of good Cost of franc Other o 1,752,776 Total operat 1,583,968 Bank borrowings maturing ofter one year (Note 12) Receipts in advance (Note 14) Deposits received (Note 13) 1,001,801 839,295 41,775 446,038 10,157,729 1,034,260 680,694 38,787 401,893 10,478,940 Advertising Other oper Profit from Interest exp Share of pr Deferred liability Accrued pension liabilities (Note 15) Total liabilities Commitments and contingencies (Note 16) Minority interest Profit befos minority in 216,754 162,343 Common stock, no par share (Note 17) 60,000,000 shares authorized; 25,000,000 shares issued and outstanding at December 31 2008 and 2007, respectively Additional paid in capital 8,592,138 8,592,138 Minority i 194,021 65,320 (6,340,449) (1,026,713) (271,498) 1,212,819 194,021 65,320 (7,179,418) 932,027 1220,032) 520,002 11,161,285 Accumulated deficit (Note 18) Accumulated other comprehensive loss Net loss not recognized as pension cost Total shareholders' equity Total liabilities and shareholders' equity 11,587,302 Fraud Focus: Contemporary KID CASTLE EDUCATIONAL CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS Years Ended December 31 2007 (Expressed in U.S. dollars) 2006 2008 7,905,949 2,380,930 2,558,232 12,845,111 7,671,392 2,205,668 1,359,552 11.236,612 6,774,260 2,080,551 856,772 9.711.583 91 Cost of franchising Other operating costs 3,357,441 368,061) (3,154,509) 451,469) (491,869) 12,684,650) (337,986) 1,777,86 1,752,776 (5,503,364 7,341,747 122,735 272,753 1,046,259 (89,761) 6,072,845 (21,833) 15.526,318) 524,694 (179,825) (39,489) (153,803) 151,577 7,138,765 680,694 38,787 401,893 10,478,940 Advertising Oner operating expenses Piohit from operations hlerest expense, net (Note 12) Shore of profit (loss) of investments Oher nonoperating income (loss), net Pioht before income taxes and 1,767,308 (90,299 27,007 552,611 2,256,627 24,789 986,396 162,343 Income toxes (expense) benefit (Note 7) income (loss) after income taxes (173,325) (21,748) (24,463 46,211 8,592,138 880,181 (41.212) 838,969 0.034 1,978,436 (101287) 1,877,149 0.075 Minority interest income 194,021 65,320 7.179,418) 932,027) hcome (loss) per share-basic and diluted During 2010, Kid Castle stock was no longer trading in any 1220,032 U.S. markets. James Waggoner was censured by the PCAOB and prohibited from practicing on any public company audits in the 520,002 U.S. for at least three years 161,285 a. Why would the inherent and control risks at Kid Castle be of concern to a potential auditor? b. Review the financial statements and calculate the commonly used ratios from Exhibit 7.3 for the years ending 2008 and 2007. Assume that the auditor expected the 2008 financial results to be line with the 2007 financial results. Given this expectation, comment on the trends in the financial state- ments and ratios that would cause the auditor to assess heightened risk. Would the auditor likely conclude that there was a heightened risk of fraud? udit: Identihying and Responding to the Risks of Material Misstatement Based on your answers to (a) and (b), for what accounts would you recommend that the auditor plan to conduct more substantive audit procedures? c. d. The 10-K discloses the fact that BSP earned total audit fees in 2007 and 2008 of $121,026 and $150,000, respectively Comment on the motivations of BSP and Waggoner to accept the foreign audits and how those motivations might have affected Waggoner's lack of ethics and how those motiva- tions might have affected his professional skepticism. Presum ably, BSP had to pay the Taiwanese and Chinese audit firms a portion of the audit fee, and based on the allegations in the PCAOB enforcement release, BSP did virtually no audit work. Comment on your thoughts about the appropriateness of hiring a foreign audit firm to conduct the majority of audit work on an engagement and on BSP's actions (or lack thereof) in this regard. Use the framework for making quality professional decisions from Chapter 4 to identify those steps in the framework where Waggoner went wrong and describe what he should have done differently e. f. Describe the risks that an audit firm faces when it att audit a company in a foreign country. For additional information on the PCAOB enforcement releases relating to this case, see PCAOB Release Nos. 105- 2012-002 and 10S-2012-003 LSAVINGS AND LOAN

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started