Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kilamy Co. mines and produces aluminum. During 2018, the company explored two new sitas and evaluated them for aluminum ore potential. By the year

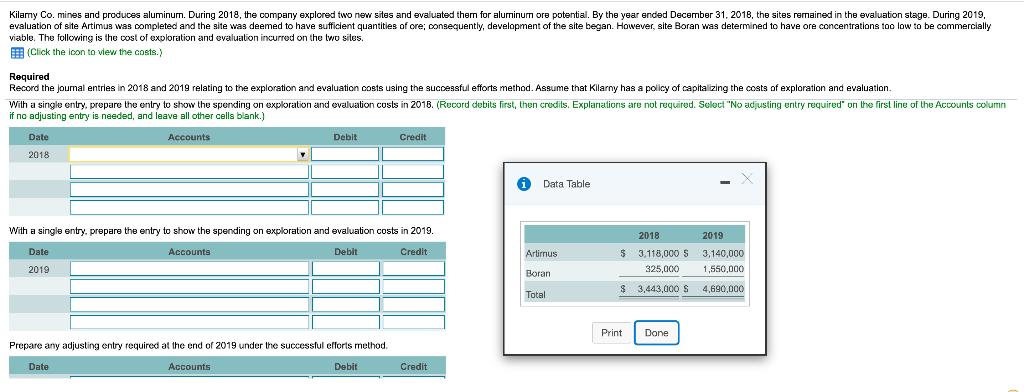

Kilamy Co. mines and produces aluminum. During 2018, the company explored two new sitas and evaluated them for aluminum ore potential. By the year ended December 31, 2018, the sites remained in the evaluation stage. During 2019, evaluation of site Artimus was completed and the site was deemed to have sufficient quantities of ore; consequently, development of the site began. However, site Boran was determined to have ore concentrations too low to be commercially viable. The following is the cost of exploration and evaluation incurred on the two sites. E (Click the ioon to view the costs.) Required Record the journal entries in 2018 and 2019 relating to the exploration and evaluation costs using the successful efforts method. Assume that Kllarny has a policy of capitalizing the costs of exploration and evaluation. With a single entry, prepare the entry to show the spending on exploration and evaluation costs in 2018. (Record debits first, then credits. Explanations are not required. Select "No adjusting entry required" on the first line of the Accounts column if no adjusting entry is needed, and leave all other cells biank.) Date Accounts Debit Credit 2018 Data Table With a single entry. prepare the entry to show the spending on exploration and evaluation costs in 2019. 2018 2019 Date Accounts Debit Credit Artirnus 3,118,000 S 3,140,000 2019 325.000 1. 550 000 Boran $ 3,443,000 S 4,690,000 Total Print Done Prepare any adjusting entry required at the end of 2019 under the successful efforts method. Date Accounts Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Journal Entry for 2018 Particulars Debit Credit Exploration Evaluation Expenses Ac 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started