Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kilbride Engineering's beta has been estimated to be 1.40. The expected rate of return on the market portfolio for the coming year is 12

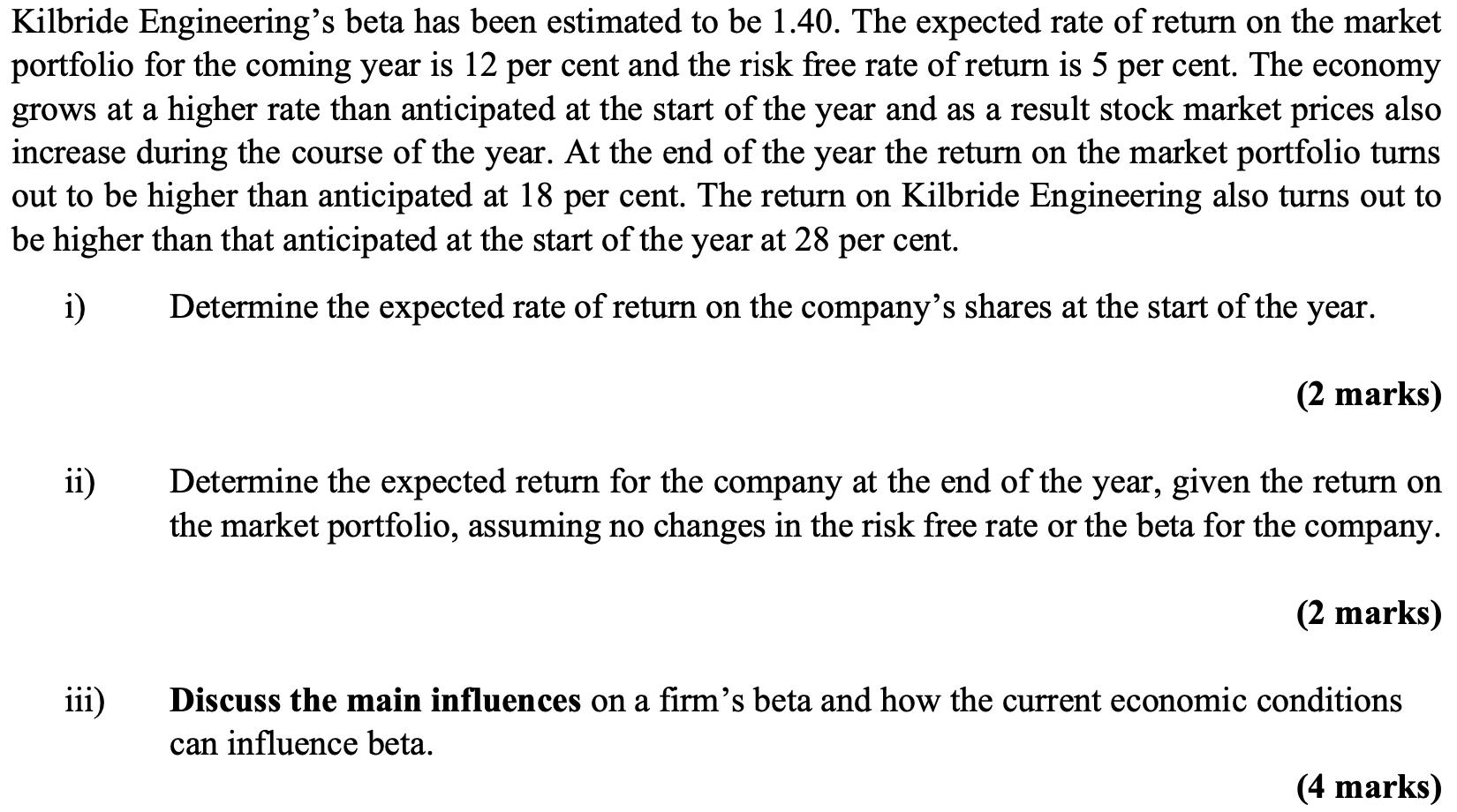

Kilbride Engineering's beta has been estimated to be 1.40. The expected rate of return on the market portfolio for the coming year is 12 per cent and the risk free rate of return is 5 per cent. The economy grows at a higher rate than anticipated at the start of the year and as a result stock market prices also increase during the course of the year. At the end of the year the return on the market portfolio turns out to be higher than anticipated at 18 per cent. The return on Kilbride Engineering also turns out to be higher than that anticipated at the start of the year at 28 per cent. i) Determine the expected rate of return on the company's shares at the start of the year. ii) iii) (2 marks) Determine the expected return for the company at the end of the year, given the return on the market portfolio, assuming no changes in the risk free rate or the beta for the company. (2 marks) Discuss the main influences on a firm's beta and how the current economic conditions can influence beta. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The question relates to finance and the concept of beta in the Capital Asset Pricing Model CAPM Lets address each part individually i To determine the expected rate of return on the companys shares at ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started