Answered step by step

Verified Expert Solution

Question

1 Approved Answer

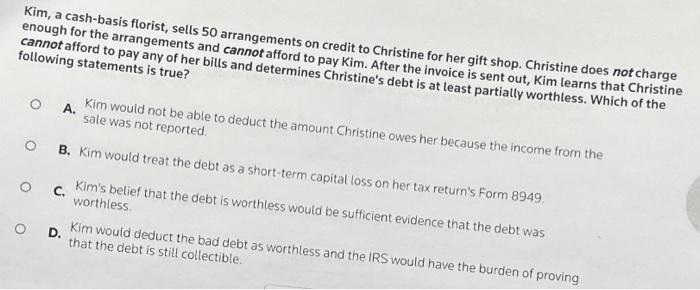

Kim, a cash-basis florist, sells 50 arrangements on credit to Christine for her gift shop. Christine does not charge enough for the arrangements and cannot

Kim, a cash-basis florist, sells 50 arrangements on credit to Christine for her gift shop. Christine does not charge enough for the arrangements and cannot afford to pay Kim. After the invoice is sent out, Kim learns that Christine cannot afford to pay any of her bills and determines Christine's debt is at least partially worthless. Which of the following statements is true? A.Kim would not be able to deduct the amount Christine owes her because the income from the sale was not reported. B. Kim would treat the debt as a short-term capital loss on her tax return's Form 8949. C. Kim's belief that the debt is worthless would be sufficient evidence that the debt was worthless. D.Kim would deduct the bad debt as worthless and the IRS would have the burden of proving that the debt is still collectible.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started