Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kimble, Sykes, and Gerard open an accounting practice on January 1, 2019, in Chicago, Illinois, to be operated as a partnership. Kimble and Sykes

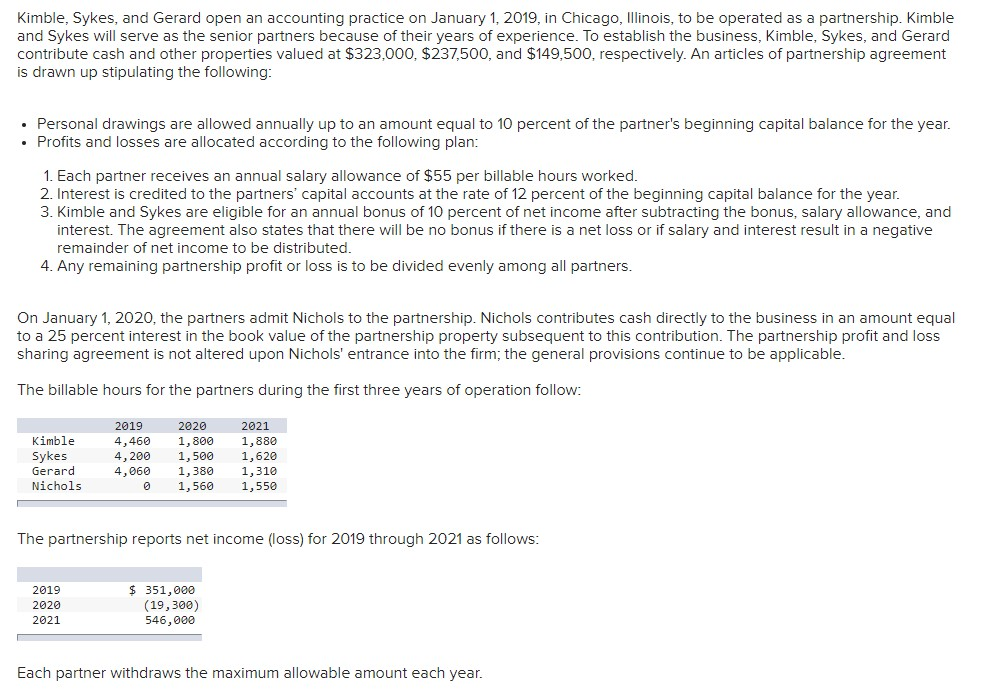

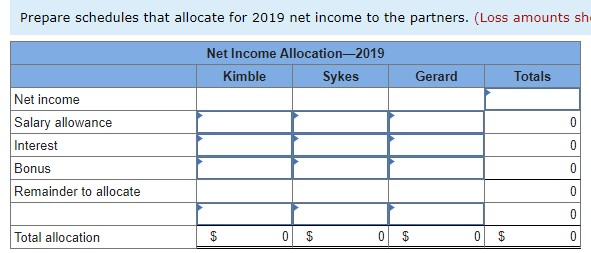

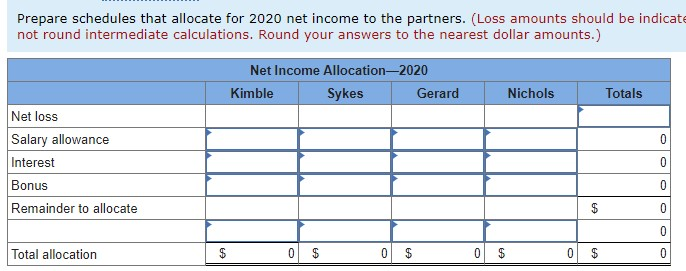

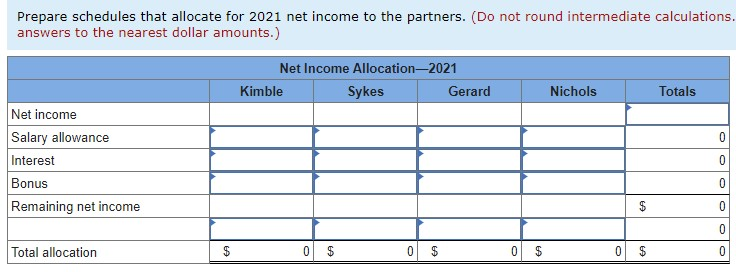

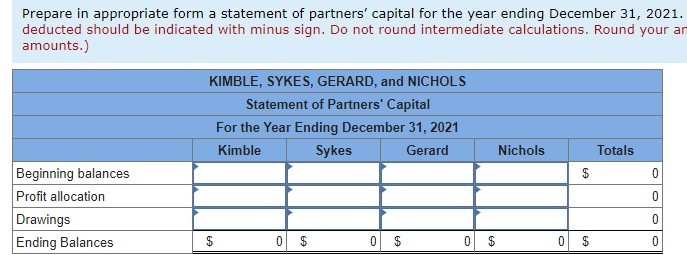

Kimble, Sykes, and Gerard open an accounting practice on January 1, 2019, in Chicago, Illinois, to be operated as a partnership. Kimble and Sykes will serve as the senior partners because of their years of experience. To establish the business, Kimble, Sykes, and Gerard contribute cash and other properties valued at $323,000, $237,500, and $149,500, respectively. An articles of partnership agreement is drawn up stipulating the following: Personal drawings are allowed annually up to an amount equal to 10 percent of the partner's beginning capital balance for the year. Profits and losses are allocated according to the following plan: 1. Each partner receives an annual salary allowance of $55 per billable hours worked. 2. Interest is credited to the partners' capital accounts at the rate of 12 percent of the beginning capital balance for the year. 3. Kimble and Sykes are eligible for an annual bonus of 10 percent of net income after subtracting the bonus, salary allowance, and interest. The agreement also states that there will be no bonus if there is a net loss or if salary and interest result in a negative remainder of net income to be distributed. 4. Any remaining partnership profit or loss is to be divided evenly among all partners. On January 1, 2020, the partners admit Nichols to the partnership. Nichols contributes cash directly to the business in an amount equal to a 25 percent interest in the book value of the partnership property subsequent to this contribution. The partnership profit and loss sharing agreement is not altered upon Nichols' entrance into the firm; the general provisions continue to be applicable. The billable hours for the partners during the first three years of operation follow: Kimble Sykes Gerard Nichols 0 2019 2020 4,460 1,800 1,880 4,200 1,500 1,620 4,060 1,380 1,310 1,550 2021 1,560 The partnership reports net income (loss) for 2019 through 2021 as follows: 2019 2020 2021 $ 351,000 (19,300) 546,000 Each partner withdraws the maximum allowable amount each year. Prepare schedules that allocate for 2019 net income to the partners. (Loss amounts sh Net Income Allocation-2019 Net income Salary allowance Interest Bonus Remainder to allocate Total allocation Kimble Sykes Gerard Totals 0 $ 0 EA $ 0 EA 0 0 0 0 0 0 Prepare schedules that allocate for 2020 net income to the partners. (Loss amounts should be indicate not round intermediate calculations. Round your answers to the nearest dollar amounts.) Net Income Allocation-2020 Net loss Salary allowance Interest Bonus Remainder to allocate Total allocation Kimble $ 0 Sykes 69 Gerard Nichols Totals 0 $ 0 $ 0 0 0 0 $ 0 0 69 0 Prepare schedules that allocate for 2021 net income to the partners. (Do not round intermediate calculations. answers to the nearest dollar amounts.) Net Income Allocation-2021 Net income Salary allowance Interest Bonus Remaining net income Total allocation Kimble Sykes Gerard Nichols Totals 0 0 0 $ 0 0 0 0 0 0 0 Prepare in appropriate form a statement of partners' capital for the year ending December 31, 2021. deducted should be indicated with minus sign. Do not round intermediate calculations. Round your an amounts.) Beginning balances Profit allocation Drawings Ending Balances KIMBLE, SYKES, GERARD, and NICHOLS Statement of Partners' Capital For the Year Ending December 31, 2021 Kimble Sykes Gerard Nichols Totals $ 0 $ 0 0 $ 0 $ 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the calculations for partner capital balances and distributions for 20192021 2019 Beginning Capital Balances Kimble 323000 Sykes 237500 Gerar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started