Answered step by step

Verified Expert Solution

Question

1 Approved Answer

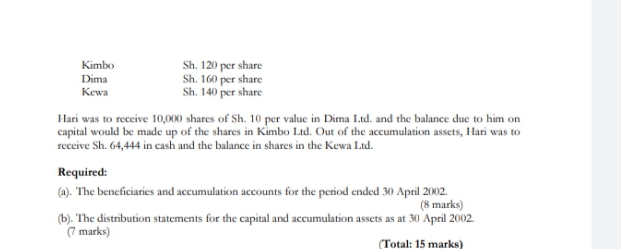

Kimbo Dima Kewa Sh. 120 per share Sh. 160 per share Sh. 140 per share Hari was to receive 10,000 shares of Sh. 10

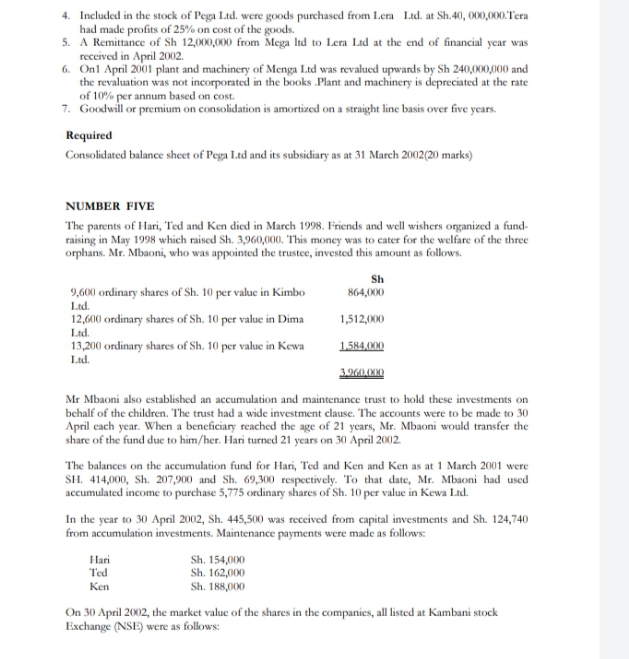

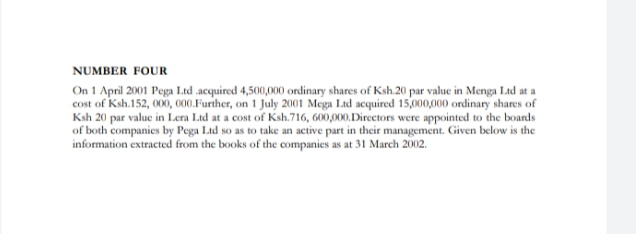

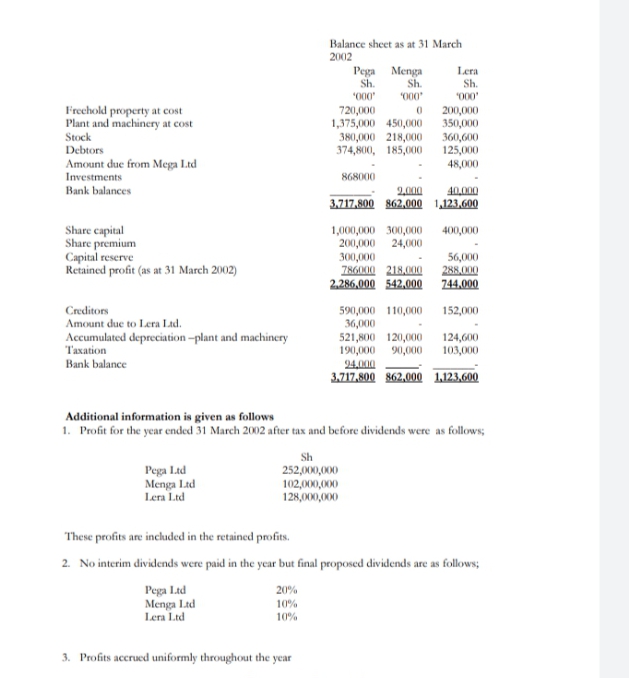

Kimbo Dima Kewa Sh. 120 per share Sh. 160 per share Sh. 140 per share Hari was to receive 10,000 shares of Sh. 10 per value in Dima Ltd. and the balance due to him on capital would be made up of the shares in Kimbo Ltd. Out of the accumulation assets, Hari was to receive Sh. 64,444 in cash and the balance in shares in the Kewa Ltd. Required: (a). The beneficiaries and accumulation accounts for the period ended 30 April 2002. (8 marks) (b). The distribution statements for the capital and accumulation assets as at 30 April 2002. (7 marks) Total: 15 marks) 4. Included in the stock of Pega Ltd. were goods purchased from Lera Ltd. at Sh.40,000,000. Tera had made profits of 25% on cost of the goods. 5. A Remittance of Sh 12,000,000 from Mega ltd to Lera Ltd at the end of financial year was received in April 2002. 6. On1 April 2001 plant and machinery of Menga Ltd was revalued upwards by Sh 240,000,000 and the revaluation was not incorporated in the books Plant and machinery is depreciated at the rate of 10% per annum based on cost. 7. Goodwill or premium on consolidation is amortized on a straight line basis over five years. Required Consolidated balance sheet of Pega Ltd and its subsidiary as at 31 March 2002(20 marks) NUMBER FIVE The parents of Hari, Ted and Ken died in March 1998. Friends and well wishers organized a fund- raising in May 1998 which raised Sh. 3,960,000. This money was to cater for the welfare of the three orphans. Mr. Mbaoni, who was appointed the trustee, invested this amount as follows. Sh 9,600 ordinary shares of Sh. 10 per value in Kimbo Ltd. 864,000 12,600 ordinary shares of Sh. 10 per value in Dima Ltd. 1,512,000 13,200 ordinary shares of Sh. 10 per value in Kewa Ltd. 1,584,000 3,960,000 Mr Mbaoni also established an accumulation and maintenance trust to hold these investments on behalf of the children. The trust had a wide investment clause. The accounts were to be made to 30 April each year. When a beneficiary reached the age of 21 years, Mr. Mbaoni would transfer the share of the fund due to him/her. Hari turned 21 years on 30 April 2002. The balances on the accumulation fund for Hari, Ted and Ken and Ken as at 1 March 2001 were SH. 414,000, Sh. 207,900 and Sh. 69,300 respectively. To that date, Mr. Mbaoni had used accumulated income to purchase 5,775 ordinary shares of Sh. 10 per value in Kewa Ltd. In the year to 30 April 2002, Sh. 445,500 was received from capital investments and Sh. 124,740 from accumulation investments. Maintenance payments were made as follows: Hari Ted Ken Sh. 154,000 Sh. 162,000 Sh. 188,000 On 30 April 2002, the market value of the shares in the companies, all listed at Kambani stock Exchange (NSE) were as follows: NUMBER FOUR On 1 April 2001 Pega Ltd acquired 4,500,000 ordinary shares of Ksh.20 par value in Menga Ltd at a cost of Ksh.152, 000, 000.Further, on 1 July 2001 Mega Ltd acquired 15,000,000 ordinary shares of Ksh 20 par value in Lera Ltd at a cost of Ksh.716, 600,000.Directors were appointed to the boards of both companies by Pega Ltd so as to take an active part in their management. Given below is the information extracted from the books of the companies as at 31 March 2002. Balance sheet as at 31 March Freehold property at cost Plant and machinery at cost Stock Debtors Amount due from Mega Ltd Investments Bank balances Share capital 2002 Pega Menga Lera Sh. Sh. Sh. '000' '000' '000' 720,000 0 200,000 350,000 380,000 218,000 360,600 1,375,000 450,000 374,800, 185,000 125,000 868000 2,000 48,000 40,000 3,717,800 862,000 1,123,600 Share premium Capital reserve Retained profit (as at 31 March 2002) Creditors Amount due to Lera Ltd. Accumulated depreciation-plant and machinery Taxation Bank balance 1,000,000 300,000 400,000 200,000 24,000 300,000 56,000 786000 218,000 288,000 2,286,000 542,000 744,000 590,000 110,000 152,000 36,000 521,800 120,000 124,600 190,000 90,000 103,000 94,000 3.717,800 862,000 1,123,600 Additional information is given as follows 1. Profit for the year ended 31 March 2002 after tax and before dividends were as follows; Pega Ltd Menga Ltd Lera Ltd Sh 252,000,000 102,000,000 128,000,000 These profits are included in the retained profits. 2. No interim dividends were paid in the year but final proposed dividends are as follows; Pega Ltd Menga Ltd Lera Ltd 20% 10% 10% 3. Profits accrued uniformly throughout the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the calculations for the different sections of the question a Beneficiaries and accumulatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started