KIND REQUEST NOT TO ATTEND THE QUESTION IF ONLY ONE QUESTION IS GOING TO BE ANSWERED. IM AWARE OF POLICIES. PLEASE MAKE FOR OTHERS WHO CAN SOLVE ALL THE PARTS. WILL DISLIKE IF ONE QUESTION IS ANSWERED.

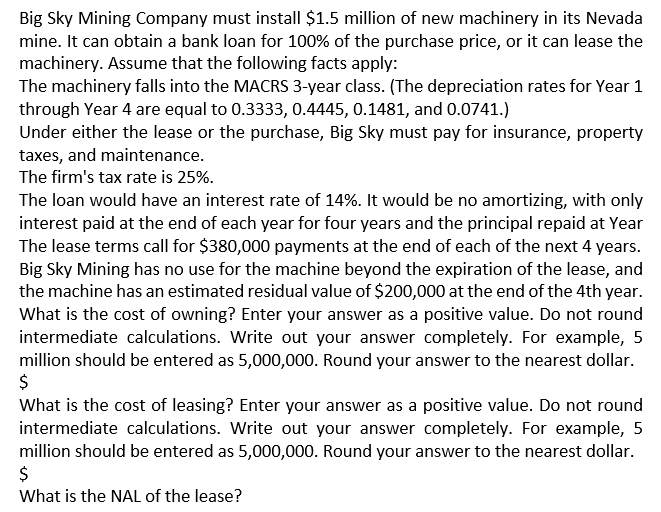

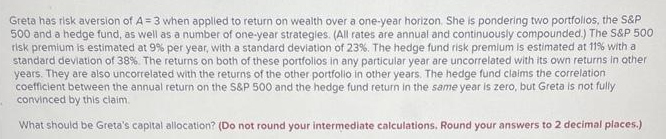

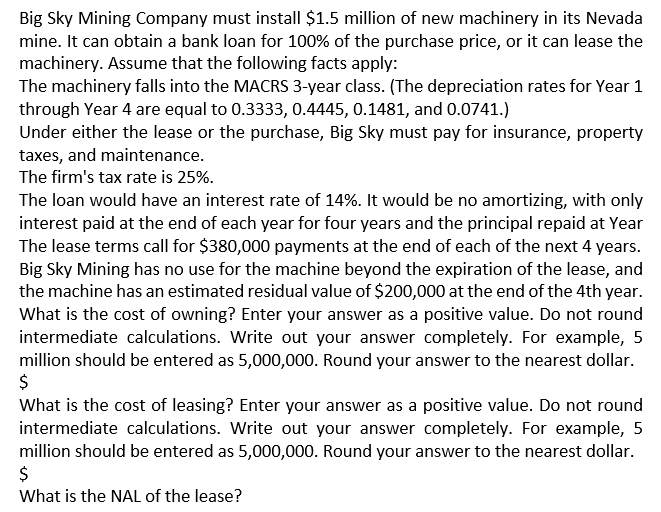

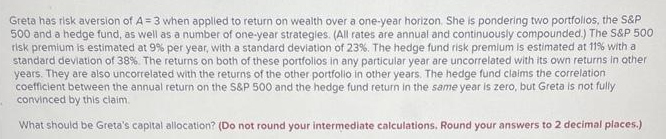

Big Sky Mining Company must install $1.5 million of new machinery in its Nevada mine. It can obtain a bank loan for 100% of the purchase price, or it can lease the machinery. Assume that the following facts apply: The machinery falls into the MACRS 3-year class. (The depreciation rates for Year 1 through Year 4 are equal to 0.3333,0.4445,0.1481, and 0.0741 .) Under either the lease or the purchase, Big Sky must pay for insurance, property taxes, and maintenance. The firm's tax rate is 25%. The loan would have an interest rate of 14%. It would be no amortizing, with only interest paid at the end of each year for four years and the principal repaid at Year The lease terms call for $380,000 payments at the end of each of the next 4 years. Big Sky Mining has no use for the machine beyond the expiration of the lease, and the machine has an estimated residual value of $200,000 at the end of the 4th year. What is the cost of owning? Enter your answer as a positive value. Do not round intermediate calculations. Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answer to the nearest dollar. $ What is the cost of leasing? Enter your answer as a positive value. Do not round intermediate calculations. Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answer to the nearest dollar. $ What is the NAL of the lease? Greta has risk aversion of A=3 when applled to return on wealth over a one-year horizon. She is pondering two portfollos, the S\&P 500 and a hedge fund, as well as a number of one-year strategles. (All rates are annual and continuously compounded.) The S\&P 500 risk premium is estimated at 9% per year, with a standard deviation of 23%. The hedge fund risk premlum is estimated at 11% with a standard deviation of 38%. The returns on both of these portfolios in any particular year are uncorrelated with its own returns in other years. They are also uncorrelated with the returns of the other portfollo in other years. The hedge fund claims the correlation coefficient between the annual return on the S\&P 500 and the hedge fund return in the same year is zero, but Greta is not fully corvinced by this claim. What should be Greta's capital allocation? (Do not round your intermediate calculations. Round your answers to 2 decimal places.)