Answered step by step

Verified Expert Solution

Question

1 Approved Answer

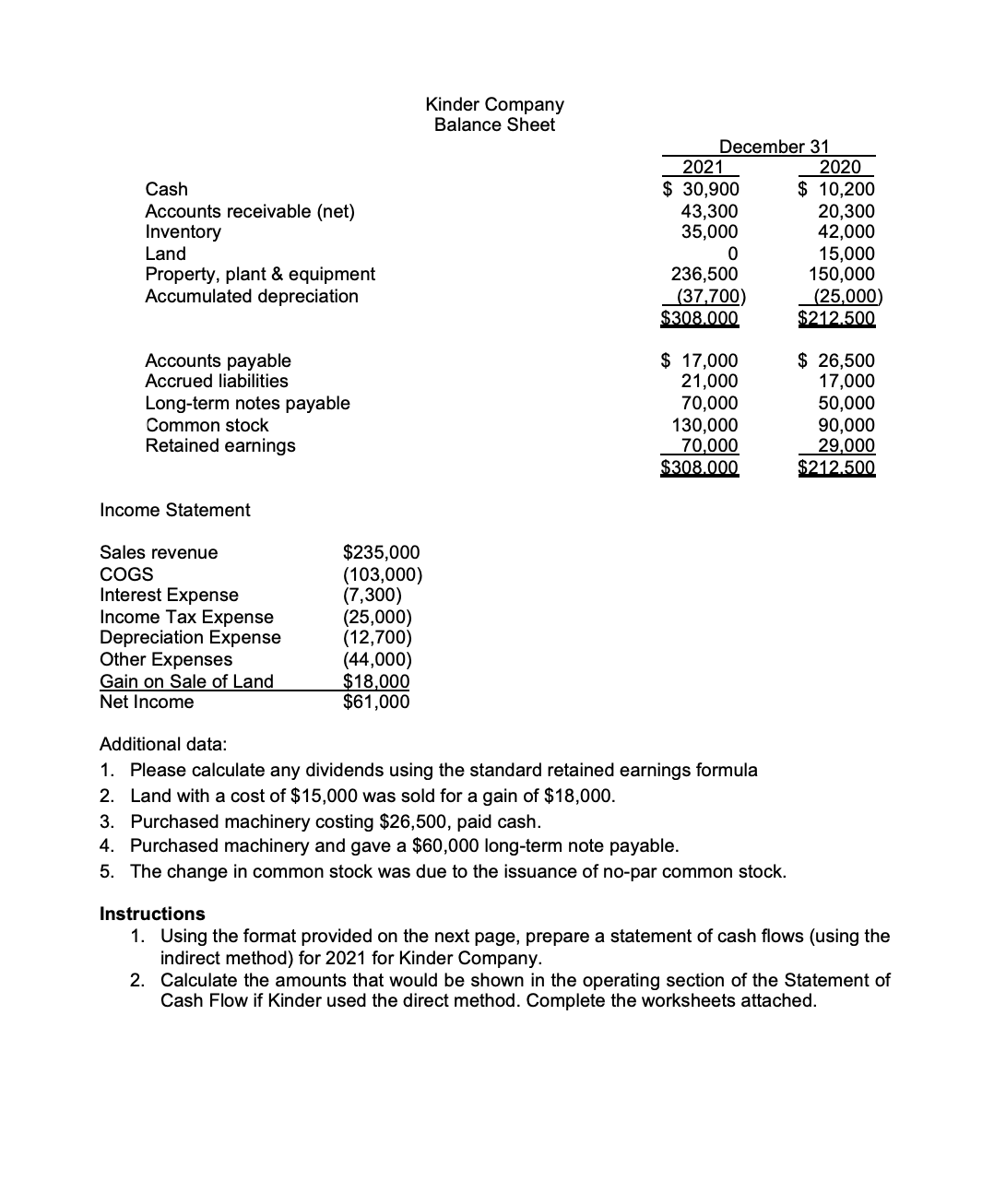

Kinder Company Balance Sheet December 31 Cash Accounts receivable (net) Inventory Land Property, plant & equipment Accumulated depreciation Accounts payable Accrued liabilities Long-term notes

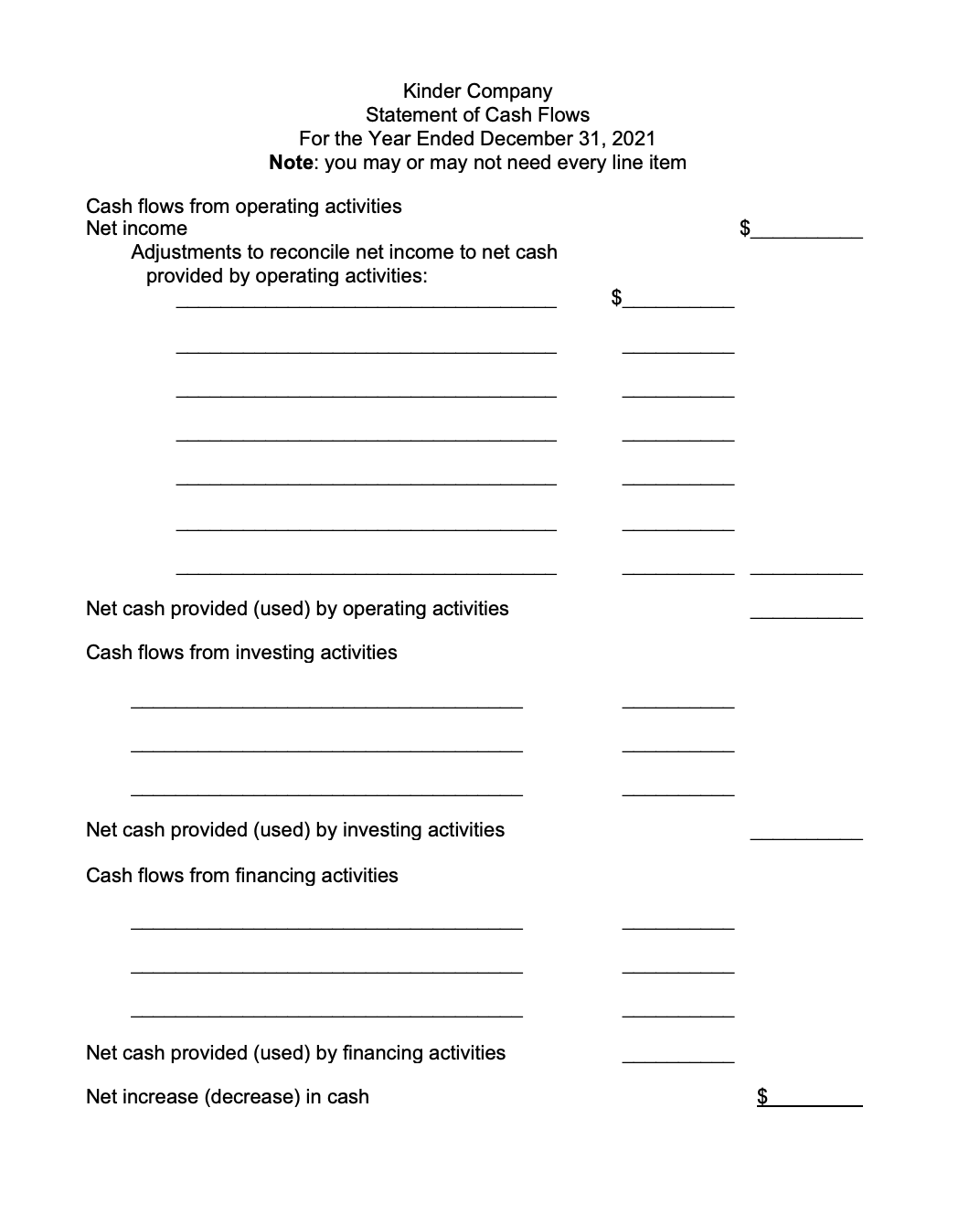

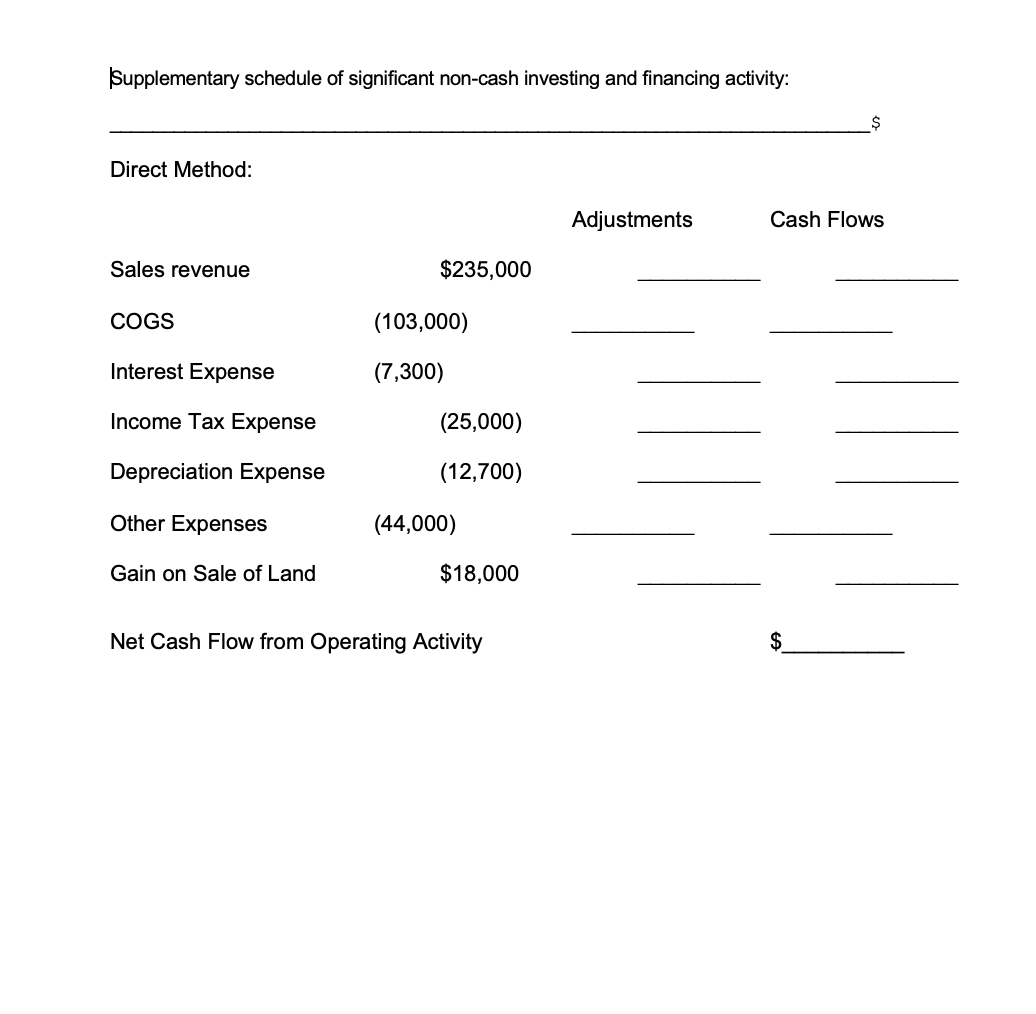

Kinder Company Balance Sheet December 31 Cash Accounts receivable (net) Inventory Land Property, plant & equipment Accumulated depreciation Accounts payable Accrued liabilities Long-term notes payable Common stock Retained earnings 2021 2020 $ 30,900 $ 10,200 43,300 20,300 35,000 42,000 0 15,000 236,500 150,000 (37,700) $308.000 $ 17,000 21,000 (25,000) $212.500 $ 26,500 17,000 70,000 130,000 50,000 90,000 70,000 $308.000 29,000 $212.500 Sales revenue COGS Income Statement $235,000 (103,000) Interest Expense (7,300) Income Tax Expense (25,000) Depreciation Expense (12,700) Other Expenses (44,000) Gain on Sale of Land $18,000 Net Income $61,000 Additional data: 1. Please calculate any dividends using the standard retained earnings formula 2. Land with a cost of $15,000 was sold for a gain of $18,000. 3. Purchased machinery costing $26,500, paid cash. 4. Purchased machinery and gave a $60,000 long-term note payable. 5. The change in common stock was due to the issuance of no-par common stock. Instructions 1. Using the format provided on the next page, prepare a statement of cash flows (using the indirect method) for 2021 for Kinder Company. 2. Calculate the amounts that would be shown in the operating section of the Statement of Cash Flow if Kinder used the direct method. Complete the worksheets attached. Kinder Company Statement of Cash Flows For the Year Ended December 31, 2021 Note: you may or may not need every line item Cash flows from operating activities Net income Adjustments to reconcile net income to net cash provided by operating activities: Net cash provided (used) by operating activities Cash flows from investing activities Net cash provided (used) by investing activities Cash flows from financing activities Net cash provided (used) by financing activities Net increase (decrease) in cash $ $ Supplementary schedule of significant non-cash investing and financing activity: Direct Method: $ Adjustments Cash Flows Sales revenue $235,000 COGS (103,000) Interest Expense (7,300) Income Tax Expense (25,000) Depreciation Expense (12,700) Other Expenses (44,000) Gain on Sale of Land $18,000 Net Cash Flow from Operating Activity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started