Answered step by step

Verified Expert Solution

Question

1 Approved Answer

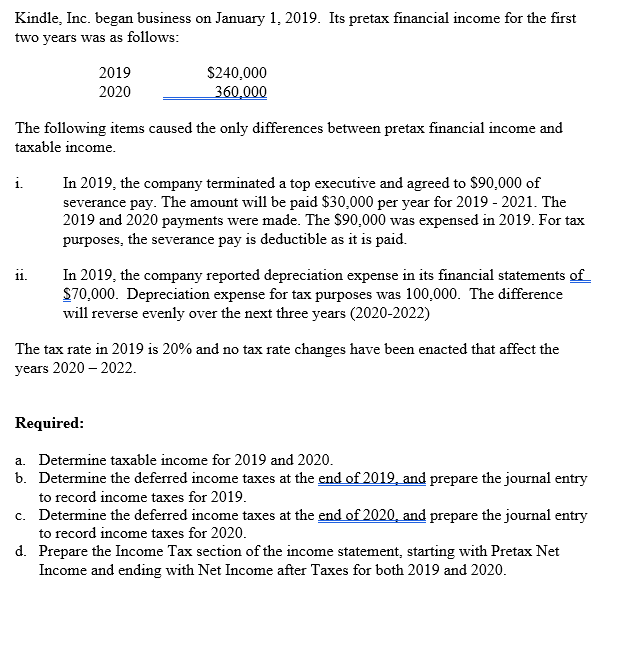

Kindle, Inc. began business on January 1, 2019. Its pretax financial income for the first two years was as follows: 2019 $240,000 360,000 2020

Kindle, Inc. began business on January 1, 2019. Its pretax financial income for the first two years was as follows: 2019 $240,000 360,000 2020 The following items caused the only differences between pretax financial income and taxable income. i. In 2019, the company terminated a top executive and agreed to $90,000 of severance pay. The amount will be paid $30,000 per year for 2019-2021. The 2019 and 2020 payments were made. The $90,000 was expensed in 2019. For tax purposes, the severance pay is deductible as it is paid. In 2019, the company reported depreciation expense in its financial statements of $70,000. Depreciation expense for tax purposes was 100,000. The difference will reverse evenly over the next three years (2020-2022) The tax rate in 2019 is 20% and no tax rate changes have been enacted that affect the years 2020-2022. Required: a. Determine taxable income for 2019 and 2020. b. Determine the deferred income taxes at the end of 2019, and prepare the journal entry to record income taxes for 2019. c. Determine the deferred income taxes at the end of 2020, and prepare the journal entry to record income taxes for 2020. d. Prepare the Income Tax section of the income statement, starting with Pretax Net Income and ending with Net Income after Taxes for both 2019 and 2020.

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

A The calculation of taxable income is as follows Calculation of taxable income for 2019 Particulars Amountin Financial income 240000 Add Top executiv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started