kindly ans please thanks

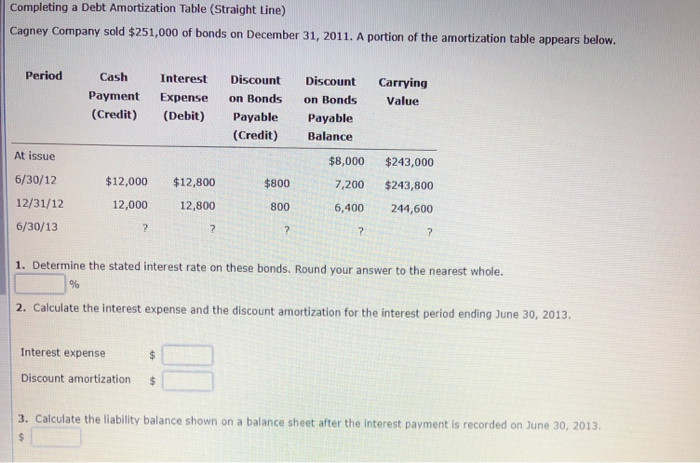

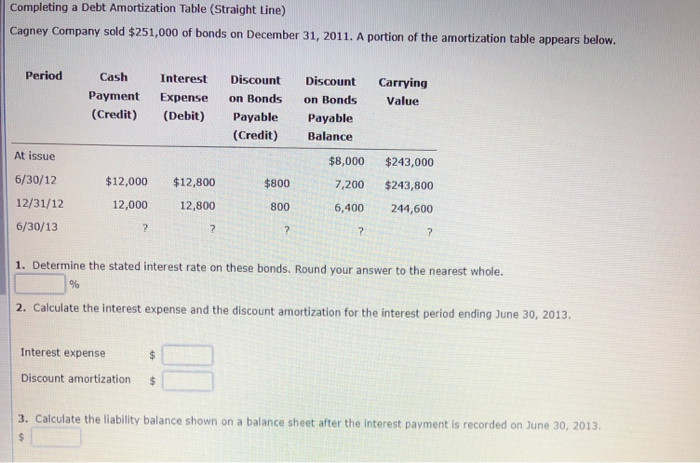

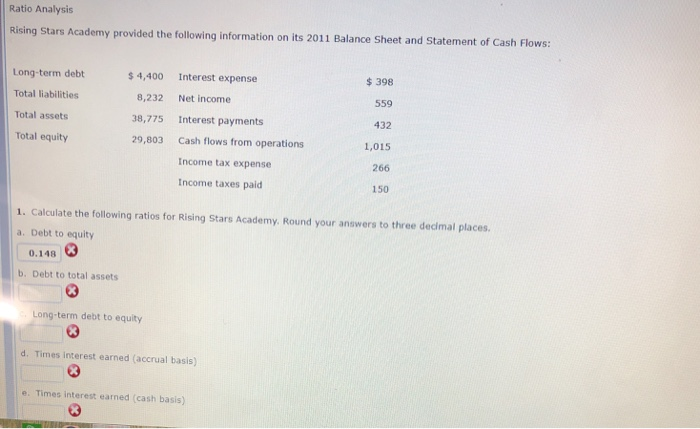

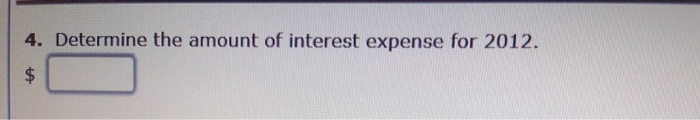

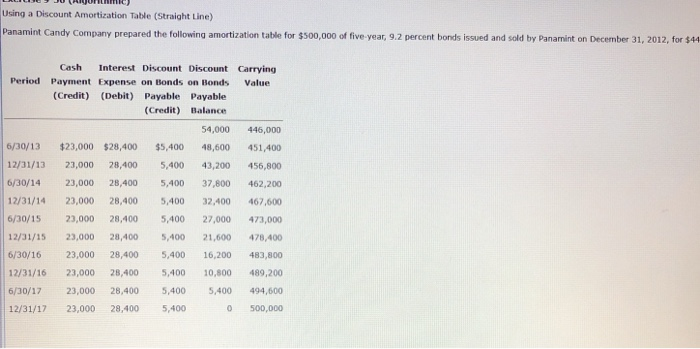

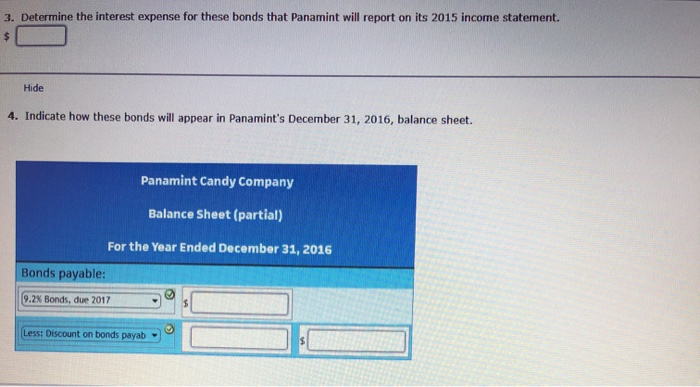

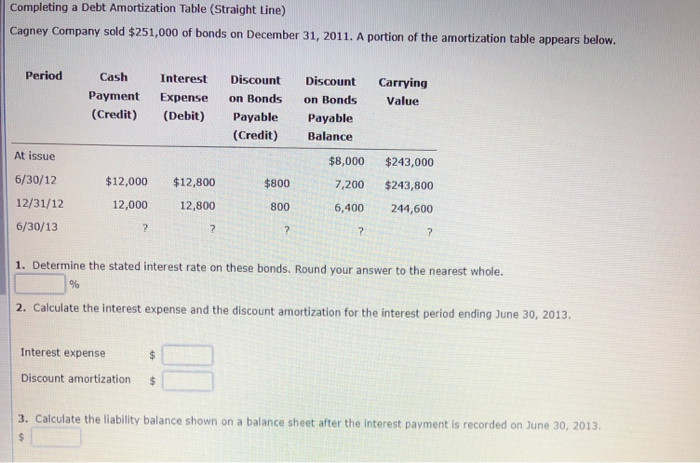

Completing a Debt Amortization Table (Straight line) Cagney Company sold $251,000 of bonds on December 31, 2011. A portion of the amortization table appears below. Period Cash Payment (Credit) Interest Expense (Debit) Carrying Value Discount on Bonds on Bonds Payable (Credit) Discount on Bonds Payable Balance $8,000 7,200 6,400 At issue 6/30/12 12/31/12 6/30/13 $12,000 12,000 $12,800 12,800 $800 800 $243,000 $243,800 244,600 ? ? 1. Determine the stated interest rate on these bonds. Round your answer to the nearest whole. 2. Calculate the interest expense and the discount amortization for the interest period ending June 30, 2013. Interest expense Discount amortization $ 3. Calculate the liability balance shown on a balance sheet after the interest payment is recorded on June 30, 2013 Ratio Analysis Rising Stars Academy provided the following information on its 2011 Balance Sheet and Statement of Cash Flows: Long-term debt $ 4,400 Interest expense $ 398 Total liabilities 8,232 Net income 559 Total assets 38,775 Interest payments 432 Total equity 29,803 Cash flows from operations 1,015 266 Income tax expense Income taxes paid 150 1. Calculate the following ratios for Rising Stars Academy. Round your answers to three dedmal places. a. Debt to equity 0.1433 b. Debt to total assets 83 Long-term debt to equity d. Times interest earned (accrual basis) e Times interest earned cash basis) HOLL Interest Payments and Interest Expense for Bonds (Straight Line) Klamath Manufacturing sold 20-year bonds with a total face amount of $413,000 and a stated rate of 7.5 percent. The bonds sold for $437,000 on De semiannually on June 30 and December 31. 4. Determine the amount of interest expense for 2012. Using a Discount Amortization Table (Straight Line) Panamint Candy Company prepared the following amortization table for $500,000 of five-year, 9.2 percent bonds issued and sold by Panamint on December 31, 2012, for $44 Cash Interest Discount Discount Carrying Period Payment Expense on Bonds on Bonds Value (Credit) (Debit) Payable Payable (Credit) Balance 54,000 445,000 6/30/13 $23,000 $28,400 $5,400 48,600 451,400 12/31/13 23,000 28,400 5,400 43,200 456,800 6/30/14 23,000 28,400 5,400 37,800 462,200 12/31/14 23,000 28.400 5,400 32,400 467,600 6/30/15 23,000 28,400 5,400 27.000 473,000 12/31/15 23.000 28.400 5.400 21,600 478,400 6/30/16 23.000 28.400 5,400 16,200 483,800 12/31/16 23,000 28,400 5,400 10,800 489,200 6/30/17 23,000 28,400 5,400 5,400 494,600 12/31/17 23,000 28,400 5,400 500,000 3. Determine the interest expense for these bonds that Panamint will report on its 2015 income statement. Hide 4. Indicate how these bonds will appear in Panamint's December 31, 2016, balance sheet. Panamint Candy Company Balance Sheet (partial) For the Year Ended December 31, 2016 Bonds payable: 9.2% Bonds, due 2017 Less: Discount on bonds payab