Answered step by step

Verified Expert Solution

Question

1 Approved Answer

KINDLY ANSWER AND SHOW COMPLETE SOLUTIONS 11. On December 27, 20x1, ABC received a sale order for a credit sale on goods with selling price

KINDLY ANSWER AND SHOW COMPLETE SOLUTIONS

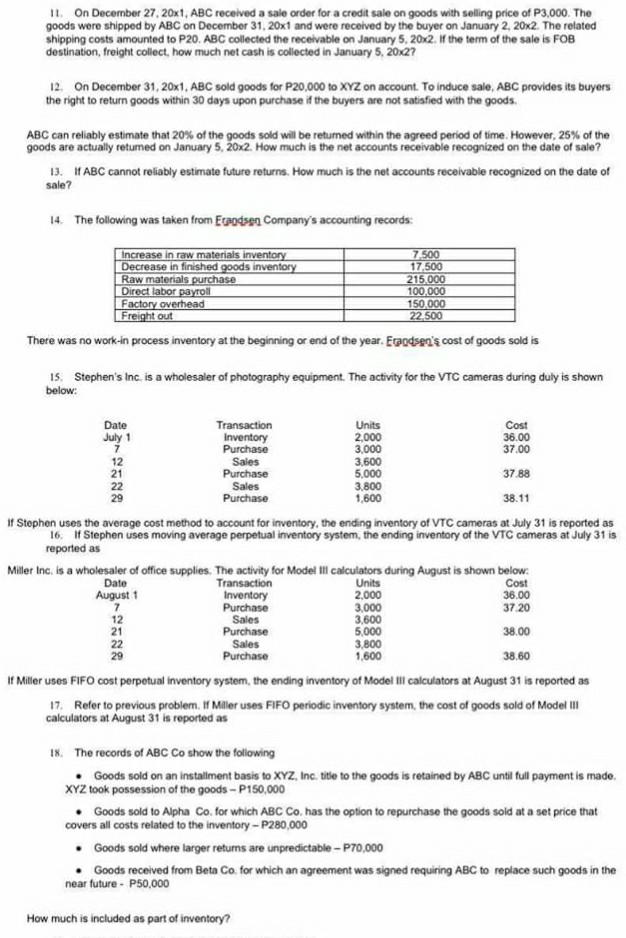

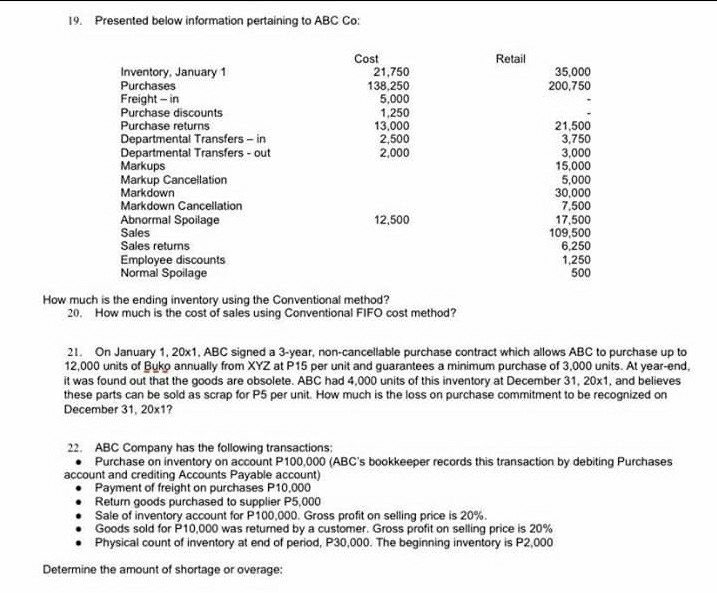

11. On December 27, 20x1, ABC received a sale order for a credit sale on goods with selling price of P3,000. The goods were shipped by ABC on December 31, 20x1 and were received by the buyer on January 2, 20x2. The related shipping costs amounted to P20. ABC collected the receivable on January 5, 20x2. If the term of the sale is FOB destination, freight collect, how much net cash is collected in January 5, 20x2? 12. On December 31, 20x1, ABC sold goods for P20,000 to XYZ on account. To induce sale, ABC provides its buyers the right to return goods within 30 days upon purchase if the buyers are not satisfied with the goods. ABC can reliably estimate that 20% of the goods sold will be returned within the ag goods are actually retumed on January 5, 20x2. How much is the net accounts receivable recognized on the date of sale? goods are actually returned on January 2013 De returned within the agreed period of time. However, 25% of the 13. If ABC cannot reliably estimate future returns. How much is the net accounts receivable recognized on the date of sale? 14. The following was taken from Epodsen Company's accounting records: Increase in raw materials inventory Decrease in finished goods inventory Raw materials purchase Direct labor payroll Factory overhead Freight out 7500 17.500 215.000 100.000 150.000 22.500 There was no work in process inventory at the beginning or end of the year. Erandsen's cost of goods sold is 15. Stephen's Inc. is a wholesaler of photography equipment. The activity for the VTC cameras during duly is shown below: Date July 1 Cost 36.00 37.00 Transaction Inventory Purchase Sales Purchase Sales Purchase Units 2,000 3,000 3,600 5.000 3.800 1,600 37.88 38.11 If Stephen uses the average cost method to account for inventory, the ending inventory of VTC cameras at July 31 is reported as 16. If Stephen uses moving average perpetual inventory system, the ending inventory of the VTC cameras at July 31 is reported as Miller Inc. is a wholesaler of office supplies. The activity for Model Il calculators during August is shown below. Date Transaction Units Cost August 1 Inventory 2,000 36.00 Purchase 3,000 37.20 Sales 3.600 Purchase 5,000 38.00 Sales 3.800 Purchase 1,600 38.60 21 If Miller uses FIFO cost perpetual inventory system, the ending inventory of Model lll calculators at August 31 is reported as 17. Refer to previous problem. If Miller uses FIFO periodic inventory system, the cost of goods sold of Model III calculators at August 31 is reported as 18. The records of ABC Co show the following Goods sold on an installment basis to XYZ, Inc. title to the goods is retained by ABC until full payment is made XYZ took possession of the goods-P150,000 Goods sold to Alpha Co. for which ABC Co. has the option to repurchase the goods sold at a set price that covers all costs related to the inventory-P280,000 Goods sold where larger returns are unpredictable -P70,000 Goods received from Beta Co. for which an agreement was signed requiring ABC to replace such goods in the near future - P50,000 How much is included as part of inventory? 19. Presented below information pertaining to ABC Co: Retail 35,000 200,750 Cost 21.750 138.250 5,000 1,250 13,000 2,500 2,000 Inventory. January 1 Purchases Freight-in Purchase discounts Purchase returns Departmental Transfers - in Departmental Transfers -out Markups Markup Cancellation Markdown Markdown Cancellation Abnormal Spoilage Sales Sales retums Employee discounts Normal Spoilage 21,500 3,750 3,000 15,000 5,000 30,000 7.500 17,500 109,500 6.250 1,250 500 12,500 How much is the ending inventory using the Conventional method? 20. How much is the cost of sales using Conventional FIFO cost method? 21. On January 1, 20x1. ABC signed a 3-year, non-cancellable purchase contract which allows ABC to purchase up to 12,000 units of Buko annually from XYZ at P15 per unit and guarantees a minimum purchase of 3,000 units. At year-end, it was found out that the goods are obsolete. ABC had 4,000 units of this inventory at December 31, 20x1, and believes these parts can be sold as scrap for P5 per unit. How much is the loss on purchase commitment to be recognized on December 31, 20x1? 22. ABC Company has the following transactions: Purchase on inventory on account P100,000 (ABC's bookkeeper records this transaction by debiting Purchases account and crediting Accounts Payable account) Payment of freight on purchases P10,000 Return goods purchased to supplier P5,000 Sale of inventory account for P100,000. Gross profit on selling price is 20% Goods sold for P10,000 was returned by a customer. Gross profit on selling price is 20% . Physical count of inventory at end of period, P30,000. The beginning inventory is P2,000 Determine the amount of shortage or overageStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started