Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly answer correctly showing your working. and filling the table. Part 1 -Budget Basics Budget Basics a) Monthly Net Pay I. In the table below,

Kindly answer correctly showing your working. and filling the table.

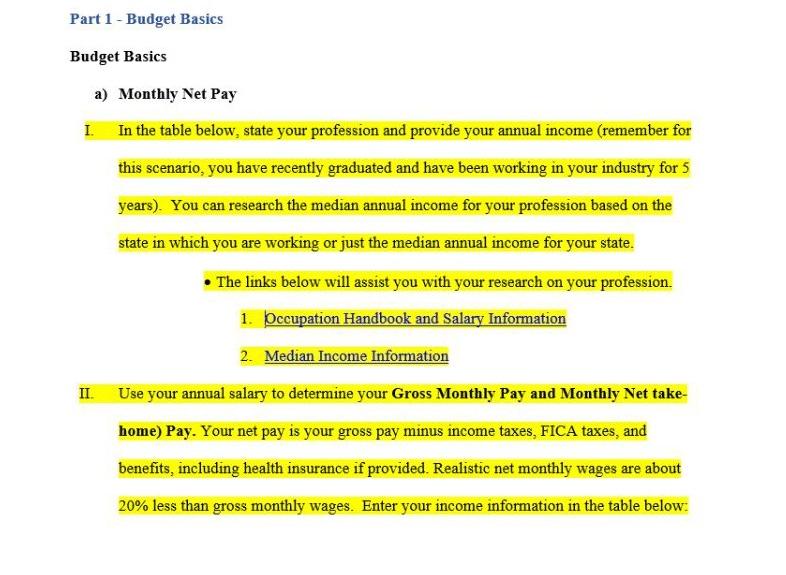

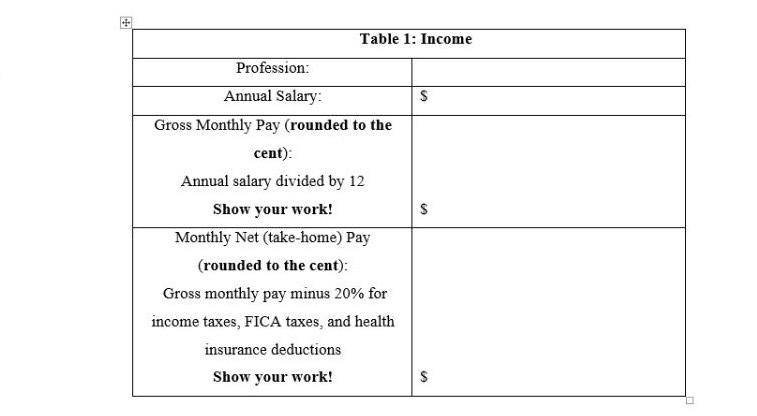

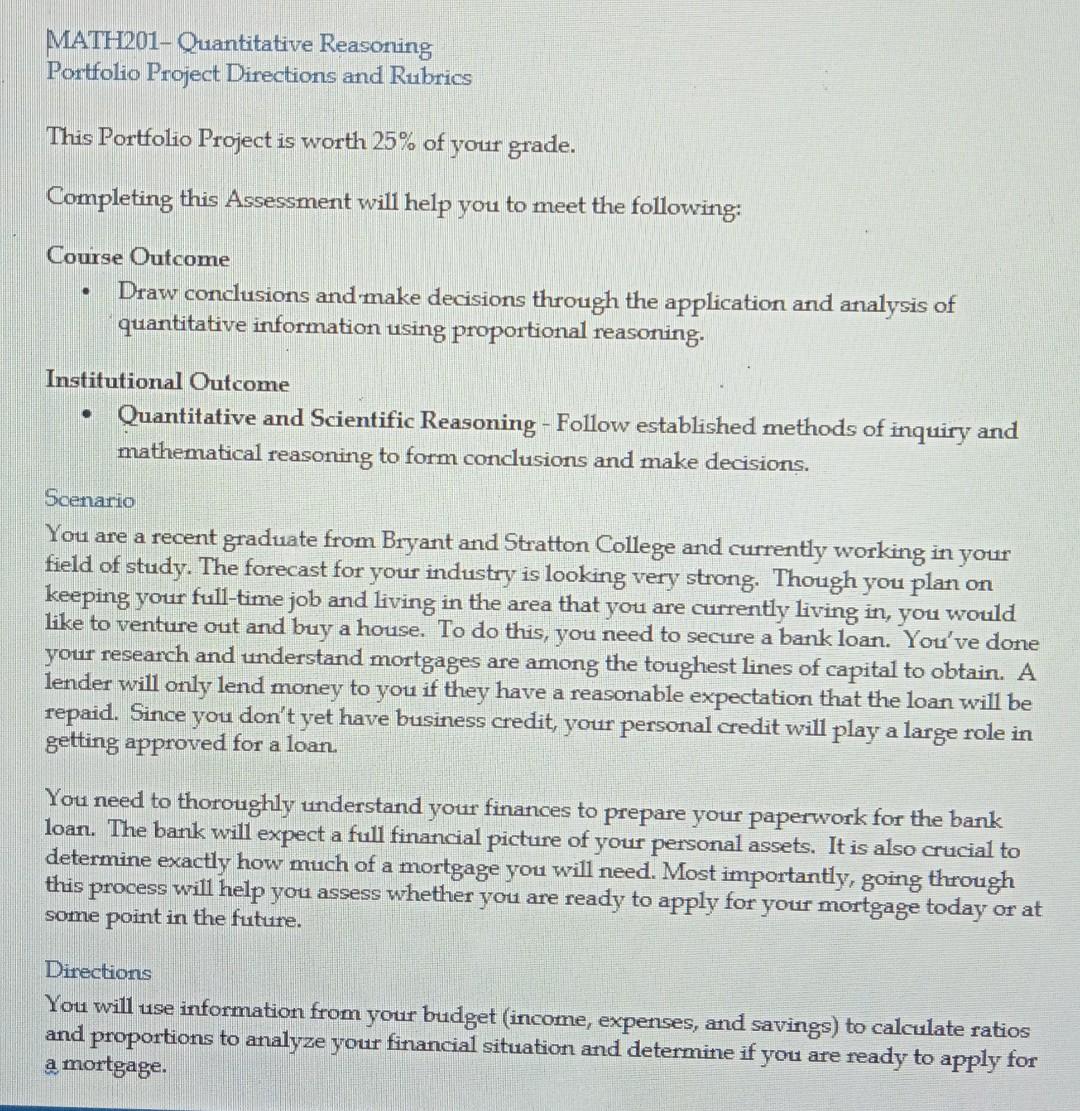

Part 1 -Budget Basics Budget Basics a) Monthly Net Pay I. In the table below, state your profession and provide your annual income (remember for this scenario, you have recently graduated and have been working in your industry for 5 years). You can research the median annual income for your profession based on the state in which you are working or just the median annual income for your state. - The links below will assist you with your research on your profession. 1. Pccupation Handbook and Salary Information 2. Median Income Information II. Use your annual salary to determine your Gross Monthly Pay and Monthly Net take-home) Pay. Your net pay is your gross pay minus income taxes, FICA taxes, and benefits, including health insurance if provided. Realistic net monthly wages are about 20% less than gross monthly wages. Enter your income information in the table below: MATH201-Quantitative Reasoning Portfolio Project Directions and Rubrics This Portfolio Project is worth 25% of your grade. Completing this Assessment will help you to meet the following: Course Outcome - Draw conclusions and make decisions through the application and analysis of quantitative information using proportional reasoning. Institutional Outcome - Quantitative and Scientific Reasoning-Follow established methods of inquiry and mathematical reasoning to form conclusions and make decisions. Scenario You are a recent graduate from Bryant and Stratton College and currently working in your field of study. The forecast for your industry is looking very strong. Though you plan on keeping your full-time job and living in the area that you are currently living in, you would like to venture out and buy a house. To do this, you need to secure a bank loan. You've done your research and understand mortgages are among the toughest lines of capital to obtain. A lender will only lend money to you if they have a reasonable expectation that the loan will be repaid. Since you don't yet have business credit, your personal credit will play a large role in getting approved for a loan. You need to thoroughly understand your finances to prepare your paperwork for the bank loan. The bank will expect a full financial picture of your personal assets. It is also crucial to determine exactly how much of a mortgage you will need. Most importantly, going through this process will help you assess whether you are ready to apply for your mortgage today or at some point in the future. Directions You will use information from your budget (income, expenses, and savings) to calculate ratios and proportions to analyze your financial situation and determine if you are ready to apply for a mortgage

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started