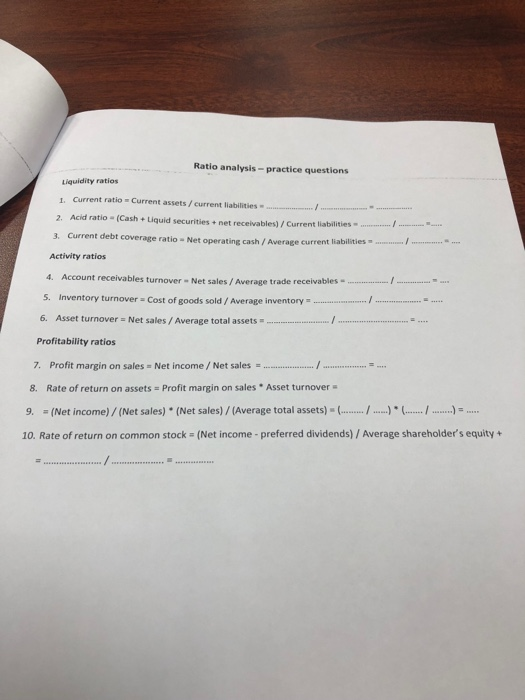

Kindly answer the questions by using the attachments

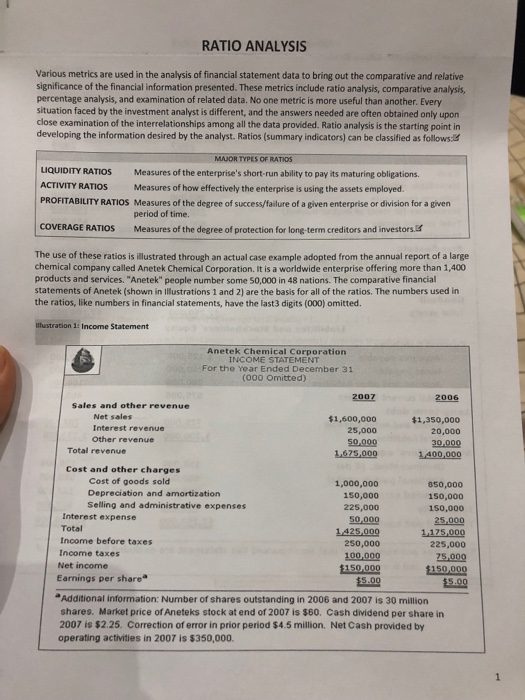

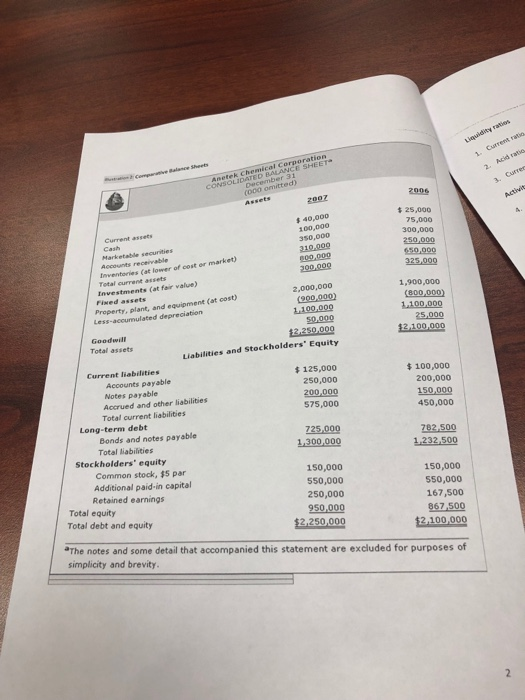

RATIO ANALYSIS Various metrics are used in the analysis of financial statement data to bring out the comparative and relative significance of the financial information presented. These metrics include ratio analysis, comparative analysis, percentage analysis, and examination of related data. No one metric is more useful than another. Every situation faced by the investment analyst is different, and the answers needed are often obtained only upon close examination of the interrelationships among all the data provided. Ratio analysis is the starting point in developing the information desired by the analyst. Ratios (summary indicators) can be classified as follows MAUOR TYPES OF RATIOs LIQUIDITY RATIOS Measures of the enterprise's short-run ability to pay its maturing obligations ACTIVITY RATIOS Measures of how effectively the enterprise is using the assets employed PROFITABILITY RATIOS Measures of the degree of success/failure of a given enterprise or division for a given period of time COVERAGE RATIOS Measures of the degree of protection for long-term creditors and investors The use of these ratios is illustrated through an actual case example adopted from the annual report of a large chemical company called Anetek Chemical Corporation. It is a worldwide enterprise offering more than 1,400 products and services. "Anetek" people number some 50,000 in 48 nations. The comparative financial statements of Anetek (shown in Illustrations 1 and 2) are the basis for all of the ratios. The numbers used in the ratios, like numbers in financial statements, have the last3 digits (000) omitted. Ilustration 1: Income Statement Anetek Chemical Corporation INCOME STATEMENT For the Year Ended December 31 (000 Omitted) 2007 2006 Sales and other revenue Net sales Interest revenue Other revenue $1,600,000 25,000 50,000 $1,350,000 20,000 30.000 Total revenue Cost and other charges Cost of goods sold Depreciation and amortization Selling and administrative expenses 1,000,000 150,000 22s,000 50,000 850,000 150,000 150,000 25,000 Interest expense Total Income before taxes Income taxes Net income Earnings per share 250,000 225,000 25,000 150,000 5.00 Additional information: Number of shares outstanding in 2006 and 2007 is 30 million shares. Market price of Aneteks stock at end of 2007 is $60. Cash dividend per share in 2007 is $2.25. Correction of error in prior period $4.5 million. Net Cash provided by operating activities in 2007 is $350,000