Answered step by step

Verified Expert Solution

Question

1 Approved Answer

kindly answer the questions in 5 mins it's urgent. Johnny B. Goode has realized that he has to start depositing every month to live a

kindly answer the questions in 5 mins it's urgent.

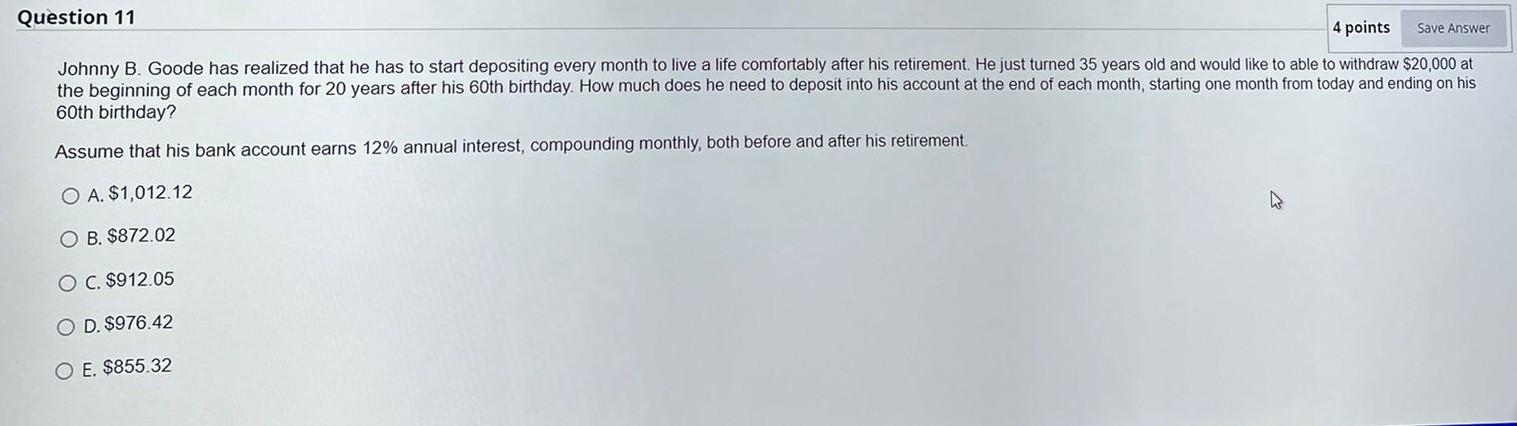

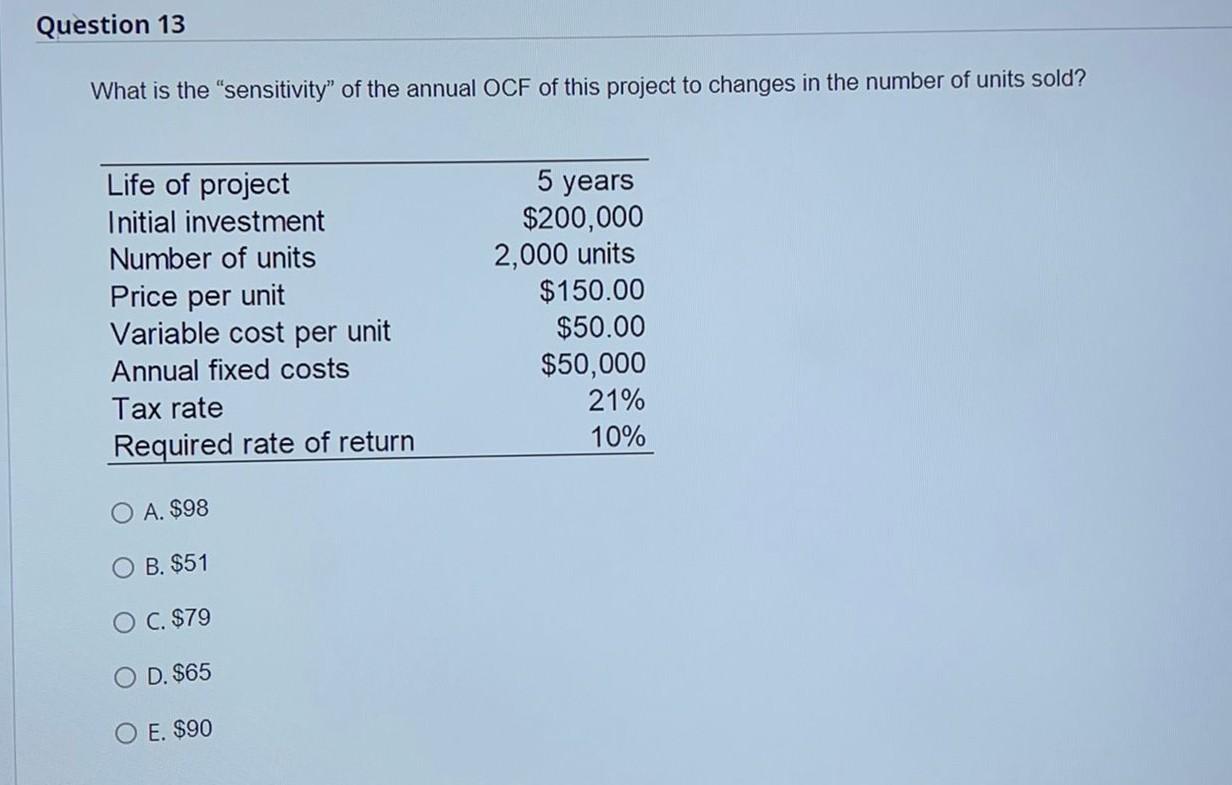

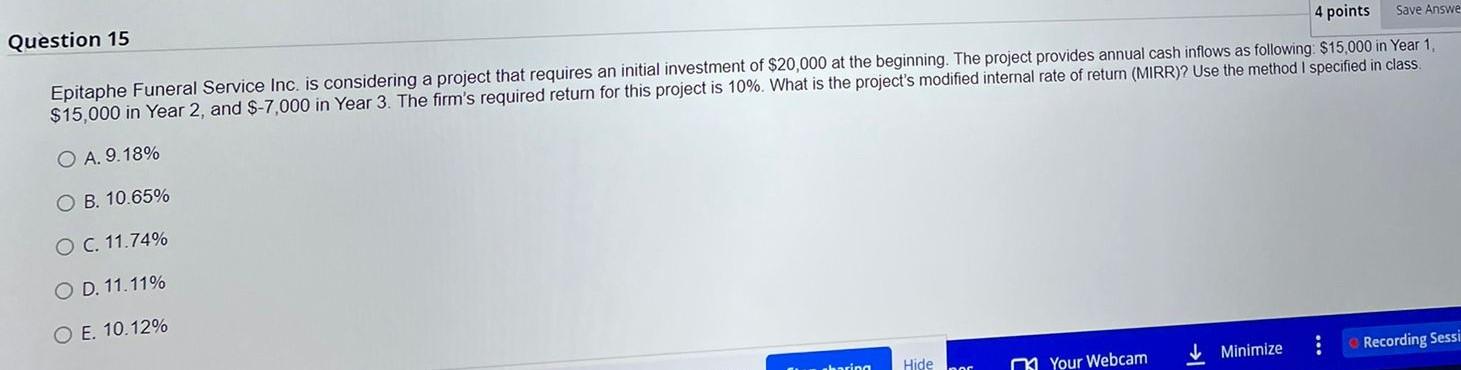

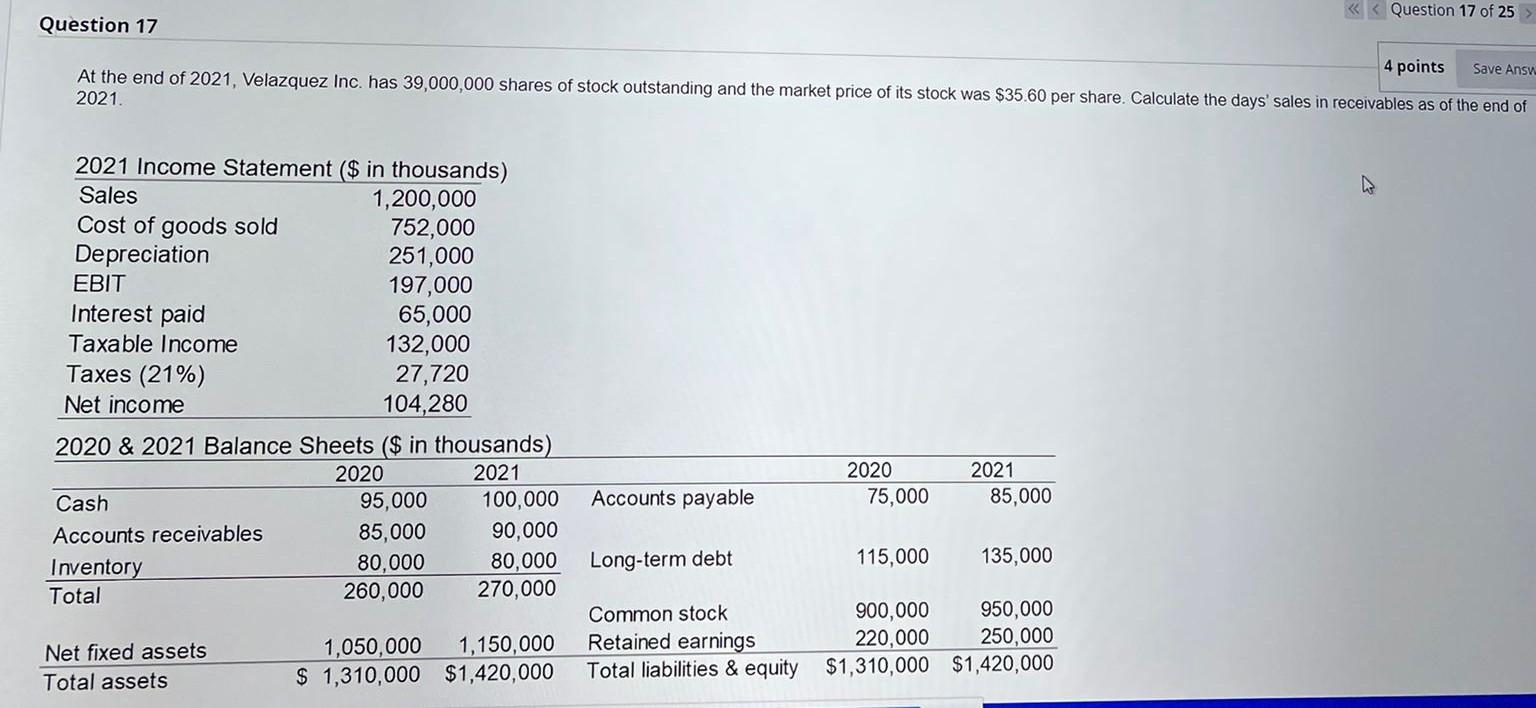

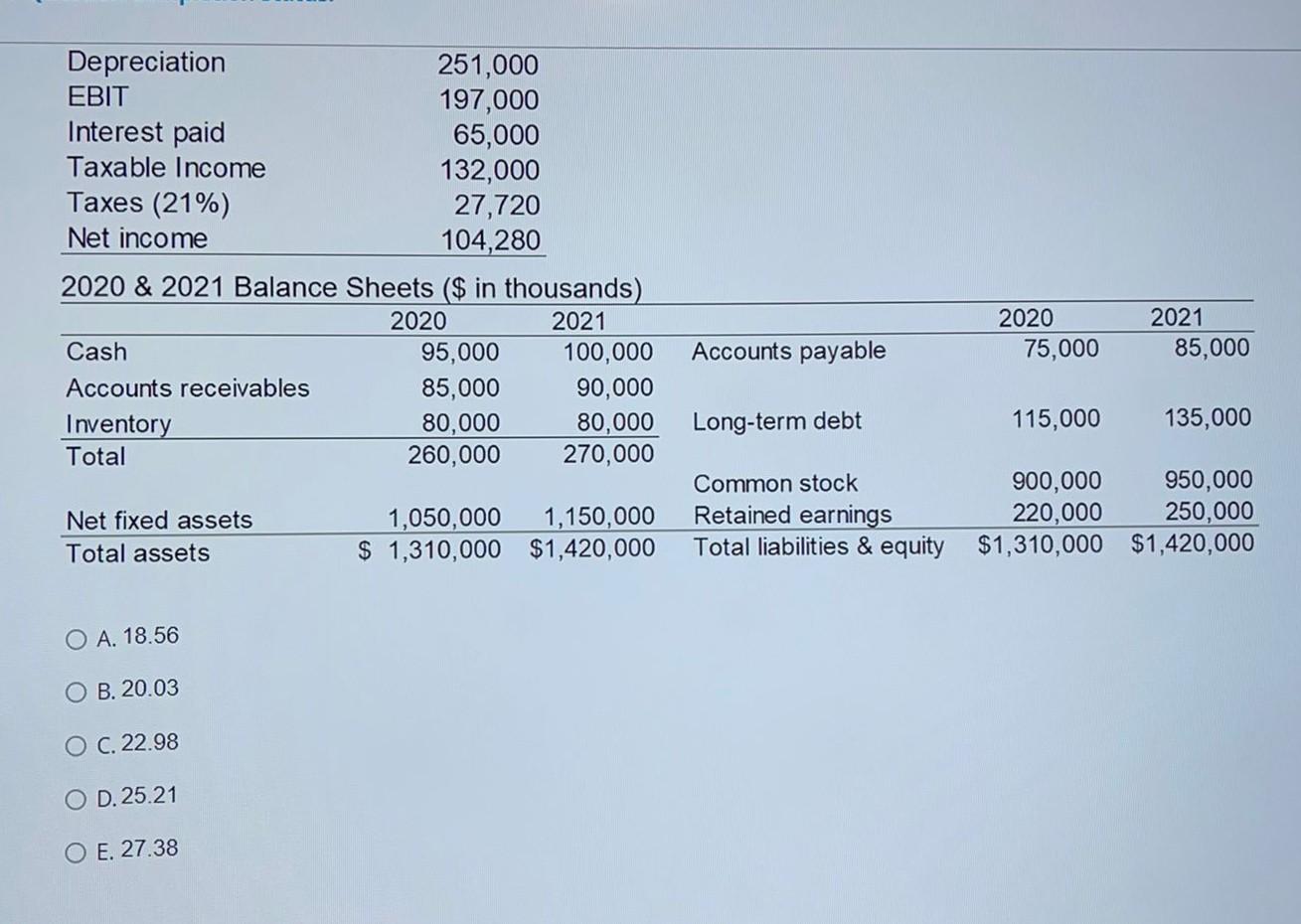

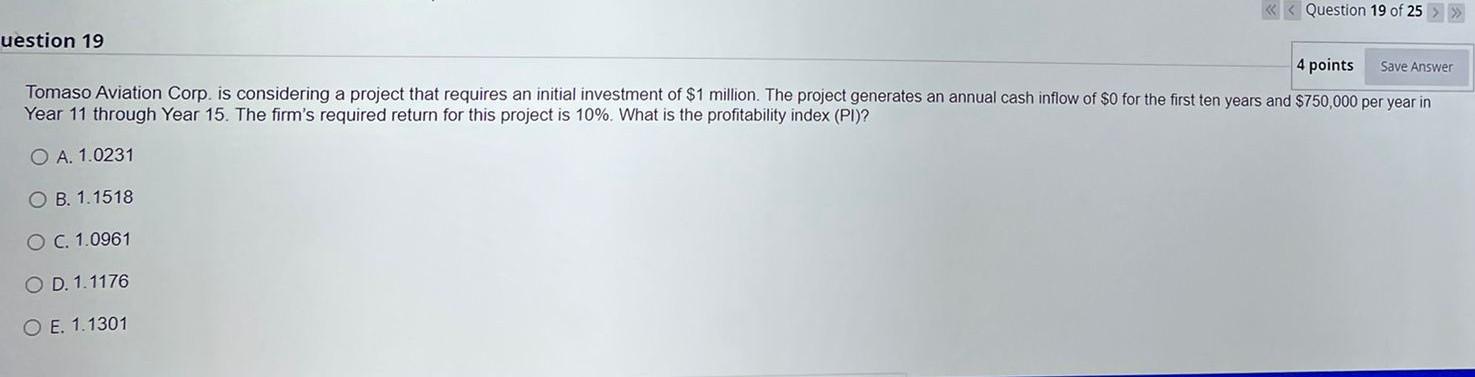

Johnny B. Goode has realized that he has to start depositing every month to live a life comfortably after his retirement. He just turned 35 years old and would like to able to withdraw $20,000 at the beginning of each month for 20 years after his 60 th birthday. How much does he need to deposit into his account at the end of each month, starting one month from today and ending on his 60th birthday? Assume that his bank account earns 12% annual interest, compounding monthly, both before and after his retirement. A. $1,012.12 B. $872.02 C. $912.05 D. $976.42 E. $855.32 What is the "sensitivity" of the annual OCF of this project to changes in the number of units sold? A. $98 B. $51 Epitaphe Funeral Service Inc. is considering a project that requires an initial investment of $20,000 at the beginning. The project provides annual cash inflows as following: $15,000 in Year 1 , $15,000 in Year 2 , and $7,000 in Year 3. The firm's required return for this project is 10%. What is the project's modified internal rate of return (MIRR)? Use the method I specified in class. A. 9.18% B. 10.65% C. 11.74% D. 11.11% E. 10.12% 4 points At the end of 2021 , Velazquez Inc. has 39,000,000 shares of stock outstanding and the market price of its stock was $35.60 per share. Calculate the days' sales in receivables as of the end of 2021. A. 18.56 B. 20.03 C. 22.98 D. 25.21 E. 27.38 Tomaso Aviation Corp. is considering a project that requires an initial investment of $1 million. The project generates an annual cash inflow of $0 for the first ten years and $750,000 per year in Year 11 through Year 15 . The firm's required return for this project is 10%. What is the profitability index (PI)? A. 1.0231 B. 1.1518 C. 1.0961 D. 1.1176 E. 1.1301Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started