Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly answer this ASAP Problem 1 (10 points). The following table depicts current market conditions (assume annual compounding): Year Current spot rates (rt) Implied 2-year

Kindly answer this ASAP

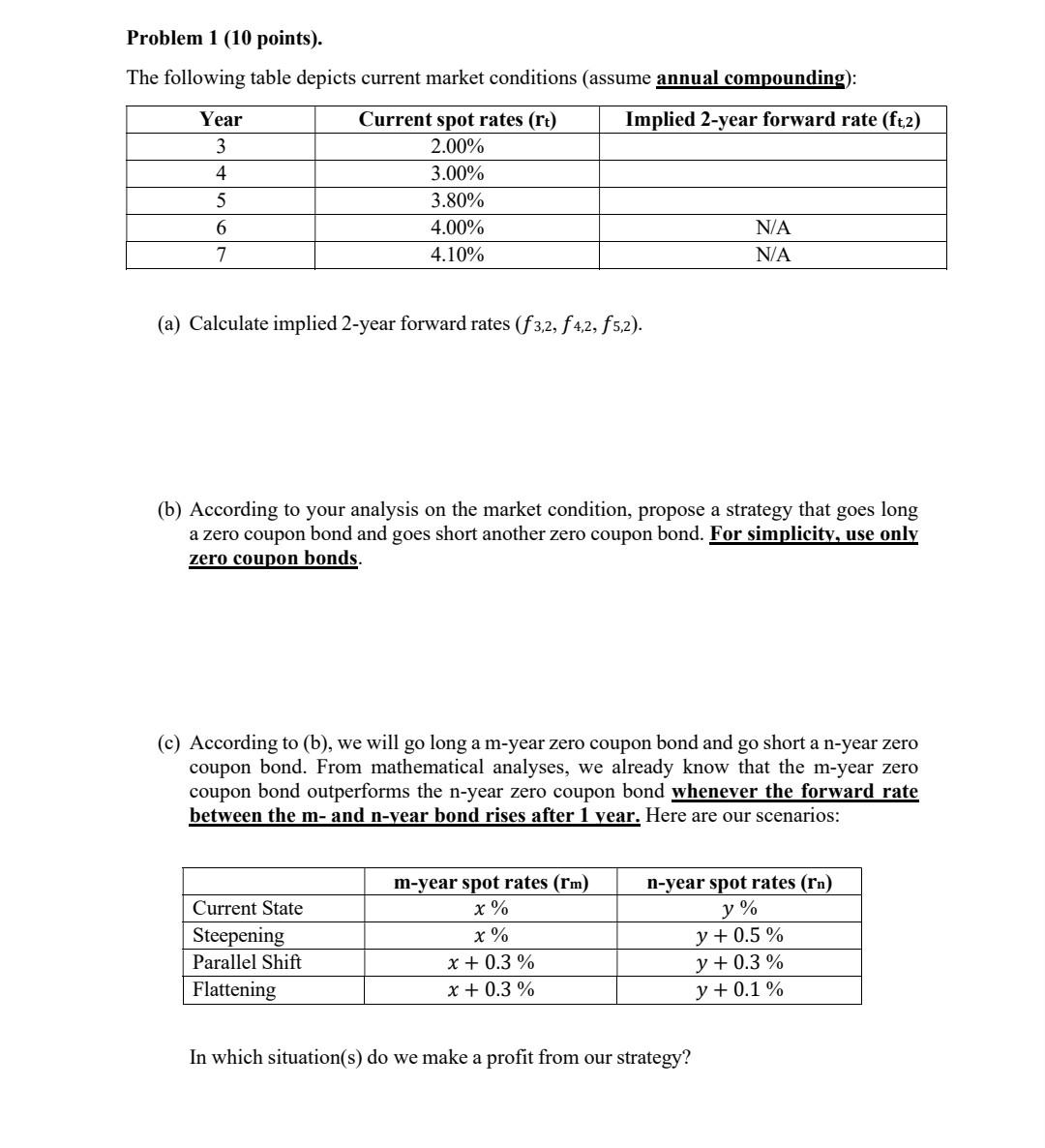

Problem 1 (10 points). The following table depicts current market conditions (assume annual compounding): Year Current spot rates (rt) Implied 2-year forward rate (ft,2) 3 2.00% 4 3.00% 5 3.80% 6 4.00% N/A 7 4.10% N/A (a) Calculate implied 2-year forward rates (f3,2, f 4,2, f5,2). (b) According to your analysis on the market condition, propose a strategy that goes long a zero coupon bond and goes short another zero coupon bond. For simplicity, use only zero coupon bonds. (c) According to (b), we will go long a m-year zero coupon bond and go short a n-year zero coupon bond. From mathematical analyses, we already know that the m-year zero coupon bond outperforms the n-year zero coupon bond whenever the forward rate between the m- and n-year bond rises after 1 year. Here are our scenarios: Current State Steepening Parallel Shift Flattening m-year spot rates (rm) x % x % X + 0.3% x + 0.3% n-year spot rates (rn) y % y + 0.5% y + 0.3% y + 0.1% In which situation(s) do we make a profit from our strategy? Problem 1 (10 points). The following table depicts current market conditions (assume annual compounding): Year Current spot rates (rt) Implied 2-year forward rate (ft,2) 3 2.00% 4 3.00% 5 3.80% 6 4.00% N/A 7 4.10% N/A (a) Calculate implied 2-year forward rates (f3,2, f 4,2, f5,2). (b) According to your analysis on the market condition, propose a strategy that goes long a zero coupon bond and goes short another zero coupon bond. For simplicity, use only zero coupon bonds. (c) According to (b), we will go long a m-year zero coupon bond and go short a n-year zero coupon bond. From mathematical analyses, we already know that the m-year zero coupon bond outperforms the n-year zero coupon bond whenever the forward rate between the m- and n-year bond rises after 1 year. Here are our scenarios: Current State Steepening Parallel Shift Flattening m-year spot rates (rm) x % x % X + 0.3% x + 0.3% n-year spot rates (rn) y % y + 0.5% y + 0.3% y + 0.1% In which situation(s) do we make a profit from our strategyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started