Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly assist me ASAP 9. Incremental Cash Flow (9 Marks) A motorcycle shop has been successfully selling 710 units of the classic motorcycle Yahoo Moto

Kindly assist me ASAP

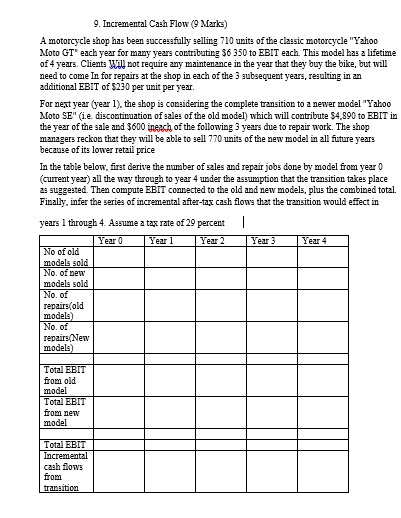

9. Incremental Cash Flow (9 Marks) A motorcycle shop has been successfully selling 710 units of the classic motorcycle "Yahoo Moto GT' each year for many years contributing 56 350 to EBIT each. This model has a lifetime of 4 years. Clients will not require any maintenance in the year that they buy the bike, but will need to come In for repairs at the shop in each of the 3 subsequent years, resulting in an additional EBIT of $230 per unit per year. For next year (year 1), the shop is considering the complete transition to a nerver model "Yahoo Moto SE" (i.e discontinuation of sales of the old model) which will contribute $4.890 to EBIT in the year of the sale and 3600 ineach of the following 3 years due to repair work. The shop managers reckon that they will be able to sell 770 units of the new model in all future years because of its lower retail price In the table below, first derive the number of sales and repair jobs done by model from year 0 (current year) all the way through to year 4 under the assumption that the transition takes place 23 suggested. Then compute EBIT connected to the old and new models, plus the combined total. Finally, infer the series of incremental after-tax cash flows that the transition would effect in years 1 through 4. Assume a tax rate of 29 percent 1 Year 0 Year 1 Year 2 Year 3 Year 4 No of old models sold No. of new models sold No. of repairs(old models) No. of repairs New models) Total EBIT from old model Total EBIT from new model Total EBIT Incremental cash flows from transitionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started