Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(b) Assume an individual with current wealth, Wo. The individual would like to spend an amount C, for current consumption and invest the rest

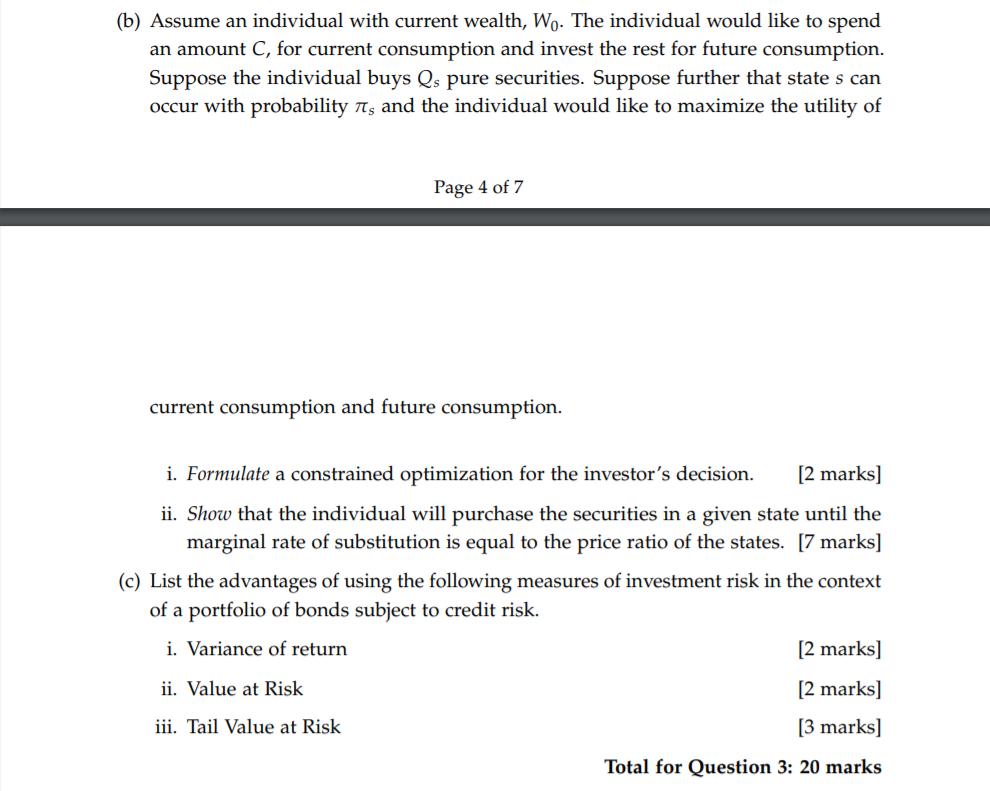

(b) Assume an individual with current wealth, Wo. The individual would like to spend an amount C, for current consumption and invest the rest for future consumption. Suppose the individual buys Qs pure securities. Suppose further that state s can occur with probability ns and the individual would like to maximize the utility of Page 4 of 7 current consumption and future consumption. i. Formulate a constrained optimization for the investor's decision. [2 marks] ii. Show that the individual will purchase the securities in a given state until the marginal rate of substitution is equal to the price ratio of the states. [7 marks] (c) List the advantages of using the following measures of investment risk in the context of a portfolio of bonds subject to credit risk. i. Variance of return [2 marks] ii. Value at Risk [2 marks] iii. Tail Value at Risk [3 marks] Total for Question 3: 20 marks

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer b i The individual s optimization problem is max U Cs C fs subject to Cs C fs Wo Q s Wo C s P 1 where U is the individual s utility function C ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started