Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly assist me with this question from 8 to 11 as per the screen shot (0) TUUUU mation provided below, for Summerhill Traders for the

Kindly assist me with this question from 8 to 11 as per the screen shot

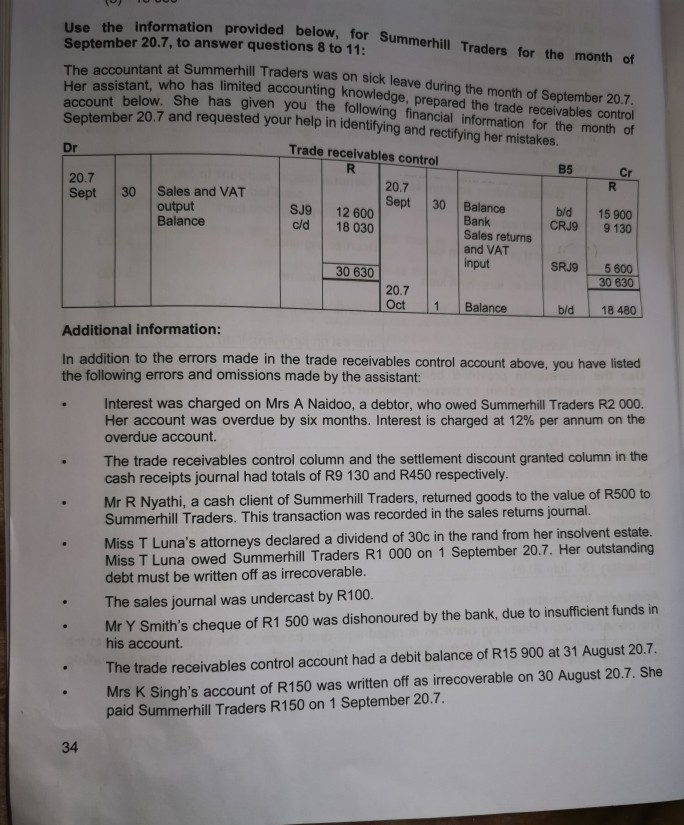

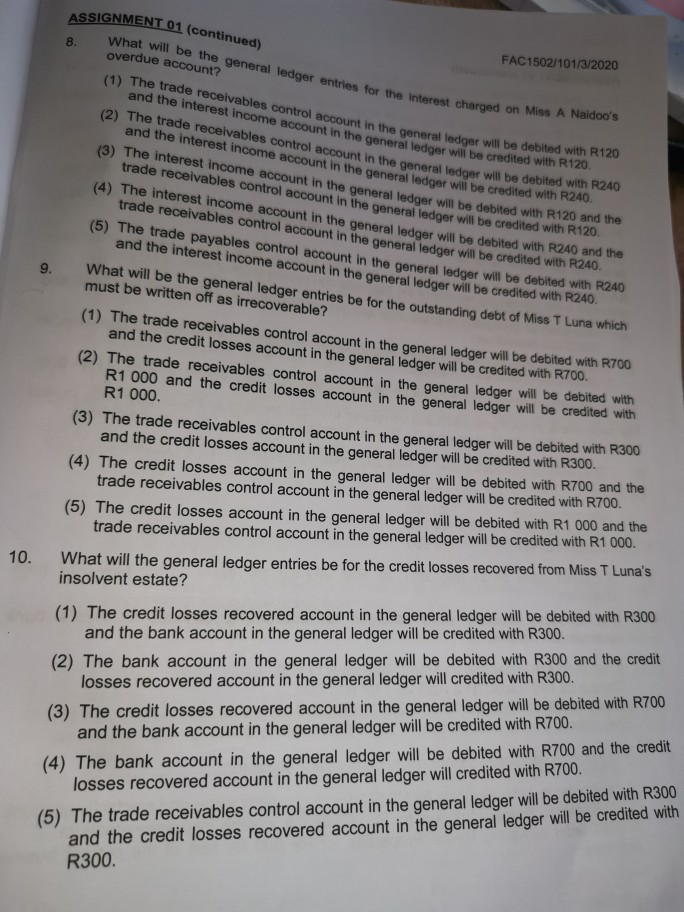

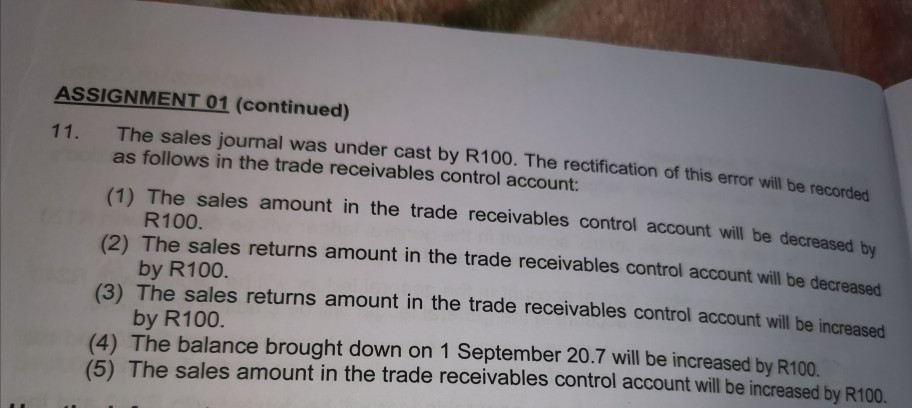

(0) TUUUU mation provided below, for Summerhill Traders for the month of Use the information provided below, for Sum September 20.7, to answer questions 8 to 11: The accountant at Summerhill Trade Her assistant, who has limited acco account below. She has given you September 20.7 and requested your help in identifyin + at Summerhill Traders was on sick leave during the month of September 20.7. ant who has limited accounting knowledge, prepared the trade receivables control She has given you the following financial information for the month of d requested your help in identifying and rectifying her mistakes. Trade receivables control B5 Cr 20.7 Sept 30 Sales and VAT output Balance 20.7 Sept SJ9 30 c/d 12 600 18 030 b/d CRJ9 Balance Bank Sales returns and VAT input 15 900 9 130 30 630 SRJ9 5600 30 630 20.7 Oct 1 Balance bld 18 480 Additional information: In addition to the errors made in the trade receivables control account above, you have listed the following errors and omissions made by the assistant: Interest was charged on Mrs A Naidoo, a debtor, who owed Summerhill Traders R2 000. Her account was overdue by six months. Interest is charged at 12% per annum on the overdue account. The trade receivables control column and the settlement discount granted column in the cash receipts journal had totals of R9 130 and R450 respectively. Mr R Nyathi, a cash client of Summerhill Traders, returned goods to the value of R500 to Summerhill Traders. This transaction was recorded in the sales returns journal. Miss T Luna's attorneys declared a dividend of 30c in the rand from her insolvent estate. Miss T Luna owed Summerhill Traders R1 000 on 1 September 20.7. Her outstanding debt must be written off as irrecoverable. The sales journal was undercast by R100. Mr Y Smith's cheque of R1 500 was dishonoured by the bank, due to insufficient funds in his account. The trade receivables control account had a debit balance of R15 900 at 31 August 20.7. Mrs K Singh's account of R150 was written off as irrecoverable on 30 August 20.7. She paid Summerhill Traders R150 on 1 September 20.7. 34 8. What wil FAC1502/101/3/2020 terest charged on Miss A Naidoo's SSIGNMENT 01 (continued) What will be the general ledger entries for the interest charged or overdue account? (1) The trade receivables control account in the general ledger will be and the interest income account in the general ledger will be creo (2) The trade receivables control account in the general ledger will be deon and the interest income account in the general ledger will be credited with 13) The interest income account in the general ledger will be debited with R12 general ledger will be debited with R120 and the trade receivables control account in the general ledger will be credited with (4) The interest income account in the general ledger will be debited with R240 and trade receivables control account in the general ledger will be credited with R240 (5) The trade payables control account in the general ledger will be debited with R240 and the interest income account in the general ledger will be credited with R240 ral ledger will be debited with R120 eneral ledger will be credited with R120 te general ledger will be debited with R240 What will be the general ledger entries be for the outstanding debt of Miss T Luna which must be written off as irrecoverable? (1) The trade receivables control account in the general ledger will be debited with R700 and the credit losses account in the general ledger will be credited with R700. (2) The trade receivables control account in the general ledger will be debited with R1 000 and the credit losses account in the general ledger will be credited with R1 000. (3) The trade receivables control account in the general ledaer will be debited with R300 and the credit losses account in the general ledger will be credited with R300. (4) The credit losses account in the general ledger will be debited with R700 and the trade receivables control account in the general ledger will be credited with R700. (5) The credit losses account in the general ledger will be debited with R1 000 and the trade receivables control account in the general ledger will be credited with R1 000. 10. What will the general ledger entries be for the credit losses recovered from Miss T Luna's insolvent estate? (1) The credit losses recovered account in the general ledger will be debited with R300 and the bank account in the general ledger will be credited with R300. (2) The bank account in the general ledger will be debited with R300 and the credit losses recovered account in the general ledger will credited with R300. (3) The credit losses recovered account in the general ledger will be debited with R700 and the bank account in the general ledger will be credited with R700. (4) The bank account in the general ledger will be debited with R700 and the credit losses recovered account in the general ledger will credited with R700. (5) The trade receivables control account in the general ledger will be debited with R300 and the credit losses recovered account in the general ledger will be credited with R300 ASSIGNMENT 01 (continued) 11. The sales journal was under cast by R100. The rectification of this error will be as follows in the trade receivables control account: (1) The sales amount in the trade receivables control account will be decreased R100. (2) The sales returns amount in the trade receivables control account will be decreased by R100. (3) The sales returns amount in the trade receivables control account will be increased by R100. (4) The balance brought down on 1 September 20.7 will be increased by R100 (5) The sales amount in the trade receivables control account will be increased by R100Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started