Answered step by step

Verified Expert Solution

Question

1 Approved Answer

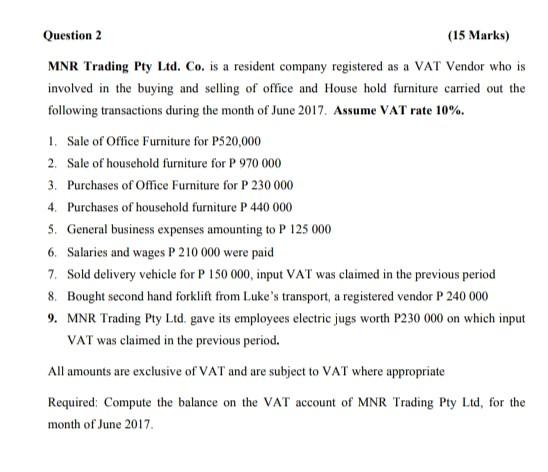

Kindly assist Question 2 (15 Marks) MNR Trading Pty Ltd. Co. is a resident company registered as a VAT Vendor who is involved in the

Kindly assist

Question 2 (15 Marks) MNR Trading Pty Ltd. Co. is a resident company registered as a VAT Vendor who is involved in the buying and selling of office and House hold furniture carried out the following transactions during the month of June 2017. Assume VAT rate 10%. 1. Sale of Office Furniture for P520,000 2. Sale of household furniture for P 970 000 3. Purchases of Office Furniture for P 230 000 4. Purchases of household furniture P 440 000 5. General business expenses amounting to P 125 000 6. Salaries and wages P 210 000 were paid 7. Sold delivery vehicle for P 150 000, input VAT was claimed in the previous period 8. Bought second hand forklift from Luke's transport, a registered vendor P 240 000 9. MNR Trading Pty Ltd. gave its employees electric jugs worth P230 000 on which input VAT was claimed in the previous period. All amounts are exclusive of VAT and are subject to VAT where appropriate Required: Compute the balance on the VAT account of MNR Trading Pty Ltd, for the month of June 2017Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started