Answered step by step

Verified Expert Solution

Question

1 Approved Answer

kindly assist with the above questions 1. Cash flow or Cash flow/share trend over five-years in table and graph form (line or bar) this can

kindly assist with the above questions

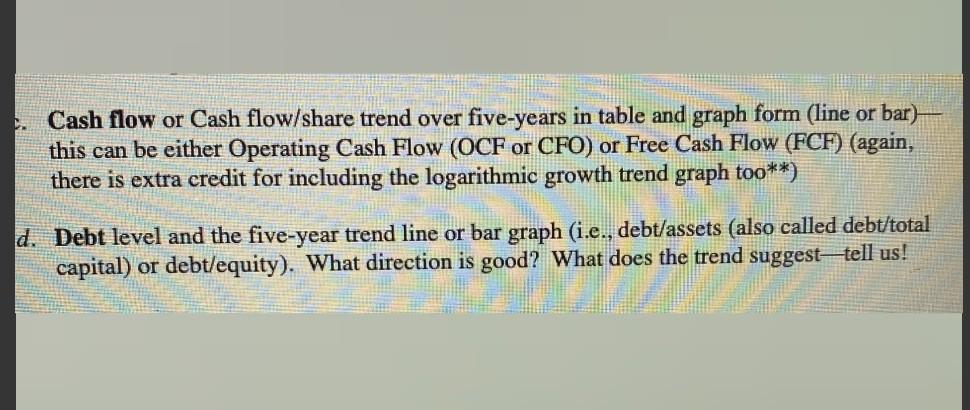

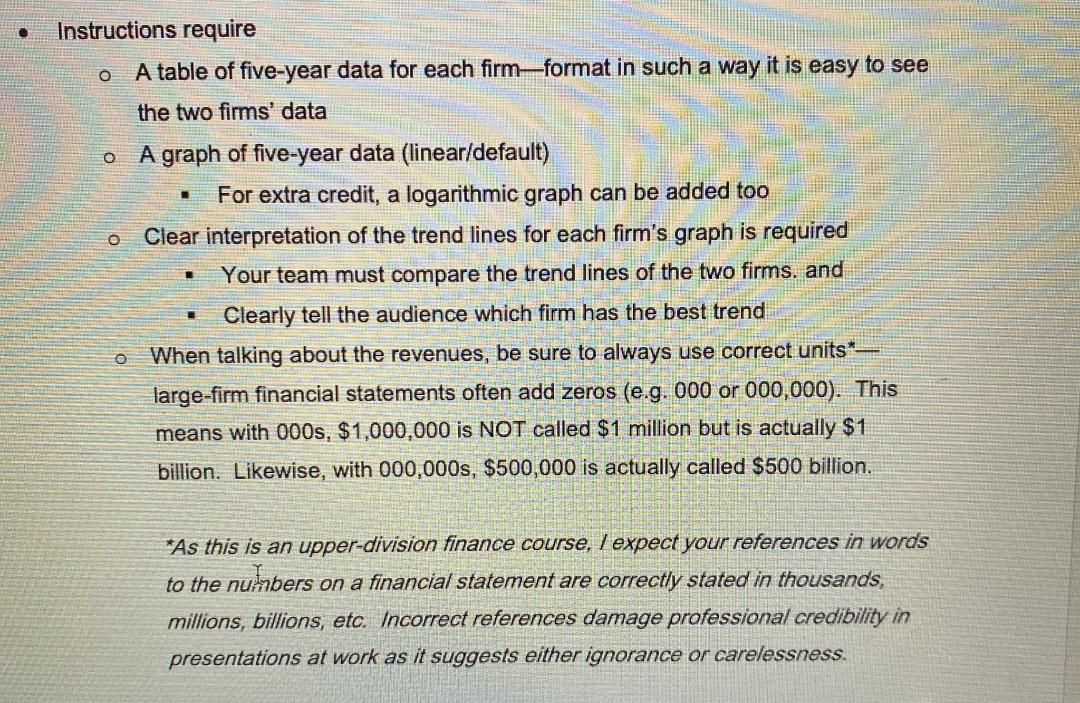

1. Cash flow or Cash flow/share trend over five-years in table and graph form (line or bar) this can be either Operating Cash Flow (OCF or CFO) or Free Cash Flow (FCF) (again, there is extra credit for including the logarithmic growth trend graph too**) d. Debt level and the five-year trend line or bar graph (i.e., debt/assets (also called debt/total capital) or debt/equity). What direction is good? What does the trend suggesttell us! o O Instructions require A table of five-year data for each firmformat in such a way it is easy to see the two firms' data A graph of five-year data (linear/default) For extra credit, a logarithmic graph can be added too Clear interpretation of the trend lines for each firm's graph is required Your team must compare the trend lines of the two firms, and Clearly tell the audience which firm has the best trend When talking about the revenues, be sure to always use correct units* large-firm financial statements often add zeros (e.g. 000 or 000,000). This means with 000s, $1,000,000 is NOT called $1 million but is actually $1 billion. Likewise, with 000,000s, $500,000 is actually called $500 billion. o *As this is an upper-division finance course, / expect your references in words to the numbers on a financial statement are correctly stated in thousands, millions, billions, etc. Incorrect references damage professional credibility in presentations at work as it suggests either ignorance or carelessness. 1. Cash flow or Cash flow/share trend over five-years in table and graph form (line or bar) this can be either Operating Cash Flow (OCF or CFO) or Free Cash Flow (FCF) (again, there is extra credit for including the logarithmic growth trend graph too**) d. Debt level and the five-year trend line or bar graph (i.e., debt/assets (also called debt/total capital) or debt/equity). What direction is good? What does the trend suggesttell us! o O Instructions require A table of five-year data for each firmformat in such a way it is easy to see the two firms' data A graph of five-year data (linear/default) For extra credit, a logarithmic graph can be added too Clear interpretation of the trend lines for each firm's graph is required Your team must compare the trend lines of the two firms, and Clearly tell the audience which firm has the best trend When talking about the revenues, be sure to always use correct units* large-firm financial statements often add zeros (e.g. 000 or 000,000). This means with 000s, $1,000,000 is NOT called $1 million but is actually $1 billion. Likewise, with 000,000s, $500,000 is actually called $500 billion. o *As this is an upper-division finance course, / expect your references in words to the numbers on a financial statement are correctly stated in thousands, millions, billions, etc. Incorrect references damage professional credibility in presentations at work as it suggests either ignorance or carelessnessStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started