kindly explain how we got $405, check highlited part and if possible provide solution for calculating LCR with details

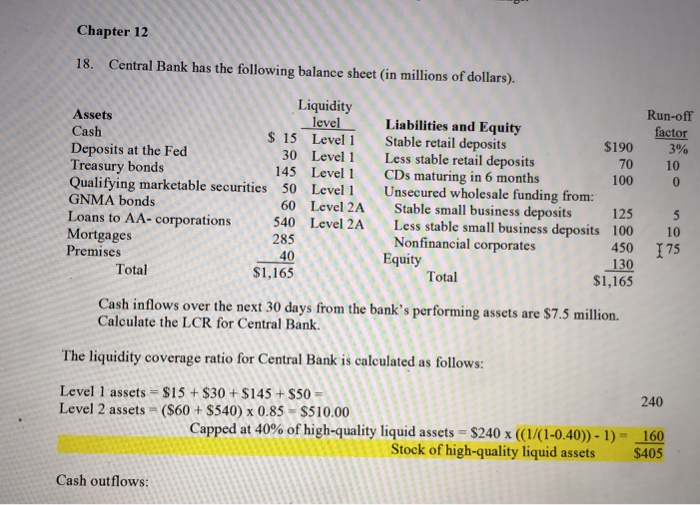

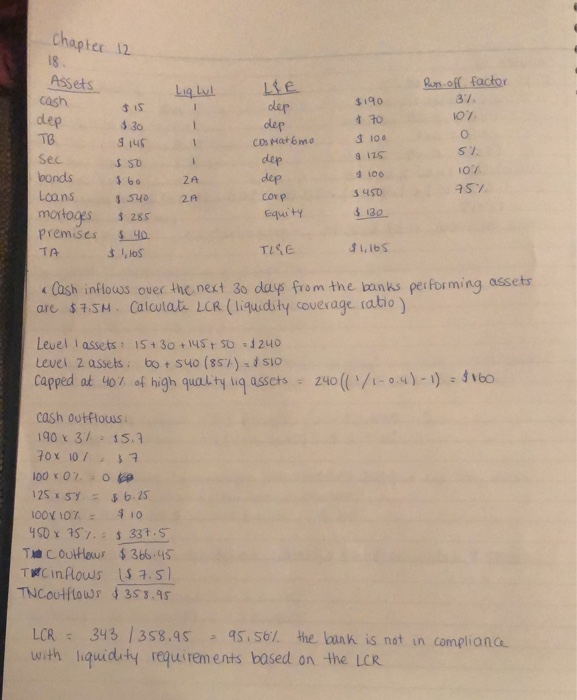

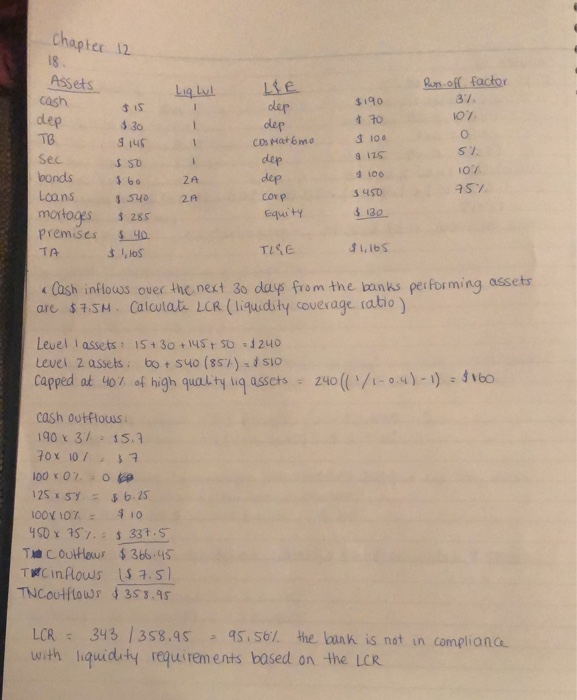

Chapter 12 Central Bank has the following balance sheet (in millions of dollars). 18. Liquidity levelLiabilities and Equity $ 15 Level 1 Stable retail deposits 30 Level 1 Less stable retail deposits 145 Level CDs maturing in 6 months 50 Run-off Assets factor Cash $190 3% Deposits at the Fed Treasury bonds Qualifying marketable securities GNMA bonds 70 10 100 0 Unsecured wholesale funding from: Stable small business deposits Less stable small business deposits Nonfinancial corporates Equity Total Level 1 1255 100 60 Level 2A Loans to AA-corporations Mortgages Premises 540 285 Level 2A 10 450 I75 130 40 Total S1,165 $1,165 Cash inflows over the next 30 days from the bank's performing assets are $7.5 million. Calculate the LCR for Central Bank. The liquidity coverage ratio for Central Bank is calculated as follows: Level 1 assets $15+$30+$145+$50 Level 2 assets ($60$540) x 0.85 $510.00 240 Capped at 40% of high-quality liquid assets = $240 x (( 1/( 1-0.40))-1 ) = 160 Stock of high-quality liquid assets $405 Cash outflows: chapter 12 Assets cash n off factor Ligu Lie. dep dep 37. $190 dep TB d to $ 30 145 S1. Sec dep S SD 100 bonds dep 36o2A Laans mortoges 285 orp 1 542 Equi ty premises5 40 TISE e Cash inflocus over the next 30 days fro m the tanks peiforming assets are $7.SH. Calcutati LCR (liqudity covexage rabio ) Level I assets: IS+30 +145 t So 1240 Level 2 asseks. bo t S40 (85%)-d so capped at 40 z of high qualty iq assets ; 2 ((*/i-o.4)-1)-1 60 cash outflous 140 x 3/ 15. 100 07. ;o $10 100X107. TNCoutftows 353.45 LOR 343 1358.9S,s6 the lank is not in compliana with iquiduhy requirem ents based on the LCR Chapter 12 Central Bank has the following balance sheet (in millions of dollars). 18. Liquidity levelLiabilities and Equity $ 15 Level 1 Stable retail deposits 30 Level 1 Less stable retail deposits 145 Level CDs maturing in 6 months 50 Run-off Assets factor Cash $190 3% Deposits at the Fed Treasury bonds Qualifying marketable securities GNMA bonds 70 10 100 0 Unsecured wholesale funding from: Stable small business deposits Less stable small business deposits Nonfinancial corporates Equity Total Level 1 1255 100 60 Level 2A Loans to AA-corporations Mortgages Premises 540 285 Level 2A 10 450 I75 130 40 Total S1,165 $1,165 Cash inflows over the next 30 days from the bank's performing assets are $7.5 million. Calculate the LCR for Central Bank. The liquidity coverage ratio for Central Bank is calculated as follows: Level 1 assets $15+$30+$145+$50 Level 2 assets ($60$540) x 0.85 $510.00 240 Capped at 40% of high-quality liquid assets = $240 x (( 1/( 1-0.40))-1 ) = 160 Stock of high-quality liquid assets $405 Cash outflows: chapter 12 Assets cash n off factor Ligu Lie. dep dep 37. $190 dep TB d to $ 30 145 S1. Sec dep S SD 100 bonds dep 36o2A Laans mortoges 285 orp 1 542 Equi ty premises5 40 TISE e Cash inflocus over the next 30 days fro m the tanks peiforming assets are $7.SH. Calcutati LCR (liqudity covexage rabio ) Level I assets: IS+30 +145 t So 1240 Level 2 asseks. bo t S40 (85%)-d so capped at 40 z of high qualty iq assets ; 2 ((*/i-o.4)-1)-1 60 cash outflous 140 x 3/ 15. 100 07. ;o $10 100X107. TNCoutftows 353.45 LOR 343 1358.9S,s6 the lank is not in compliana with iquiduhy requirem ents based on the LCR