Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly explain in easy sep by sep method Thanks Exercise 1 The Research department of Constant plc has identified a new prod that is expected

Kindly explain in easy sep by sep method

Thanks

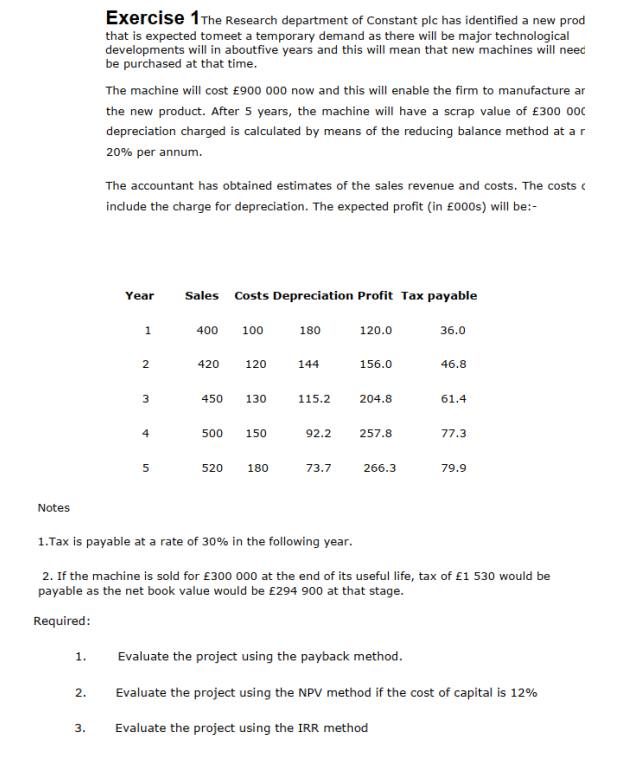

Exercise 1 The Research department of Constant plc has identified a new prod that is expected tomeet a temporary demand as there will be major technological developments will in aboutfive years and this will mean that new machines will need be purchased at that time. The machine will cost 900 000 now and this will enable the firm to manufacture ar the new product. After 5 years, the machine will have a scrap value of 300 OOC depreciation charged is calculated by means of the reducing balance method at ar 20% per annum. The accountant has obtained estimates of the sales revenue and costs. The costs include the charge for depreciation. The expected profit (in 000s) will be:- Year Sales Costs Depreciation Profit Tax payable 1 400 100 180 120.0 36.0 2 420 120 144 156.0 46.8 3 450 130 115.2 204.8 61.4 4 500 150 92.2 257.8 77.3 5 520 180 73.7 266.3 79.9 Notes 1.Tax is payable at a rate of 30% in the following year. 2. If the machine is sold for 300 000 at the end of its useful life, tax of 1 530 would be payable as the net book value would be 294 900 at that stage. Required: 1. Evaluate the project using the payback method. Evaluate the project using the NPV method if the cost of capital is 12% 2. 3. Evaluate the project using the IRR methodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started