Answered step by step

Verified Expert Solution

Question

1 Approved Answer

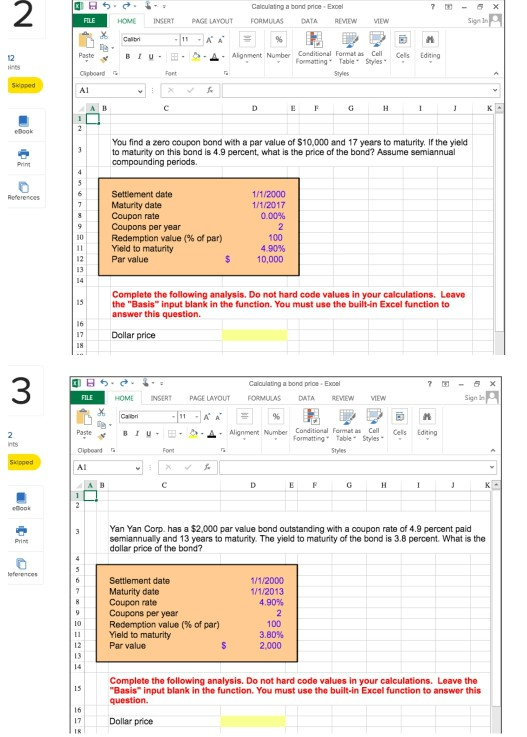

Kindly give all answers as a formula please. E l Calculating a bond FORMULAS DATA HOME INSERT PAGE LAYOUT VW VW BIL BIU.E. - Alignment

Kindly give all answers as a formula please.

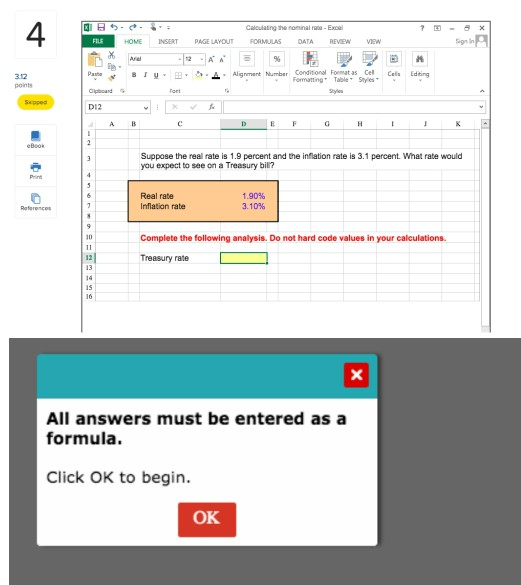

E l Calculating a bond FORMULAS DATA HOME INSERT PAGE LAYOUT VW VW BIL BIU.E. - Alignment Number Fo n g Table Styles You find a zero coupon bond with a par value of $10,000 and 17 years to maturity. If the yield to maturity on this bond is 4.9 percent, what is the price of the bond? Assume semiannual compounding periods. 11/2000 1/1/2017 0.00% Settlement date Maturity date Coupon rate Coupons per year Redemption value % of par) Yield to maturity Par value 100 4 90% 10,000 Complete the following analysis. Do not hard code values in your calculations. Leave the "Basis" input blank in the function. You must use the built-in Excel function to answer this question. Dollar price H FILE . HOME Calculating a bond price Excel FORMULAS DATA REVIEW INSERT PAGE LAYOUT VIEW Sign in Paste TU. A. cele din Alignment Number Conditional Formatas Call Formatting Table Styles Styles Yan Yan Corp. has a $2.000 par value bond outstanding with a coupon rate of 4.9 percent paid semiannually and 13 years to maturity. The yield to maturity of the bond is 3.8 percent. What is the dollar price of the bond? 1/1/2000 11/2013 4.90% Settlement date Maturity date Coupon rate Coupons per year Redemption value (% of par) Yield to maturity Par value 100 3.80% 2,000 Complete the following analysis. Do not hard code values in your calculations. Leave the Basis input blank in the function. You must use the built-in Excel function to answer this question Dollar price - - - HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEN VIEW - Al b er Conditional Formatas Cal Cale D E F G H I Suppose the real rate is 1.9 percent and the inflation rate is 3.1 percent What rate would you expect to see on a Treasury bill? Real rate Inflation rate 1.90% 3.10% Complete the following analysis. Do not hard code values in your calculations. Treasury rate All answers must be entered as a formula. Click OK to begin. OK

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started