Kindly help me answer question 1-7 in case 33 shuckers miller and modigliani -cases in financial management.

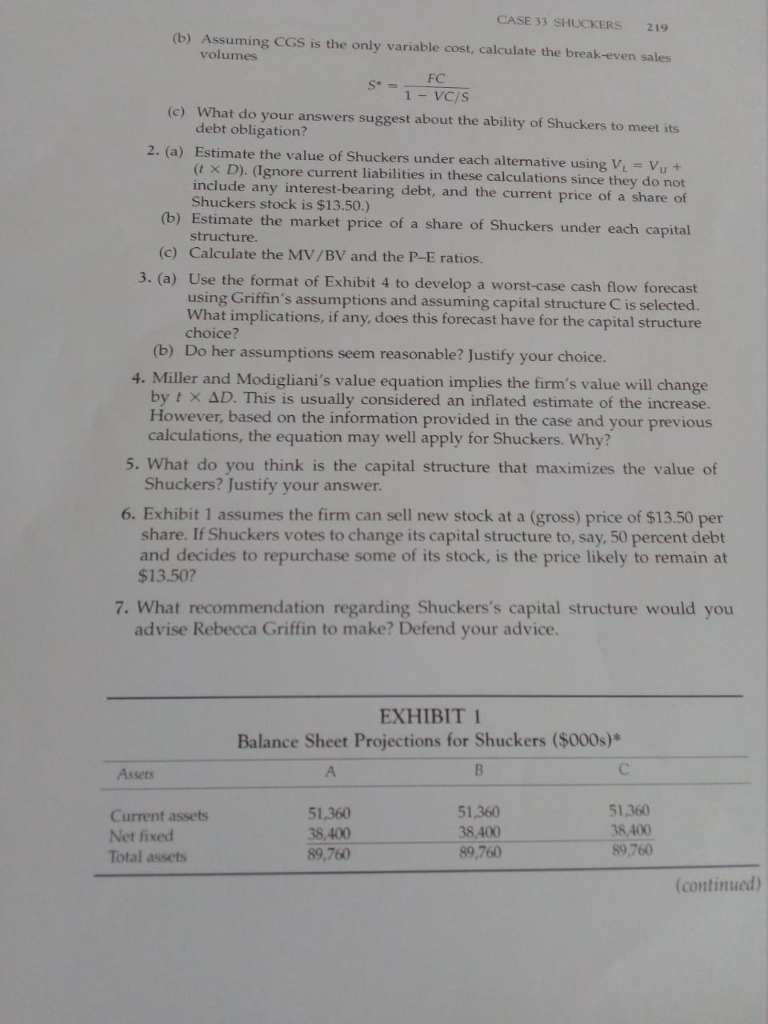

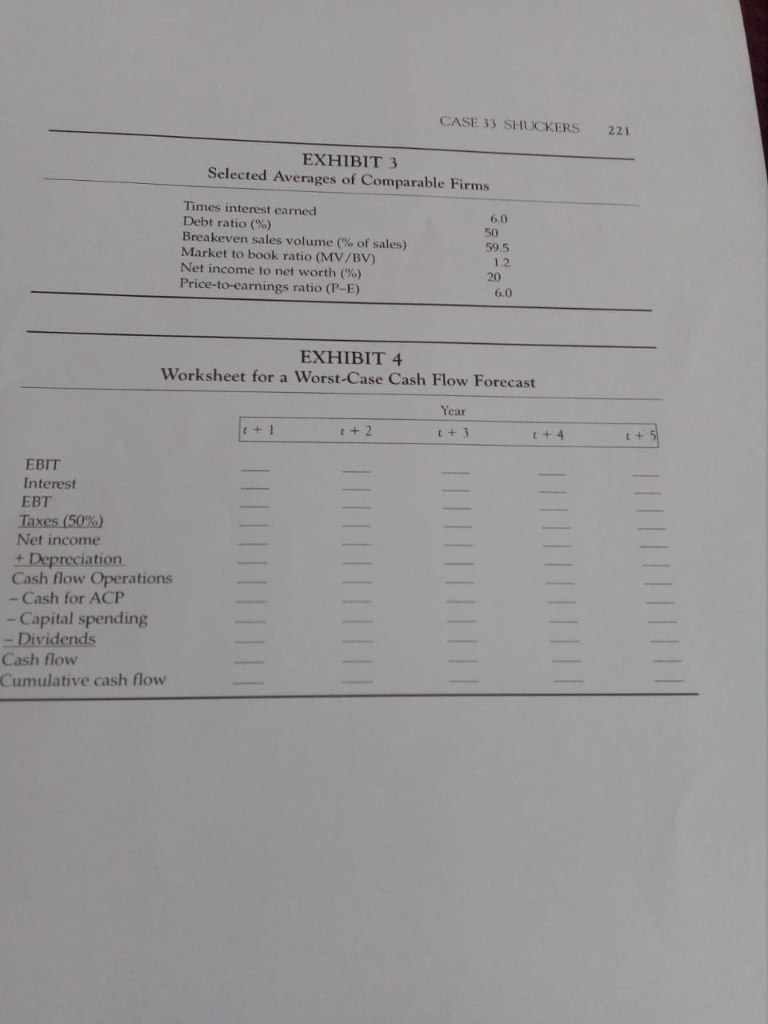

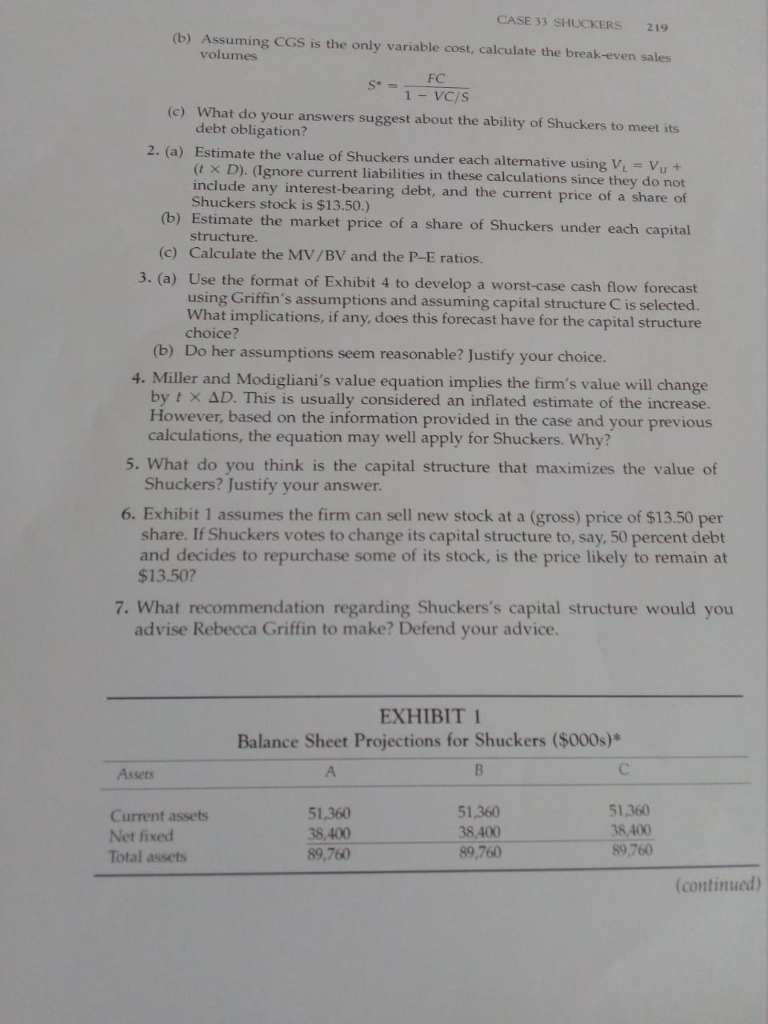

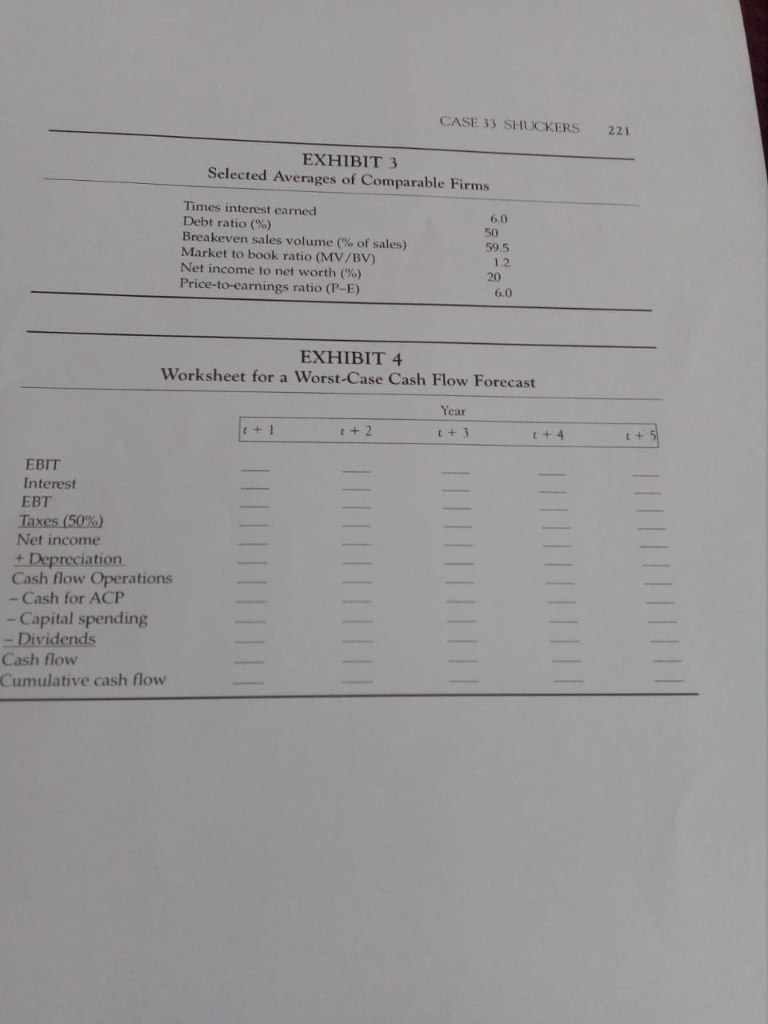

TTHTCASE 3 3 SHUCKER S MILLER AND MODIGLIANI The results of the market test had surprised Rebecca Griffin, the general man- ager of the A.W. Shuckers Company. But the results of the meeting with the Taylor family, owners of over half of the firm's stock, surprised her even more. EXTERNAL FINANCING Shuckers is a maker of preserves, jams, and peanut butter, and also produces fruit juices, ice cream toppings, and low-sugar jellies. The firm is particularly well known in the Northeast though it has had some modest success in the potentially lucrative Midwest market. And about twelve months ago, manage- ment began to seriously consider entering the Midwest market "in a big way Market research showed that Shuckers is definitely a recognizable name in that area, a result that surprised a number of Shuckers's executives, including Griffin. Encouraged by these results, management has decided to expand into selected areas of the Midwest, a decision that will require external financing. THE MEETING Griffin felt that the time was appropriate to meet with the Taylor family in part to discuss the expansion and in part to address the family's debt aversion. The company was founded 50 years ago by Roy Taylor, who had never borrowed a dime and had always insisted that Shuckers would "never a lender nor bor- rower be." For years Griffin has tried unsuccessfully to convince the family to use some debt financing, and at this meeting she decides to try once more. At the meeting she explained that the company's expansion necessitated rais- ing $22,000,000 of external funds. One option for raising this money, according to the firm's investment banker, is to sell new common stock at the current price of $13.50. Griffin emphasized, though, that if new shares were issued there was a real danger the Taylor family would own less than 50 percent of the company Her sug gestion was to raise any new funds by borrowing, which she felt very confident Shuckers could do at the choice rate of 8 percent. She underscored the fact that lenders would be "easy to find" given the company's strong financial position and the lack of any long-term debt in its capital structure. "Keep in mind," she told the group, "that this 8 percent rate is nearly one percent below the current home mort gage rate, and you know how safe a home mortgage loan is. The point is that if we can borrow at such a low rate, Shuckers must be a very safe company indeed!" During her presentation none of the family seemed to show any interest. At the end of the talk she asked for any questions or comments. For half a minute, whidh seemed to her like half a day, no one said a word. Suddenly, Roy Taylor, Jr., stood up and declared, "I think the use of debt is the way to go. As a matter of fact I think we should endorse ev en more borrowing in the future." Griffin was amazed not only because this was the first time a Taylor family member had pro- posed the use of debt, but also because of the force with which it was proposed At this point a lengthy discussion followed on the use of debt financing, and th Taylor family divided into three camps: one group favored no debt, a second force- fully argued for its use, while the third worried about the impact on dividends. Some felt Shuckers should maintain the family tradition, though they p ived that the growth of Shuckers necessitated external financing. This group led by Barbara Taylor, said new shares would not reduce the Taylors' control if family members bought them (although none of them had the money) or if non ce voting shares were issued. Another faction, led by Roy Jr, stated that he did not a depression mentality and during a period of little inflation when expansion want to "defile Dad's memory" but felt the company's policy was set in could be financed internally. Roy also questioned the validity of the control issue. He pointed out that the family's ownership and interest in the company had been declining for many years; he also stated that most of the stock not con- trolled by the family was owned by corporate pension funds. And, it was likely that effective control of the company would remain with the family in any event since it was improbable that the managers of these funds would become corporate busybodies." Further discussion indicated that only Barbara Taylor had any real interest in the company's operation and few cared about the degree of control the Taylor family would have. This surprised Griffin, who had thought the issue of family ownership would be an extremely important one. IMPACT ON FIRM'S VALUE The question of valuation was also addressed. Roy Taylor III, an economics grad- uate student, pointed out that a "levered firm is worth more than an unlevered CASE 33 SHUCKERS 21 firm." Pressed on what he meant, he said, "If we borrow, the price of Shuckers stock should rise." Shuckers has been publicly traded for the last three years, and his statement stirred the interest of those who admitted they were considering selling their shares. Griffin, for her part, said executive talent would be easier to obtain since stock options were likely to become more valuable through the "judi- cious use of debt." Barbara said she had trouble understanding why using debt would increase the stock's price. "People borrow money to buy stocks all the time, right? If investors are unhappy in some mysterious sense equity policy, why can't they simply create their own debt policies? I mean, I really don't see what with our all difference it makes whether Shuckers borrows or an vestor borrows and uses this money to buy our stock. I must admit, however that no one here would be able to borrow money at 8 percent on their own. A third faction was puzzled by all the debt controversy. These individuals didn't like breaking with tradition but did like the idea that the value of their stock might rise. Most of this group were retired, in low tax brackets, and depended on Shuckers' dividends for income. They were very concerned that any borrowing would jeopardize the current dividend of $1 per share in the event sales decreased. Some even questioned the ability of Shuckers to repay the debt, let alone pay dividends. One elderly gentleman did emphasize, how- ever, that Roy Sr. never literally followed the maxim he was so fond of: "Never a lender..." He pointed out that Shuckers always extended credit to its cus- tomers and received credit from its suppliers, and that "old Roy never minded taking out a short-term note if he had to." The discussion was getting extremely unwieldy. It was agreed, however, that Griffin should prepare a report on the whole issue for another meeting next month. She was instructed to include "everything relevant" but to make sure the following questions were addressed. Would debt increase the value of the firm? If so, by how much? Is there some optimal amount of debt the firm should shoot for? How risky would the use of debt make the firm? REFLECTIONS Back at her office Griffin brewed some coffee and pondered the issues raised She feels confident, though not certain, that all the new money should be bor- rowed. But is it wise to use even more debt and retire stock? She never expected that possibility would even be brought up let alone seriously discussed All debt would be raised as debentures that would mature in 12 to 15 years There would be no sinking fund, which means that Shuckers would not have to pay any of the principal until the bonds mature. The interest rate on the debt wou ld be 8 percent. Fortunately, the firm's business risk is low, and in the last 30 ears sales and EBIT have never declined, even in the recessions of 1974, 1981 to 2, and 1990. Griffin is very much aware that the firm can't take on so much debt that its commercial strategy is neglected. A key point, therefore, is the pos- sible financial needs of Shuckers in coming years, especially in bad times FORECASTING CONSIDERATIONS Though no new expansion projects are planned, Griffin would like to budget $750,000 each year for capital spending, including replacement projects. And receivables can be a problem for Shuckers. At times the average collection period has increased 10 days more than expected. The composition of this increase is relevant to the firm's financial situation. Roughly seven days of the rise in the ACP is relatively transitory and lasts anywhere from one to three months. The remaining portion is relatively permanent and lasts between 12 and 24 months. The transitional component can be easily financed from the firm's cash account and by a modest increase in accounts payable. The three-day "permanent" com- ponent has typically been financed from operating profit. Griffin recognizes that this may not be possible should Shucker decide to borrow There is talk that the industry's production techniques may change some- what in the future. The impact is hard to gauge, though it is probably at least three to five years away, assuming it even occurs. Griffin had no good idea how much money this would require, though she "guesstimated" a total of $3 million with $8 million the upper limit She then decided that a worst-case, five-year cash flow forecast should based on the following: be 1. Sales each year will be $192,000(000) and EBIT $19808(000), amounts found in Exhibit 2 2. The firm's present working capital situation is adequate; that is, receivables, inventory, accounts payable, and accruals are normal 3. If Shuckers borrows, then its cash position by the end of year 1 should be sufficient to finance a five-day "permanent" increase in the ACP. (This represents an amount over and above any cash the company has presently.) 4. Dividends are $1 per share. 5. Yearly depreciation will be $900(000). 6. Shuckers will need the ability to raise $4 million in years 3 and 5 (a total of s8 million) for new capital equipment if industry production techniques change. Equipment replacement will require $1,100(000) a year. QUESTIONS different assumptions about the firm's borrowing. (a) Calculate the times interest earned and debt ratios under each capital 1. Exhibits 1 and 2 present the firm's balance sheet and income statement under structure CASE 33 SHUCKERS 219 (b) Assuming CGS is the only variable cost, calculate the break-even sales volumes FC 1-Vc/s What do your answers suggest about the ability of Shuckers to meet its debt obligation? (c) 2. (a) Estimate the value of Shuckers under each alternative using V Vu+ (I D). (Ignore current liabilities in these calculations since they do not include any interest-bearing debt, and the current price of a share of Shuckers stock is $13.50.) (b) Estimate the market price of a share of Shuckers under each capital structure. (c) Calculate the MV/BV and the P-E ratios. 3. (a) Use the format of Exhibit 4 to develop a worst-case cash flow forecast using Griffin's assumptions and assuming capital structure C is selected. What implications, if any, does this forecast have for the capital structure choice? (b) Do her assumptions seem reasonable? Justify your choice. 4. Miller and Modigliani's value equation implies the firm's value will change by t DThis is usually considered an inflated estimate of the increase. However, based on the information provided in the case and your previous calculations, the equation may well apply for Shuckers. Why? 5. What do you think is the capital structure that maximizes the value of Shuckers? Justify your answer 6. Exhibit 1 assumes the firm can sell new stock at a (gross) price of $13.50 per share. If Shuckers votes to change its capital structure to, say, 50 percent debt and decides to repurchase some of its stock, is the price likely to remain at $13.50? 7. What recommendation regarding Shuckers's capital structure would you advise Rebecca Griffin to make? Defend your advice. EXHIBIT Balance Sheet Projections for Shuckers ($000s)* Assets Current assets Net fixed Total assets 51,360 38,400 89,760 51,360 38,400 89,760 51360 38,400 89,760 (continued) CASE 33 SHUCKERS221 EXHIBIT 3 Selected Averages of Comparable Firms Times interest earned Debt ratio (%) Breakeven sales volume (% of sales) Market to book ratio (MV/BV) Net income to net worth (%) Price-to-carnings ratio (P-E) 6.0 50 59.5 1.2 20 6.0 EXHIBIT 4 Worksheet for a Worst-Case Cash Flow Forecast Year t + 1 t+ 2 + 3 +4 t + EBIT Interest EBT Net income + Depreciation Cash flow Operations - Cash for ACP -Capital spending Cash flow Cumulative cash flow TTHTCASE 3 3 SHUCKER S MILLER AND MODIGLIANI The results of the market test had surprised Rebecca Griffin, the general man- ager of the A.W. Shuckers Company. But the results of the meeting with the Taylor family, owners of over half of the firm's stock, surprised her even more. EXTERNAL FINANCING Shuckers is a maker of preserves, jams, and peanut butter, and also produces fruit juices, ice cream toppings, and low-sugar jellies. The firm is particularly well known in the Northeast though it has had some modest success in the potentially lucrative Midwest market. And about twelve months ago, manage- ment began to seriously consider entering the Midwest market "in a big way Market research showed that Shuckers is definitely a recognizable name in that area, a result that surprised a number of Shuckers's executives, including Griffin. Encouraged by these results, management has decided to expand into selected areas of the Midwest, a decision that will require external financing. THE MEETING Griffin felt that the time was appropriate to meet with the Taylor family in part to discuss the expansion and in part to address the family's debt aversion. The company was founded 50 years ago by Roy Taylor, who had never borrowed a dime and had always insisted that Shuckers would "never a lender nor bor- rower be." For years Griffin has tried unsuccessfully to convince the family to use some debt financing, and at this meeting she decides to try once more. At the meeting she explained that the company's expansion necessitated rais- ing $22,000,000 of external funds. One option for raising this money, according to the firm's investment banker, is to sell new common stock at the current price of $13.50. Griffin emphasized, though, that if new shares were issued there was a real danger the Taylor family would own less than 50 percent of the company Her sug gestion was to raise any new funds by borrowing, which she felt very confident Shuckers could do at the choice rate of 8 percent. She underscored the fact that lenders would be "easy to find" given the company's strong financial position and the lack of any long-term debt in its capital structure. "Keep in mind," she told the group, "that this 8 percent rate is nearly one percent below the current home mort gage rate, and you know how safe a home mortgage loan is. The point is that if we can borrow at such a low rate, Shuckers must be a very safe company indeed!" During her presentation none of the family seemed to show any interest. At the end of the talk she asked for any questions or comments. For half a minute, whidh seemed to her like half a day, no one said a word. Suddenly, Roy Taylor, Jr., stood up and declared, "I think the use of debt is the way to go. As a matter of fact I think we should endorse ev en more borrowing in the future." Griffin was amazed not only because this was the first time a Taylor family member had pro- posed the use of debt, but also because of the force with which it was proposed At this point a lengthy discussion followed on the use of debt financing, and th Taylor family divided into three camps: one group favored no debt, a second force- fully argued for its use, while the third worried about the impact on dividends. Some felt Shuckers should maintain the family tradition, though they p ived that the growth of Shuckers necessitated external financing. This group led by Barbara Taylor, said new shares would not reduce the Taylors' control if family members bought them (although none of them had the money) or if non ce voting shares were issued. Another faction, led by Roy Jr, stated that he did not a depression mentality and during a period of little inflation when expansion want to "defile Dad's memory" but felt the company's policy was set in could be financed internally. Roy also questioned the validity of the control issue. He pointed out that the family's ownership and interest in the company had been declining for many years; he also stated that most of the stock not con- trolled by the family was owned by corporate pension funds. And, it was likely that effective control of the company would remain with the family in any event since it was improbable that the managers of these funds would become corporate busybodies." Further discussion indicated that only Barbara Taylor had any real interest in the company's operation and few cared about the degree of control the Taylor family would have. This surprised Griffin, who had thought the issue of family ownership would be an extremely important one. IMPACT ON FIRM'S VALUE The question of valuation was also addressed. Roy Taylor III, an economics grad- uate student, pointed out that a "levered firm is worth more than an unlevered CASE 33 SHUCKERS 21 firm." Pressed on what he meant, he said, "If we borrow, the price of Shuckers stock should rise." Shuckers has been publicly traded for the last three years, and his statement stirred the interest of those who admitted they were considering selling their shares. Griffin, for her part, said executive talent would be easier to obtain since stock options were likely to become more valuable through the "judi- cious use of debt." Barbara said she had trouble understanding why using debt would increase the stock's price. "People borrow money to buy stocks all the time, right? If investors are unhappy in some mysterious sense equity policy, why can't they simply create their own debt policies? I mean, I really don't see what with our all difference it makes whether Shuckers borrows or an vestor borrows and uses this money to buy our stock. I must admit, however that no one here would be able to borrow money at 8 percent on their own. A third faction was puzzled by all the debt controversy. These individuals didn't like breaking with tradition but did like the idea that the value of their stock might rise. Most of this group were retired, in low tax brackets, and depended on Shuckers' dividends for income. They were very concerned that any borrowing would jeopardize the current dividend of $1 per share in the event sales decreased. Some even questioned the ability of Shuckers to repay the debt, let alone pay dividends. One elderly gentleman did emphasize, how- ever, that Roy Sr. never literally followed the maxim he was so fond of: "Never a lender..." He pointed out that Shuckers always extended credit to its cus- tomers and received credit from its suppliers, and that "old Roy never minded taking out a short-term note if he had to." The discussion was getting extremely unwieldy. It was agreed, however, that Griffin should prepare a report on the whole issue for another meeting next month. She was instructed to include "everything relevant" but to make sure the following questions were addressed. Would debt increase the value of the firm? If so, by how much? Is there some optimal amount of debt the firm should shoot for? How risky would the use of debt make the firm? REFLECTIONS Back at her office Griffin brewed some coffee and pondered the issues raised She feels confident, though not certain, that all the new money should be bor- rowed. But is it wise to use even more debt and retire stock? She never expected that possibility would even be brought up let alone seriously discussed All debt would be raised as debentures that would mature in 12 to 15 years There would be no sinking fund, which means that Shuckers would not have to pay any of the principal until the bonds mature. The interest rate on the debt wou ld be 8 percent. Fortunately, the firm's business risk is low, and in the last 30 ears sales and EBIT have never declined, even in the recessions of 1974, 1981 to 2, and 1990. Griffin is very much aware that the firm can't take on so much debt that its commercial strategy is neglected. A key point, therefore, is the pos- sible financial needs of Shuckers in coming years, especially in bad times FORECASTING CONSIDERATIONS Though no new expansion projects are planned, Griffin would like to budget $750,000 each year for capital spending, including replacement projects. And receivables can be a problem for Shuckers. At times the average collection period has increased 10 days more than expected. The composition of this increase is relevant to the firm's financial situation. Roughly seven days of the rise in the ACP is relatively transitory and lasts anywhere from one to three months. The remaining portion is relatively permanent and lasts between 12 and 24 months. The transitional component can be easily financed from the firm's cash account and by a modest increase in accounts payable. The three-day "permanent" com- ponent has typically been financed from operating profit. Griffin recognizes that this may not be possible should Shucker decide to borrow There is talk that the industry's production techniques may change some- what in the future. The impact is hard to gauge, though it is probably at least three to five years away, assuming it even occurs. Griffin had no good idea how much money this would require, though she "guesstimated" a total of $3 million with $8 million the upper limit She then decided that a worst-case, five-year cash flow forecast should based on the following: be 1. Sales each year will be $192,000(000) and EBIT $19808(000), amounts found in Exhibit 2 2. The firm's present working capital situation is adequate; that is, receivables, inventory, accounts payable, and accruals are normal 3. If Shuckers borrows, then its cash position by the end of year 1 should be sufficient to finance a five-day "permanent" increase in the ACP. (This represents an amount over and above any cash the company has presently.) 4. Dividends are $1 per share. 5. Yearly depreciation will be $900(000). 6. Shuckers will need the ability to raise $4 million in years 3 and 5 (a total of s8 million) for new capital equipment if industry production techniques change. Equipment replacement will require $1,100(000) a year. QUESTIONS different assumptions about the firm's borrowing. (a) Calculate the times interest earned and debt ratios under each capital 1. Exhibits 1 and 2 present the firm's balance sheet and income statement under structure CASE 33 SHUCKERS 219 (b) Assuming CGS is the only variable cost, calculate the break-even sales volumes FC 1-Vc/s What do your answers suggest about the ability of Shuckers to meet its debt obligation? (c) 2. (a) Estimate the value of Shuckers under each alternative using V Vu+ (I D). (Ignore current liabilities in these calculations since they do not include any interest-bearing debt, and the current price of a share of Shuckers stock is $13.50.) (b) Estimate the market price of a share of Shuckers under each capital structure. (c) Calculate the MV/BV and the P-E ratios. 3. (a) Use the format of Exhibit 4 to develop a worst-case cash flow forecast using Griffin's assumptions and assuming capital structure C is selected. What implications, if any, does this forecast have for the capital structure choice? (b) Do her assumptions seem reasonable? Justify your choice. 4. Miller and Modigliani's value equation implies the firm's value will change by t DThis is usually considered an inflated estimate of the increase. However, based on the information provided in the case and your previous calculations, the equation may well apply for Shuckers. Why? 5. What do you think is the capital structure that maximizes the value of Shuckers? Justify your answer 6. Exhibit 1 assumes the firm can sell new stock at a (gross) price of $13.50 per share. If Shuckers votes to change its capital structure to, say, 50 percent debt and decides to repurchase some of its stock, is the price likely to remain at $13.50? 7. What recommendation regarding Shuckers's capital structure would you advise Rebecca Griffin to make? Defend your advice. EXHIBIT Balance Sheet Projections for Shuckers ($000s)* Assets Current assets Net fixed Total assets 51,360 38,400 89,760 51,360 38,400 89,760 51360 38,400 89,760 (continued) CASE 33 SHUCKERS221 EXHIBIT 3 Selected Averages of Comparable Firms Times interest earned Debt ratio (%) Breakeven sales volume (% of sales) Market to book ratio (MV/BV) Net income to net worth (%) Price-to-carnings ratio (P-E) 6.0 50 59.5 1.2 20 6.0 EXHIBIT 4 Worksheet for a Worst-Case Cash Flow Forecast Year t + 1 t+ 2 + 3 +4 t + EBIT Interest EBT Net income + Depreciation Cash flow Operations - Cash for ACP -Capital spending Cash flow Cumulative cash flow