Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly help me answer the above term sheet question. Thanks :) TERMS FOR PRIVATE PLACEMENT OF SERIES SEED PREFERRED STOCK OF PLATINUM, INC. 31st Dec

Kindly help me answer the above term sheet question. Thanks :)

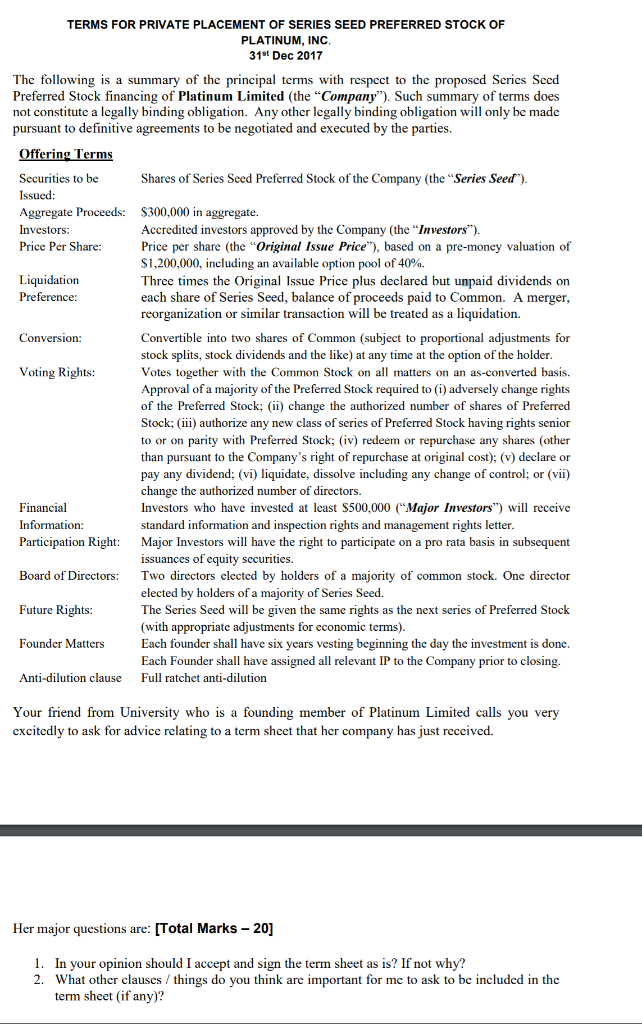

TERMS FOR PRIVATE PLACEMENT OF SERIES SEED PREFERRED STOCK OF PLATINUM, INC. 31st Dec 2017 The following is a summary of the principal terms with respect to the proposed Series Seed Preferred Stock financing of Platinum Limited (the "Company"). Such summary of terms does not constitute a legally binding obligation. Any other legally binding obligation will only be made pursuant to definitive agreements to be negotiated and executed by the parties. Offering Terms Securities to be Shares of Series Seed Preferred Stock of the Company (the "Series Seed"). Issued: Aggregate Proceeds: $300,000 in aggregate. Investors: Accredited investors approved by the Company (the "Investors). Price Per Share: Price per share (the "Original Issue Price"), based on a pre-money valuation of $1,200,000, including an available option pool of 40%. Liquidation Three times the Original Issue Price plus declared but unpaid dividends on Preference: each share of Series Seed, balance of proceeds paid to Common. A merger, reorganization or similar transaction will be treated as a liquidation. Conversion: Convertible into two shares of Common (subject to proportional adjustments for stock splits, stock dividends and the like) at any time at the option of the holder. Voting Rights: Votes together with the Common Stock on all matters on an as-converted basis. Approval of a majority of the Preferred Stock required to (i) adversely change rights of the Preferred Stock; (ii) change the authorized number of shares of Preferred Stock; (iii) authorize any new class of series of Preferred Stock having rights senior to or on parity with Preferred Stock; (iv) redeem or repurchase any shares (other than pursuant to the Company's right of repurchase at original cost); (v) declare or pay any dividend; (vi) liquidate, dissolve including any change of control; or (vii) change the authorized number of directors. Financial Investors who have invested at least $500,000 ("Major Investors) will receive Information: standard information and inspection rights and management rights letter. Participation Right: Major Investors will have the right to participate on a pro rata basis in subsequent issuances of equity securities. Board of Directors: Two directors elected by holders of a majority of common stock. One director elected by holders of a majority of Series Seed. Future Rights: The Series Seed will be given the same rights as the next series of Preferred Stock (with appropriate adjustments for economic terms). Founder Matters Each founder shall have six years vesting beginning the day the investment is done. Each Founder shall have assigned all relevant IP to the Company prior to closing. Anti-dilution clause Full ratchet anti-dilution Your friend from University who is a founding member of Platinum Limited calls you very excitedly to ask for advice relating to a term sheet that her company has just received. Her major questions are: [Total Marks - 20] 1. In your opinion should I accept and sign the term sheet as is? If not why? 2. What other clauses / things do you think are important for me to ask to be included in the term sheet (if any)? TERMS FOR PRIVATE PLACEMENT OF SERIES SEED PREFERRED STOCK OF PLATINUM, INC. 31st Dec 2017 The following is a summary of the principal terms with respect to the proposed Series Seed Preferred Stock financing of Platinum Limited (the "Company"). Such summary of terms does not constitute a legally binding obligation. Any other legally binding obligation will only be made pursuant to definitive agreements to be negotiated and executed by the parties. Offering Terms Securities to be Shares of Series Seed Preferred Stock of the Company (the "Series Seed"). Issued: Aggregate Proceeds: $300,000 in aggregate. Investors: Accredited investors approved by the Company (the "Investors). Price Per Share: Price per share (the "Original Issue Price"), based on a pre-money valuation of $1,200,000, including an available option pool of 40%. Liquidation Three times the Original Issue Price plus declared but unpaid dividends on Preference: each share of Series Seed, balance of proceeds paid to Common. A merger, reorganization or similar transaction will be treated as a liquidation. Conversion: Convertible into two shares of Common (subject to proportional adjustments for stock splits, stock dividends and the like) at any time at the option of the holder. Voting Rights: Votes together with the Common Stock on all matters on an as-converted basis. Approval of a majority of the Preferred Stock required to (i) adversely change rights of the Preferred Stock; (ii) change the authorized number of shares of Preferred Stock; (iii) authorize any new class of series of Preferred Stock having rights senior to or on parity with Preferred Stock; (iv) redeem or repurchase any shares (other than pursuant to the Company's right of repurchase at original cost); (v) declare or pay any dividend; (vi) liquidate, dissolve including any change of control; or (vii) change the authorized number of directors. Financial Investors who have invested at least $500,000 ("Major Investors) will receive Information: standard information and inspection rights and management rights letter. Participation Right: Major Investors will have the right to participate on a pro rata basis in subsequent issuances of equity securities. Board of Directors: Two directors elected by holders of a majority of common stock. One director elected by holders of a majority of Series Seed. Future Rights: The Series Seed will be given the same rights as the next series of Preferred Stock (with appropriate adjustments for economic terms). Founder Matters Each founder shall have six years vesting beginning the day the investment is done. Each Founder shall have assigned all relevant IP to the Company prior to closing. Anti-dilution clause Full ratchet anti-dilution Your friend from University who is a founding member of Platinum Limited calls you very excitedly to ask for advice relating to a term sheet that her company has just received. Her major questions are: [Total Marks - 20] 1. In your opinion should I accept and sign the term sheet as is? If not why? 2. What other clauses / things do you think are important for me to ask to be included in the term sheet (if any)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started