Answered step by step

Verified Expert Solution

Question

1 Approved Answer

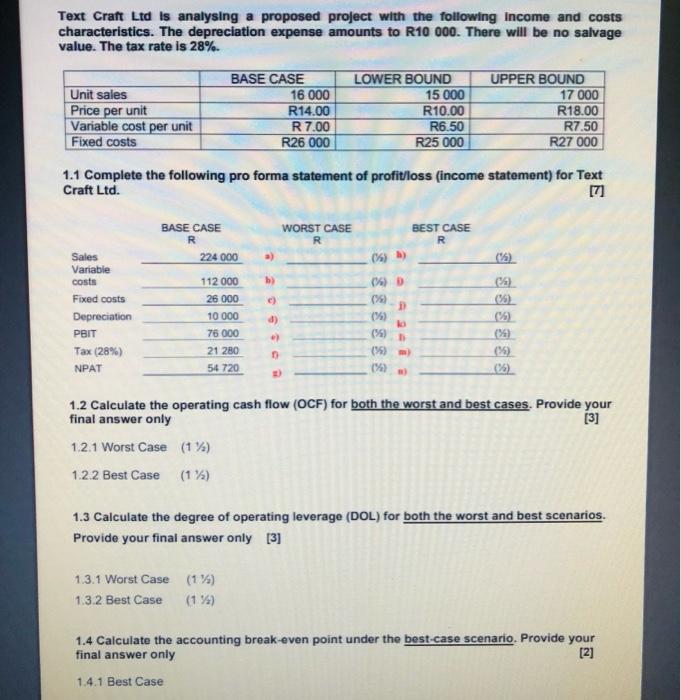

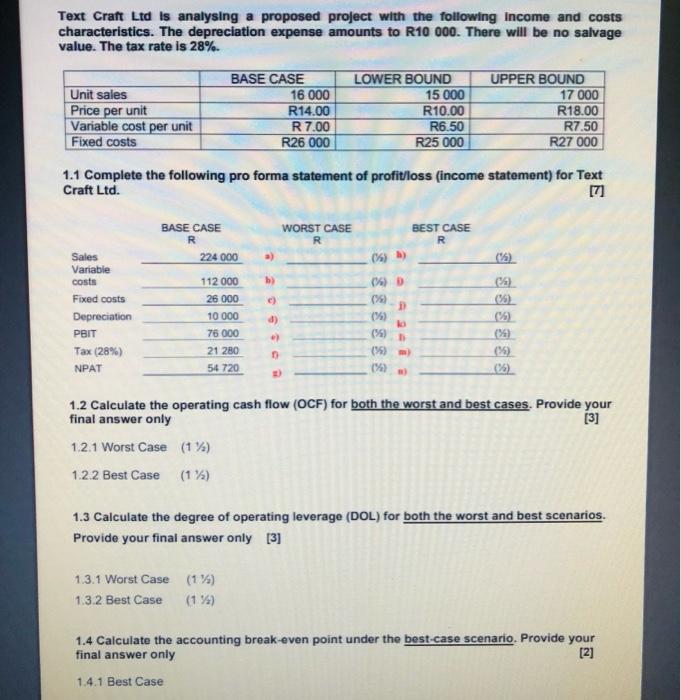

kindly help out Text Craft Ltd is analysing a proposed project with the following Income and costs characteristics. The depreciation expense amounts to R10 000.

kindly help out

Text Craft Ltd is analysing a proposed project with the following Income and costs characteristics. The depreciation expense amounts to R10 000. There will be no salvage value. The tax rate is 28%. BASE CASE LOWER BOUND UPPER BOUND 16 000 15 000 Unit sales Price per unit 17 000 R18.00 R14.00 R10.00 R6.50 Variable cost per unit R 7.00 R7.50 Fixed costs R26 000 R25 000 R27 000 1.1 Complete the following pro forma statement of profit/loss (income statement) for Text Craft Ltd. [7] BEST CASE BASE CASE R WORST CASE R R Sales 224 000 (1/6) b) (1) Variable costs 112 000 (6) D Fixed costs 26 000 (2) (6) D Depreciation 10 000 (3) (26) 76 000 (56) D (%) PBIT Tax (28%) NPAT 21 280 (15) -) (26) 54 720 (14) (1) g) H) 1.2 Calculate the operating cash flow (OCF) for both the worst and best cases. Provide your final answer only [3] 1.2.1 Worst Case (1%) 1.2.2 Best Case (1%) 1.3 Calculate the degree of operating leverage (DOL) for both the worst and best scenarios. Provide your final answer only [3] 1.3.1 Worst Case (1%) 1.3.2 Best Case (1%) 1.4 Calculate the accounting break-even point under the best-case scenario. Provide your final answer only [2] 1.4.1 Best Case b) () d) .) D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started