Answered step by step

Verified Expert Solution

Question

1 Approved Answer

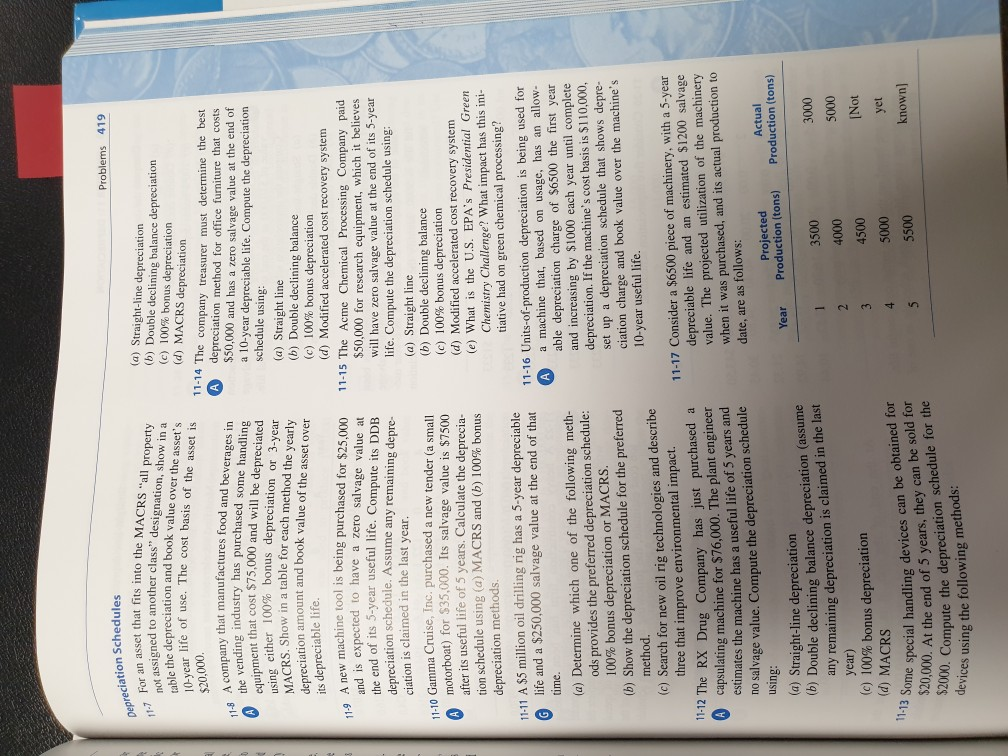

kindly help with questions #13 abcd without using excel. Problems 419 oreciation Schedules 11-7 For an asset than not assigned to a table the depreciation

kindly help with questions #13 abcd without using excel.

Problems 419 oreciation Schedules 11-7 For an asset than not assigned to a table the depreciation and 10-year life of use. The $20,000. sset that fits into the MACRS "all property signed to another class designation, show in a the depreciation and book value over the asset's ar life of use. The cost basis of the asset is 11-8 A company that m A the vending equipment that cost $75,000 using either 100% bom any that manufactures food and beverages in vending industry has purchased some handling ment that cost $75,000 and will be depreciated o either 100% bonus depreciation or 3-year MACRS. Show in a table for each method the yearly reciation amount and book value of the asset over its depreciable life. 11-9 A new machine tool is (a) Straight-line depreciation (b) Double declining balance depreciation (c) 100% bonus depreciation (d) MACRS depreciation 11-14 The company treasurer must determine the best depreciation method for office furniture that costs $50,000 and has a zero salvage value at the end of a 10-year depreciable life. Compute the depreciation schedule using: (a) Straight line (b) Double declining balance (c) 100% bonus depreciation (d) Modified accelerated cost recovery system 11-15 The Acme Chemical Processing Company paid $50,000 for research equipment, which it believes will have zero salvage value at the end of its 5-year life. Compute the depreciation schedule using: (a) Straight line (b) Double declining balance (c) 100% bonus depreciation (d) Modified accelerated cost recovery system (e) What is the U.S. EPA's Presidential Green Chemistry Challenge? What impact has this ini- tiative had on green chemical processing? 11-16 Units-of-production depreciation is being used for A a machine that, based on usage, has an allow- able depreciation charge of $6500 the first year and increasing by $1000 each year until complete depreciation. If the machine's cost basis is $110,000, set up a depreciation schedule that shows depre- ciation charge and book value over the machine's 10-year useful life. w machine tool is being purchased for $25,000 ind is expected to have a zero salvage value at the end of its 5-year useful life. Compute its DDB depreciation schedule. Assume any remaining depre- ciation is claimed in the last year. 11-10 Gamma Cruise, Inc. purchased a new tender (a small motorboat) for $35.000. Its salvage value is $7500 after its useful life of 5 years. Calculate the deprecia- tion schedule using (a) MACRS and (b) 100% bonus depreciation methods. 11-11 A $5 million oil drilling rig has a 5-year depreciable life and a $250,000 salvage value at the end of that time. (a) Determine which one of the following meth- ods provides the preferred depreciation schedule: 100% bonus depreciation or MACRS. (b) Show the depreciation schedule for the preferred method. (c) Search for new oil rig technologies and describe three that improve environmental impact. 11-12 The RX Drug Company has just purchased a A capsulating machine for $76,000. The plant engineer estimates the machine has a useful life of 5 years and no salvage value. Compute the depreciation schedule using: (a) Straight-line depreciation (b) Double declining balance depreciation (assume any remaining depreciation is claimed in the last year) (c) 100% bonus depreciation (d) MACRS come special handling devices can be obtained for $20,000. At the end of 5 years, they can be W. Compute the depreciation schedule for the devices using the following methods: 11-17 Consider a $6500 piece of machinery, with a 5-year depreciable life and an estimated $1200 salvage value. The projected utilization of the machinery when it was purchased, and its actual production to date, are as follows: Actual Projected Production (tons) Production (tons) Year 3500 4000 4500 3000 5000 Not 5000 yet known] 11-13 Some spec 5500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started