Answered step by step

Verified Expert Solution

Question

1 Approved Answer

kindly post the solution too Premier Maple Syrup, located in Quebec, process maple sap into maple syrup, maple sugar, and maple butter. The company has

kindly post the solution too

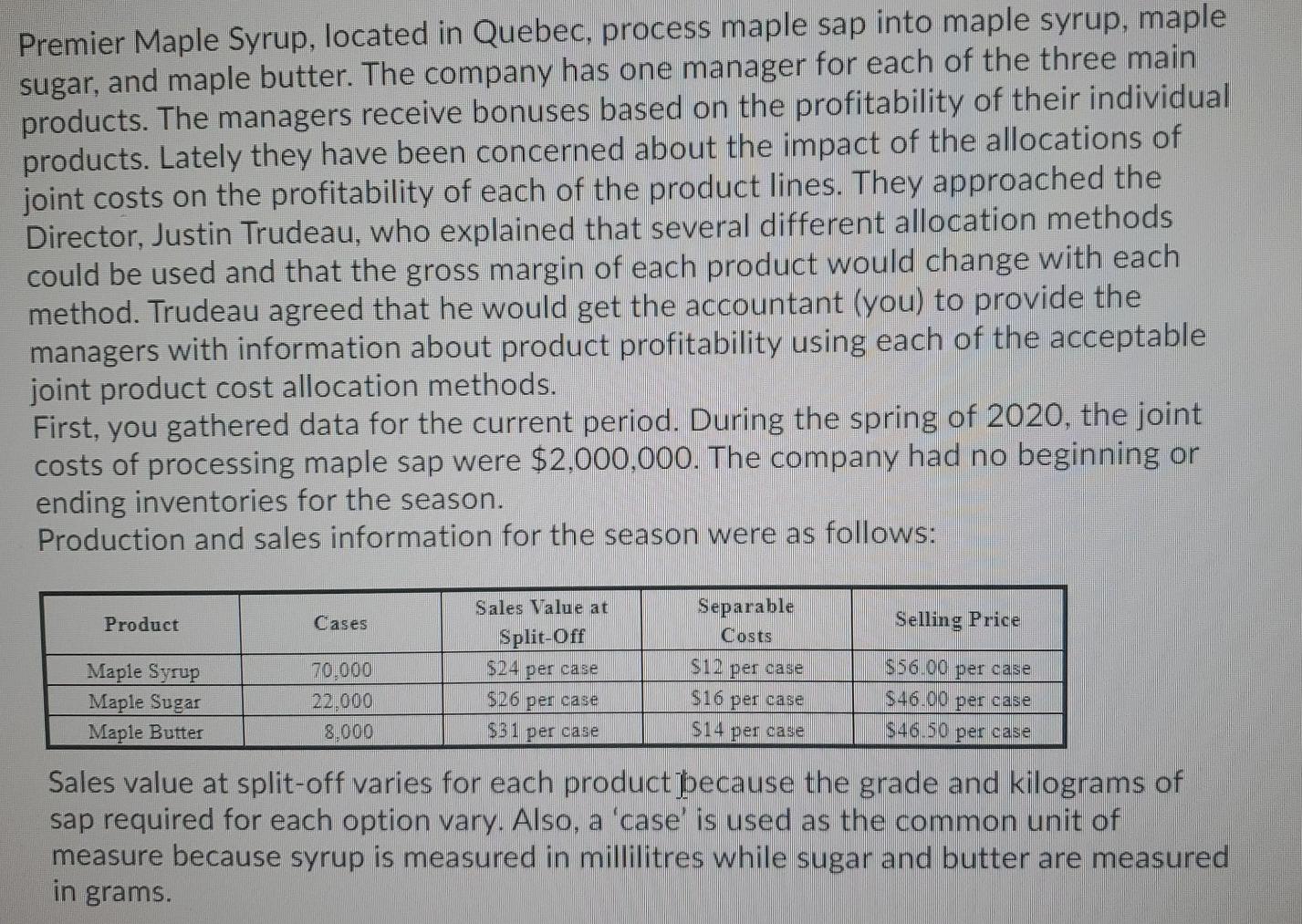

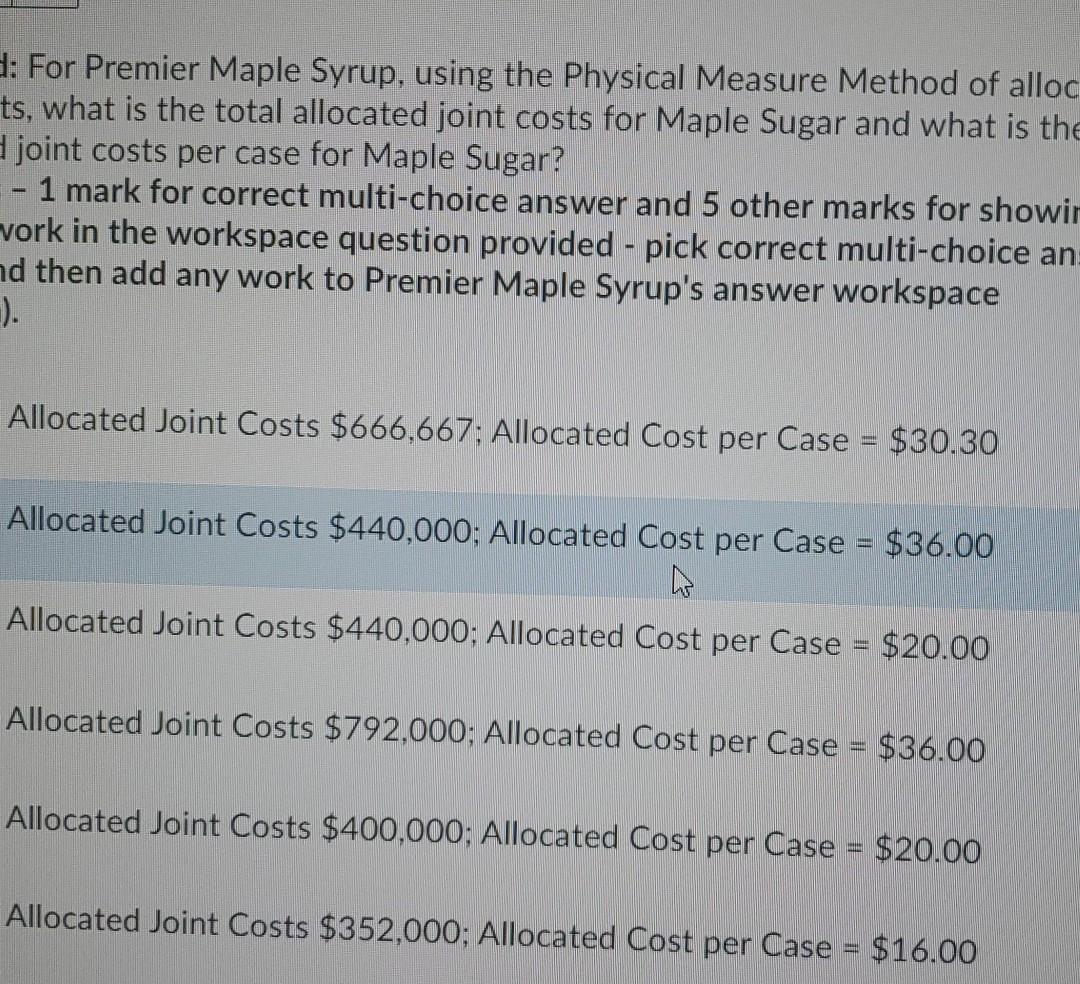

Premier Maple Syrup, located in Quebec, process maple sap into maple syrup, maple sugar, and maple butter. The company has one manager for each of the three main products. The managers receive bonuses based on the profitability of their individual products. Lately they have been concerned about the impact of the allocations of joint costs on the profitability of each of the product lines. They approached the Director, Justin Trudeau, who explained that several different allocation methods could be used and that the gross margin of each product would change with each method. Trudeau agreed that he would get the accountant (you) to provide the managers with information about product profitability using each of the acceptable joint product cost allocation methods. First, you gathered data for the current period. During the spring of 2020, the joint costs of processing maple sap were $2,000,000. The company had no beginning or ending inventories for the season. Production and sales information for the season were as follows: Sales Value at Separable Product Cases Selling Price Split-Off Costs Maple Syrup 70.000 $24 per case Si2 per case $56.00 per case Maple Sugar 22.000 $26 per case $16 per case $46.00 per case Maple Butter 8.000 $31 per case $14 per case $46.50 per case Sales value at split-off varies for each product because the grade and kilograms of sap required for each option vary. Also, a 'case' is used as the common unit of measure because syrup is measured in millilitres while sugar and butter are measured in grams. d: For Premier Maple Syrup, using the Physical Measure Method of alloc ts, what is the total allocated joint costs for Maple Sugar and what is the Hjoint costs per case for Maple Sugar? 1 mark for correct multi-choice answer and 5 other marks for showir vork in the workspace question provided - pick correct multi-choice an nd then add any work to Premier Maple Syrup's answer workspace .). Allocated Joint Costs $666,667; Allocated Cost per Case = $30.30 Allocated Joint Costs $440,000; Allocated Cost per Case = $36.00 Allocated Joint Costs $440,000; Allocated Cost per Case = $20.00 Allocated Joint Costs $792,000; Allocated Cost per Case = $36.00 Allocated Joint Costs $400,000; Allocated Cost per Case = $20.00 Allocated Joint Costs $352,000; Allocated Cost per Case = $16.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started