Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly provide an answer for this problem. Thank you. While preparing the year-end adjusting entries for 2021, ACME Incorporated's controller discovered that manufacturing equipment purchased

Kindly provide an answer for this problem. Thank you.

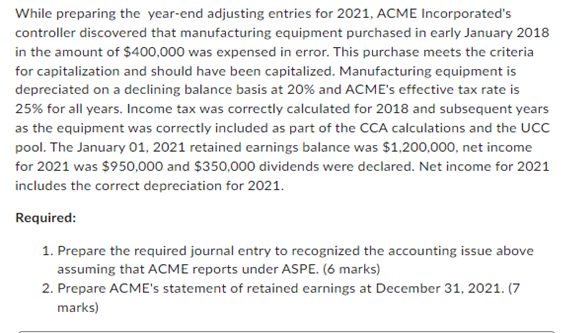

While preparing the year-end adjusting entries for 2021, ACME Incorporated's controller discovered that manufacturing equipment purchased in early January 2018 in the amount of $400,000 was expensed in error. This purchase meets the criteria for capitalization and should have been capitalized. Manufacturing equipment is depreciated on a declining balance basis at 20% and ACME's effective tax rate is 25% for all years. Income tax was correctly calculated for 2018 and subsequent years as the equipment was correctly included as part of the CCA calculations and the UCC pool. The January 01, 2021 retained earnings balance was $1,200,000, net income for 2021 was $950,000 and $350,000 dividends were declared. Net income for 2021 includes the correct depreciation for 2021. Required: 1. Prepare the required journal entry to recognized the accounting issue above assuming that ACME reports under ASPE. (6 marks) 2. Prepare ACME's statement of retained earnings at December 31, 2021. (7 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started