Answered step by step

Verified Expert Solution

Question

1 Approved Answer

kindly provide me the direct method for this cashflow question The Statement of Financial Position of Euston Ltd as at 31 December 20X8 with corresponding

kindly provide me the direct method for this cashflow question

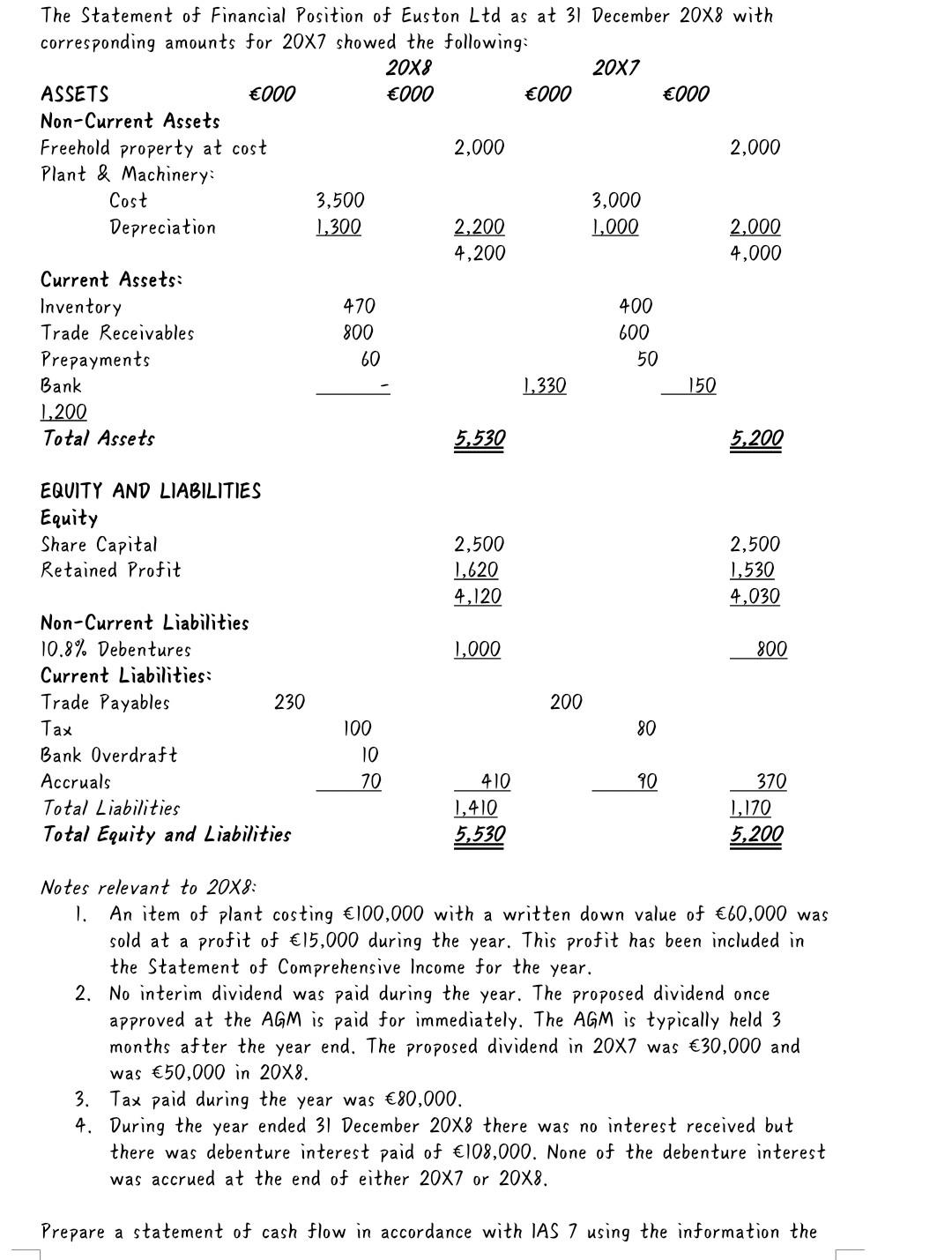

The Statement of Financial Position of Euston Ltd as at 31 December 20X8 with corresponding amounts for 20x7 showed the following: 20x8 20X7 ASSETS 000 000 000 000 Non-Current Assets Freehold property at cost 2,000 2,000 Plant & Machinery: Cost 3,500 3,000 Depreciation 1,300 2,200 1,000 2,000 4,200 4,000 Current Assets: Inventory 470 400 Trade Receivables 800 600 Prepayments 60 50 Bank 1.330 150 1,200 Total Assets 5,530 5,200 EQUITY AND LIABILITIES Equity Share Capital Retained Profit 2,500 1,620 4,120 2,500 1,530 4,030 1,000 800 200 Non-Current Liabilities 10.8% Debentures Current Liabilities: Trade Payables 230 Tax Bank Overdraft Accruals Total Liabilities Total Equity and Liabilities 80 100 10 70 90 410 1,410 5,530 370 1,170 5,200 Notes relevant to 20X8: 1. An item of plant costing 100,000 with a written down value of 60,000 was sold at a profit of 15,000 during the year. This profit has been included in the Statement of Comprehensive Income for the year. 2. No interim dividend was paid during the year. The proposed dividend once approved at the AGM is paid for immediately. The AGM is typically held 3 months after the year end. The proposed dividend in 20X7 was 30,000 and was 50,000 in 20x8. 3. Tax paid during the year was 80,000. 4. During the year ended 31 December 20X8 there was no interest received but there was debenture interest paid of 108,000. None of the debenture interest was accrued at the end of either 20X7 or 20x8. Prepare a statement of cash flow in accordance with IAS 7 using the information theStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started