Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly solve on Excel and answer the theoretical parts as well. Tri-Star Polyester is a listed company at Pakistan Stock Exchange Engaged in the manufacturing

Kindly solve on Excel and answer the theoretical parts as well.

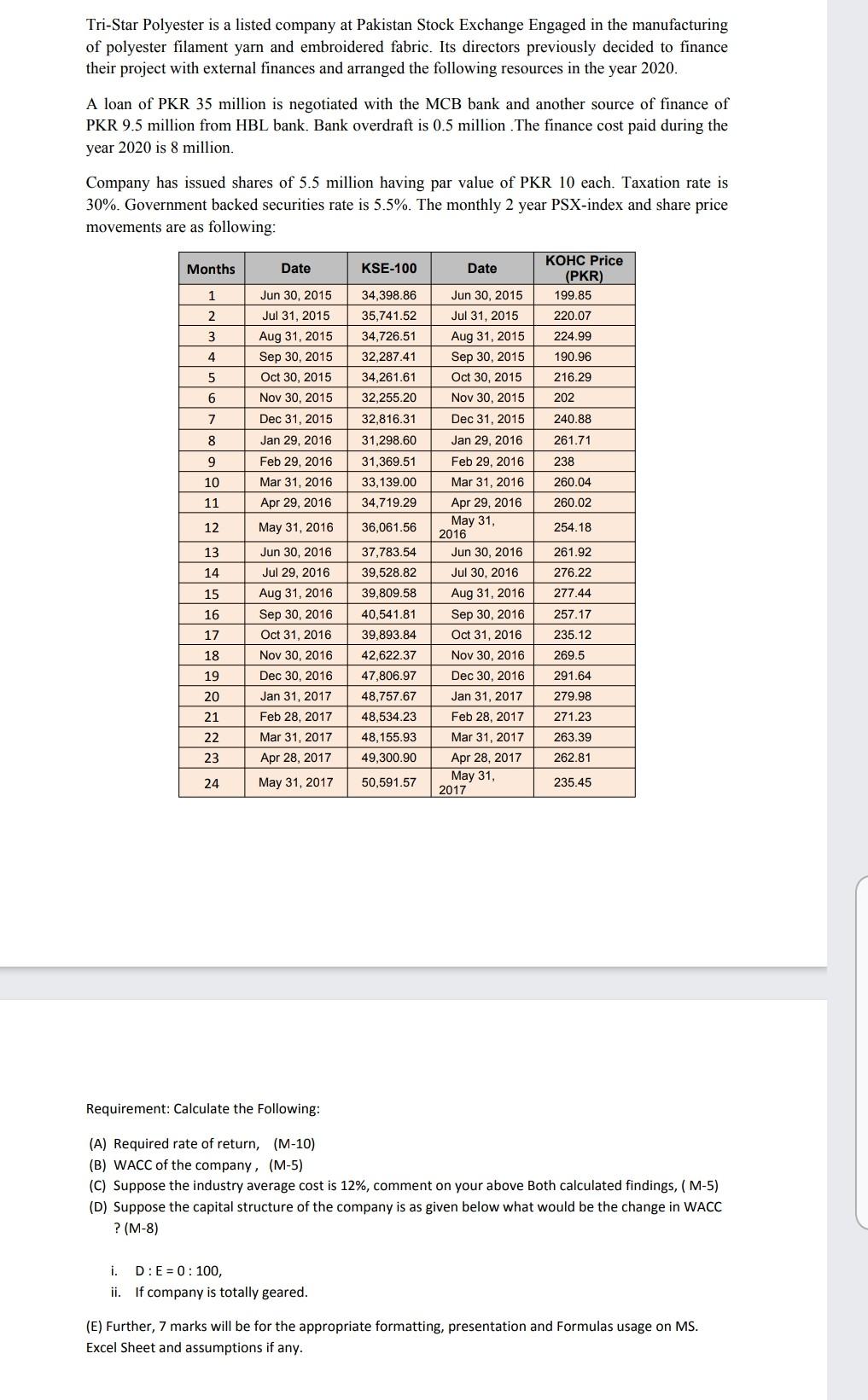

Tri-Star Polyester is a listed company at Pakistan Stock Exchange Engaged in the manufacturing of polyester filament yarn and embroidered fabric. Its directors previously decided to finance their project with external finances and arranged the following resources in the year 2020. A loan of PKR 35 million is negotiated with the MCB bank and another source of finance of PKR 9.5 million from HBL bank. Bank overdraft is 0.5 million. The finance cost paid during the year 2020 is 8 million. Company has issued shares of 5.5 million having par value of PKR 10 each. Taxation rate is 30%. Government backed securities rate is 5.5%. The monthly 2 year PSX-index and share price movements are as following: Months Date KSE-100 Date KOHC Price (PKR) 199.85 1 2 3 220.07 224.99 190.96 216.29 4 5 6 34,398.86 35,741.52 34,726.51 32,287.41 34,261.61 32,255.20 32,816.31 31,298.60 31,369.51 33,139.00 34,719.29 202 Jun 30, 2015 Jul 31, 2015 Aug 31, 2015 Sep 30, 2015 Oct 30, 2015 Nov 30, 2015 Dec 31, 2015 Jan 29, 2016 Feb 29, 2016 Mar 31, 2016 Apr 29, 2016 May 31, 2016 7 8 240.88 261.71 238 9 10 260.04 260.02 11 12 36,061.56 254.18 Jun 30, 2015 Jul 31, 2015 Aug 31, 2015 Sep 30, 2015 Oct 30, 2015 Nov 30, 2015 Dec 31, 2015 Jan 29, 2016 Feb 29, 2016 Mar 31, 2016 Apr 29, 2016 May 31, 2016 Jun 30, 2016 Jul 30, 2016 Aug 31, 2016 Sep 30, 2016 Oct 31, 2016 Nov 30, 2016 Dec 30, 2016 Jan 31, 2017 Feb 28, 2017 Mar 31, 2017 Apr 28, 2017 May 31, 2017 13 261.92 14 276.22 277.44 257.17 15 16 17 18 235.12 Jun 30, 2016 Jul 29, 2016 Aug 31, 2016 Sep 30, 2016 Oct 31, 2016 Nov 30, 2016 Dec 30, 2016 Jan 31, 2017 Feb 28, 2017 Mar 31, 2017 Apr 28, 2017 May 31, 2017 37,783.54 39,528.82 39,809.58 40,541.81 39,893.84 42,622.37 47,806.97 48,757.67 48,534.23 48,155.93 49,300.90 269.5 19 20 21 291.64 279.98 271.23 263.39 262.81 22 23 24 50,591.57 235.45 Requirement: Calculate the following: (A) Required rate of return, (M-10) (B) WACC of the company, (M-5) (C) Suppose the industry average cost is 12%, comment on your above Both calculated findings, (M-5) (D) Suppose the capital structure of the company is as given below what would be the change in WACC ? (M-8) i. D: E = 0: 100, ii. If company is totally geared. (E) Further, 7 marks will be for the appropriate formatting, presentation and Formulas usage on MS. Excel Sheet and assumptions if anyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started