kindly solve these problems

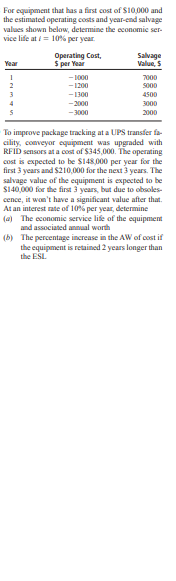

The table below shows present worth calculations of the costs associated with using a presently owned machine ( defender) and a possible replace- ment (challenger) for different numbers of years. Determine when the defender should be replaced using an interest rate of 10%% per year and a 3-year study period. Show solutions (a) by hand and (b) by spreadsheet. FW If Kept/Used Stated Number of Years Number of Years, $ Kept/Used Defender Challenger -36,000 -84,DO0 -75,DO0 -96,000 -125,00D - 102,DO0 -166,000 -217,DOD -149,000Guardian is a national manufacturing company of home health care appliances. It is faced with a make-or-buy decision. A newly engineered lift can be installed in a car trunk to raise and lower a wheelchair. The steel arm of the lift can be purchased internationally for $3.50 per unit or made in-house. If manufactured on site, two machines will be requi Machine A is esti- iated to cost $18,000, have a life of 6 years, and machine B will cost $12,000, have a life of 4 years, and have a $-500 salvage value (carry-away cost). Ma- chine A will require an overhaul after 3 years costing $3000. The annual operating cost for machine A is expected to be $6000 per year and for machine B is $5000 per year. A total of four 's at a rate of $12 30 per hour per operator. In a normal 8-hour period, the operator an produce parts sufficient to manufact ture 1000 units. Use a MARR of 15%% per year to determine the following- (a) Number of units to manufacture each year to justify the in-house (make) option. (b) The maximum capital expense justifiable to purchase machine A, assuming all other esti- mates for machines A and B are as stated. The company expects to produce 10,000 units per year.\f\fFor equipment that has a first cost of $10 000 and the estimated operating costs and year-end salvage values shown below, determine the economic ser- vice life at f = 10% per year Operating Cost, Salvage Year $ per Year Value, $ - 1030 7000 - 1700 5000 - 1300 4500 -2000 3000 2000 To improve package tracking at a UPS transfer fa- cility, conveyor equipment was upgraded with RFID sensors at a cost of $345,000. The operating cost is expected to be $148 000 per year for the first 3 years and $210,000 for the next 3 years. The salvage value of the equipment is expected to be $140,000 for the first 3 years, but due to obsoles- cence, it won't have a significant value after that. At an interest rate of 10% per year, determine (al The economic service life of the equipment and associated annual worth (b) The percentage increase in the AW of cost if the equipment is retained 2 years longer than the ESL