Answered step by step

Verified Expert Solution

Question

1 Approved Answer

* * Kindly solve this question and fill the solution and workings in Excel sheet as marked in red. Thanks * * Income Statement Overview

Kindly solve this question and fill the solution and workings in Excel sheet as marked in red. Thanks

Income Statement Overview

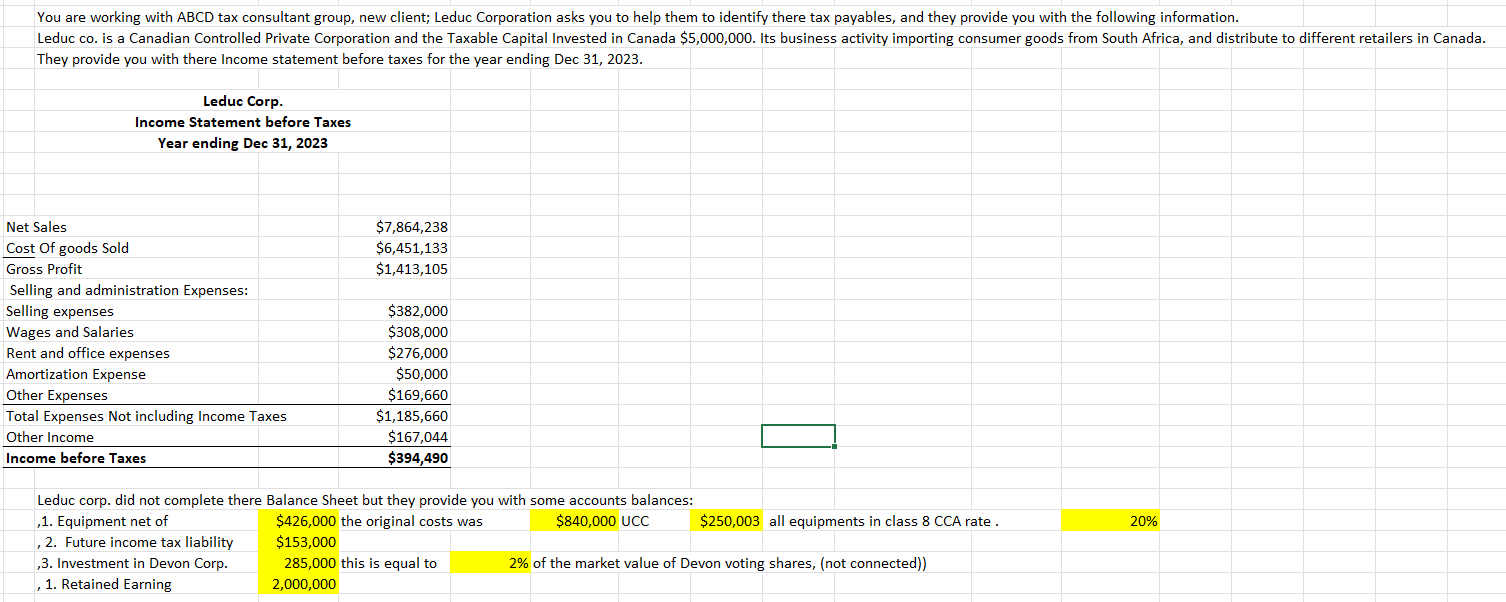

Net Sales and Cost of Goods Sold COGS

Net Sales: $

Cost of Goods Sold: $

Gross Profit: $

Selling and Administration Expenses

Selling Expenses: $

Wages and Salaries: $

Rent and Office Expenses: $

Amortization Expense: $

Other Expenses: $

Total Expenses Excluding Income Taxes: $

Other Income

Other Income: $

Income Before Taxes

Income Before Taxes: $

Balance Sheet Information Incomplete

Retained Earnings: $

Equipment Net of UCC: $

Original Cost of Equipment: $

Class CCA Rate:

Future Income Tax Liability: $

Investment in Devon Corp.:

Market Value of Devon Voting Shares: $

Leducs Ownership of Market Value: $

Other Relevant Information

Taxable Capital Invested in Canada: $

Business Activity: Importing consumer goods from South Africa and distributing them to retailers in Canada.

You are working with ABCD tax consultant group, new client; Leduc Corporation asks you to help them to identify there tax payables, and they provide you with the following information.

Leduc co is a Canadian Controlled Private Corporation and the Taxable Capital Invested in Canada $ Its business activity importing consumer goods from South Africa, and distribute to different retailers in Canada.

They provide you with there Income statement before taxes for the year ending Dec Required:

For Leduc co taxation year ended Dec calculate the following items using Excel worksheets:

Minimum Net Income for Tax Purposes if any

Taxable Income for the Year, if any

Part I federal Tax Payable including ART

Part IV Federal Tax Payable

Refundable Dividend Tax On Hand account balance at Dec

The Dividend refund if any

Total minimum Federal Tax Payable

Write a memo one to maximum pages to Leduc co The owner explains your work. The memo should include why some amount of income was replaced, some expenses removed

Also, Leduc owners think they should not pay any taxes this year based on losses from prior years.

Maybe after you complete the return you notice they should pay tax, then explain why. In general, explain what you did and justify your numbers.Calculate federal tax abatement Taxable income earned in Canada deduct

Calculate small business deduction SBD for CCPCs least of the following deduct

a Active business income ABI

b Taxable income

c Annual business limit $ unless associated with corporations

Calculate M&P deductions: of the lesser of: deduct

a M&P profit reduced by SBD amount.

b Taxable income reduced by the amount eligible for SBD

Calculate ART of the lessor of AII or Taxable Income in excess of amount eligible for

SBD ADD

Calculate general rate reduction on the excess of TI over SBD & M & P & AII deduct

Part I tax payable $$$$

Calculate Part IV tax payable With limitations

Calculate dividend refund With limitations

Total Tax Payable Part I Part IV Dividend Refund

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started